|

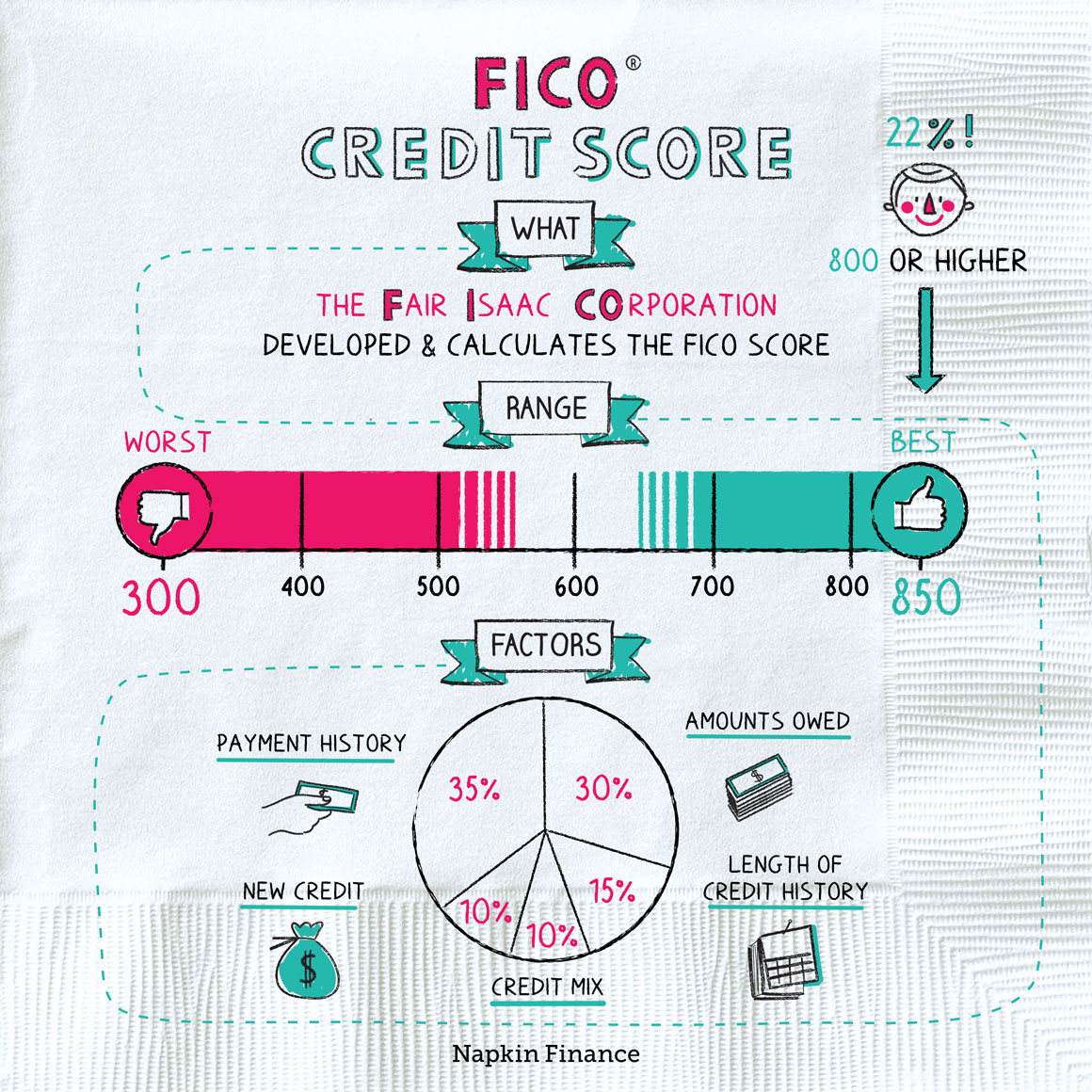

When you are ready to apply for a Kentucky mortgage loan approval to buy a house in the state of Kentucky, you will need a more accurate picture of how a mortgage lender may view your Transunion, Experian, Equifax credit reports and their scores. Scores go from 344 to 850 on each three credit bureaus and they take the middle score of the three, throwing out the highest and lowest score. Kentucky Mortgage lenders look at your credit on Equifax as well as TransUnion and Experian — all 3 bureaus. |

||||

|

If you are planning to buy a home in Kentucky, one of the first questions you should be asking is: what credit score do I need to qualify? The second question is: what credit score do I need to get the best interest rate? These are not the same question. Qualifying is one thing. Securing optimal pricing is another.

