Rural Housing Loan in Kentucky

Kentucky USDA loans are loans offered by the United States Department of Agriculture to those looking to buy homes in rural areas of Kentucky.

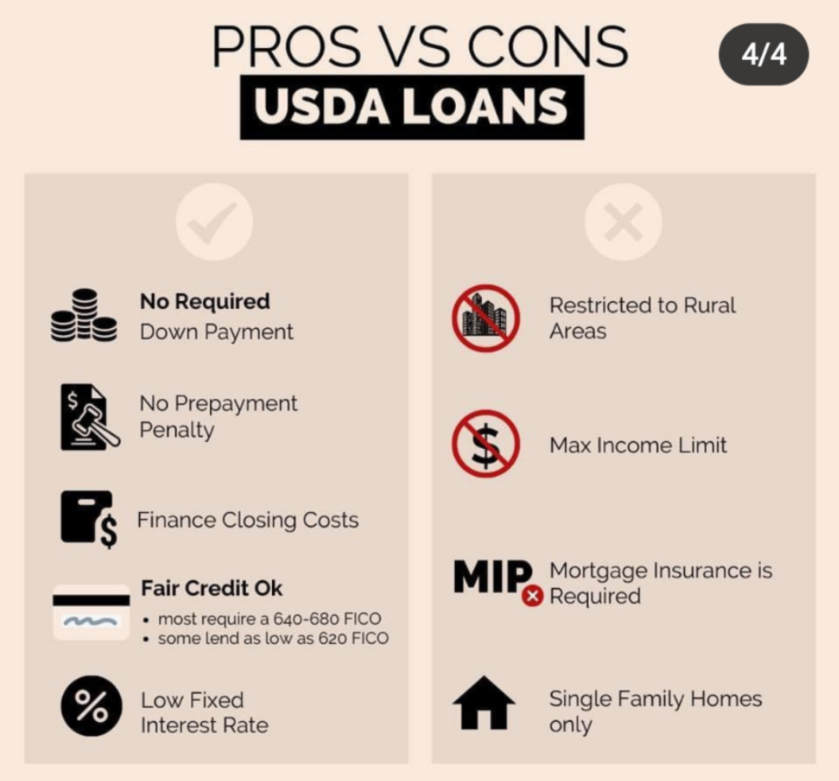

There are a few requirements and restrictions associated with this type of loan however, if you are a first time home buyer in Kentucky with a limited income, no down payment and are looking to live in a rural part of Kentucky, this may be a good option for you to purchase a home going no money down and getting a 30 year fixed rate loan.

Income Requirements for USDA Loans in Kentucky

The Rural Housing USDA website provides an income eligibility calculator depending on where you are looking for housing in the state of Kentucky. Because it is a nationally funded loan by the United States Government, the income restrictions will vary county-by-county but the loan recipient cannot make more than 115% of the median income for the area in which they are applying. There is also a chart you can consult that provides Kentucky USDA county income limits depending on the number of people in your home. Most Kentucky Counties will allow up to $90,200 for a household family of four or less, and up to $119,350 for a household of five. The Northern Kentucky Counties of Kenton, Bracken, Boone, Gallatin, Campbell allow for more. See Chart below

Households with 1-4 members have different limits as households with 5-8. Similarly, applicants living in high-cost counties will have a higher income limit than those living in counties with a more average cost of living.

Kentucky Score Requirements for a USDA Loan in Kentucky

Borrowers in Kentucky are required to have a FICO minimum credit score of 581 or higher. However, most USDA lenders will create a credit overlay where they will want a minimum credit score of 640 in order to get a GUS approval.

If the potential borrower has declared bankruptcy or foreclosure within the last 36 months, they would be ineligible for this type of loan.

If the mortgage was included in the Bankruptcy, sometimes the 36 month hold is ignored and you just have to make sure the property is out of your name before applying for a USDA loan

Can you get a USDA loan in Kentucky with a Previous Bankruptcy?

Chapter 7 bankruptcy, the bankruptcy must have been discharged at least 3 years prior to becoming eligible for a Kentucky USDA home loan.

Borrowers must be in a Chapter 13 bankruptcy for a minimum of 12 months, with documentation of 12 months of on time payments and a letter of authorization from the bankruptcy trustee authorizing you to enter into new debt.

In order to qualify for a USDA home loan after filing a Chapter 13 bankruptcy, additional documentation may be requested/required stating that the reason for the Chapter 13 filing was due to extenuating circumstances beyond the borrower’s control, temporary in nature and not likely to re-occur.

Home must be primary Residence.

Recipients must be U.S. Citizens, U.S. non-citizen nationals or Qualified Aliens to apply for this program. They must also agree to use the home as their primary residence and not as a rental property.

The property must be for a family including townhouses, single family homes, condominiums (FHA Approved), new construction or new mobile homes.

What areas of Kentucky Qualify for the USDA Loan Program?

The USDA provides a map of the where you can apply a USDA loans are eligible in Kentucky. The major metro areas of Jefferson County and Fayette County Kentucky are not eligible for Rural Housing Loans in Kentucky, along with some parts of Northern Kentucky next to Cincinnati; parts of Owensboro, Paducah, Bowling Green, Richmond, Frankfort, Winchester, Radcliff, Hopkinsville and Henderson Kentucky are not eligible.

If you have a property in mind, you can head over to the eligibility map to see if the home you are considering qualifies.

What are the advantages of USDA loans in Kentucky?

For many people in a low to middle-income bracket, saving for a down payment can be difficult. A USDA loan does not require the purchaser to put any money down toward the purchase price of a home. The government insures the loan in this case, should the borrower default, therefore the borrower is required to carry mortgage insurance during the life of the loan. The mortgage insurance for the USDA loan is provided at a more discounted rate than that required by traditional loans.

On USDA loans the mortgage insurance is 1% upfront, called a guarantee fee, and .35% monthly called an annual mortgage insurance fee to USDA. The beauty of USDA, is that it does not matter if you have a credit score of 640, or a credit score of 740, everyone pays the same premiums, unlike conventional loans.

They only offer 30 year fixed rates with no prepayment penalty, and usually the rates are very low and compare to FHA rates and much lower than conventional loans.

USDA loans take on average about 30 days to close, and the appraisal must meet FHA requirements. Home inspections are not required, and only new mobile homes are allowed on this home loan program.

Joel Lobb (NMLS#57916)

Senior Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

If you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916 http://www.nmlsconsumeraccess.org/

— Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. The content in this marketing advertisement has not been approved, reviewed, sponsored or endorsed by any department or government agency. Rates are subject to change and are subject to borrower(s) qualification.