Jump to:

Kentucky minimum credit score requirements by loan type

Credit score alone does not determine approval. Underwriting also evaluates income stability, debt-to-income ratio, assets, employment history, and the appraisal. That said, credit score is still a critical approval gate for most programs.

FHA loan (Federal Housing Administration)

- Minimum allowed by HUD: 580 for 3.5% down; 500–579 typically requires 10% down

- Real-world lender requirement in Kentucky: most lenders will not go below 580; many prefer 600–620

VA loan (Veterans Affairs)

- VA does not publish a minimum credit score

- Real-world lender overlays: most lenders require 580–620; stronger pricing typically starts at 640+

USDA Rural Development (guaranteed)

- Technically, 580 may be accepted in some cases

- In practice, 640+ is commonly needed for smoother automated approval; under 640 may trigger manual underwriting

Conventional (Fannie Mae)

- 620 minimum

- Best pricing is typically 740–760+

KHC (Kentucky Housing Corporation) with down payment assistance

- 620 minimum

- No exceptions for most KHC DPA options

Bottom line: most realistic Kentucky approval scenarios begin at 580 for FHA/VA and 620 for Conventional/KHC. USDA is often most efficient at 640+.

Government guidelines vs lender overlays

Programs like FHA, VA, USDA, Fannie Mae, and KHC publish baseline guidelines. Lenders often add overlays (stricter rules) due to risk and secondary market requirements. This is why “on paper” minimums may not match what lenders actually approve.

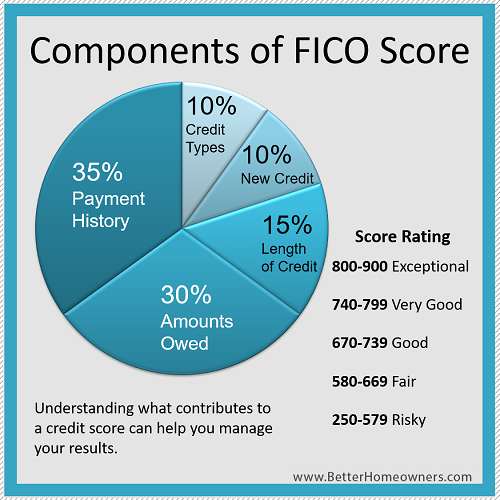

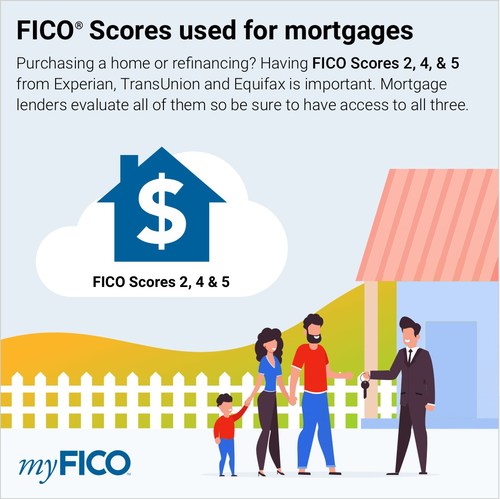

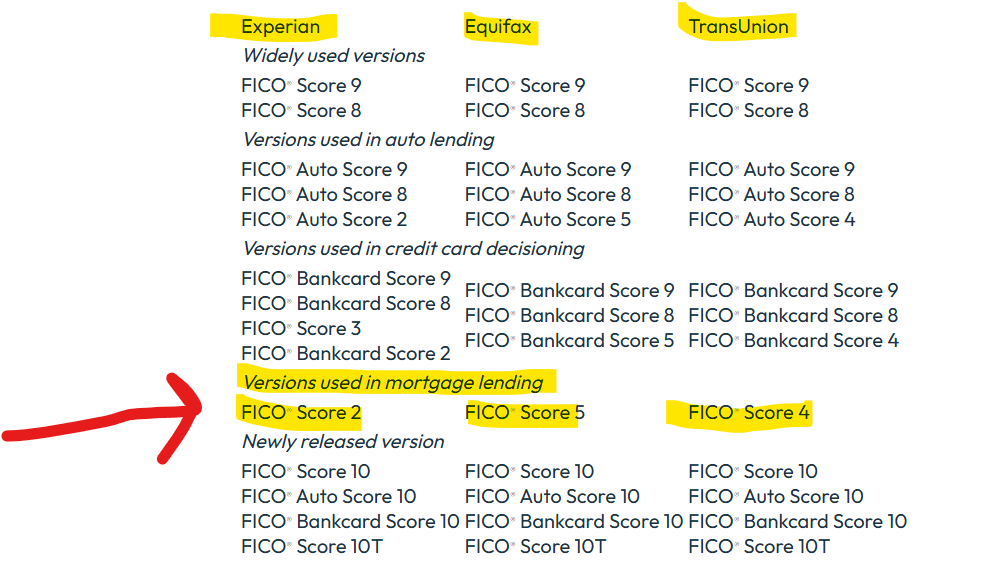

How lenders calculate your qualifying credit score

Mortgage lenders pull a tri-merge credit report showing three scores from Equifax, Experian, and TransUnion. The lender discards the highest and lowest score and uses the middle score.

Example:

- Equifax: 610

- Experian: 629

- TransUnion: 614

Your qualifying score would be 614 (the middle score).

Most lenders require at least two usable scores. Also, the score you see on consumer apps is often not the same score model used for mortgage underwriting.

What credit score typically gets the best interest rate?

Rate pricing improves as scores rise. While exact pricing varies by day, lender, and loan type, these tiers are common:

- 620–639: higher rates and limited pricing

- 640–679: improved options

- 680–719: strong approval tier

- 720–759: excellent pricing

- 760+: top tier pricing

If you are within 10–20 points of a better tier, improving your score before you lock can materially reduce your payment and long-term interest cost.

If your credit score is low: what to do next

Do not guess. Do not apply randomly. Also, do not dispute accounts without a plan (disputes can delay underwriting). The most effective approach is a structured credit review focused on:

- reducing revolving utilization

- verifying tradeline reporting accuracy

- strategic payoff sequencing if needed

- avoiding new inquiries and new debt

In many cases, meaningful improvement can happen in 30–60 days with the right steps.

Images from the original post

Replace the image URLs below with your WordPress Media Library URLs (or paste your existing image blocks here).

Frequently asked questions

What is the minimum credit score to buy a home in Kentucky?

Many lenders will consider FHA/VA at 580+ and Conventional/KHC at 620+. USDA is commonly easiest at 640+ for automated approval, though exceptions may exist depending on the full file.

Does VA have a minimum credit score requirement?

VA does not publish a minimum credit score. However, most lenders use overlays and commonly require 580–620.

Why is my Credit Karma score different than my mortgage score?

Mortgage lending uses specific FICO score models. Many consumer apps show different scoring models intended for education and monitoring, not mortgage underwriting.

How do lenders pick which credit score they use?

With three bureau scores, lenders typically use the middle score (not the highest or the lowest). Most lenders also require at least two usable scores.

What score gets the best mortgage rate?

Top pricing is commonly seen at 760+ and often strong pricing begins around 740+. Exact pricing depends on the loan type, down payment, DTI, reserves, and market conditions.

Contact

Joel Lobb

Senior Loan Officer

NMLS #57916

Website: http://mylouisvillekentuckymortgage.com/

Text or call: (502) 905-3708

Email: kentuckyloan@gmail.com

The views and opinions stated on this website belong solely to the author and are intended for informational purposes only. Posted information does not guarantee approval and does not represent full underwriting guidelines. This does not represent being part of a government agency. The views expressed do not necessarily reflect the view of my employer. Not all products or services mentioned may fit all borrowers. NMLS ID #57916 (www.nmlsconsumeraccess.org). USDA mortgage loans only offered in Kentucky.

All loans and lines are subject to credit approval, verification, and collateral evaluation and are originated by lender. Products and interest rates are subject to change without notice.