If you’re considering buying a home in Kentucky and looking for a mortgage loan with favorable terms, a Kentucky USDA loan could be a great option. Kentucky USDA loans, backed by the U.S. Department of Agriculture, are designed to help low to moderate-income borrowers in Kentucky rural areas achieve homeownership. Here’s a comprehensive guide on how to get approved for a USDA mortgage loan in Kentucky in regards to credit score, income, work history, debt to income ratios, bankruptcy and foreclosure :

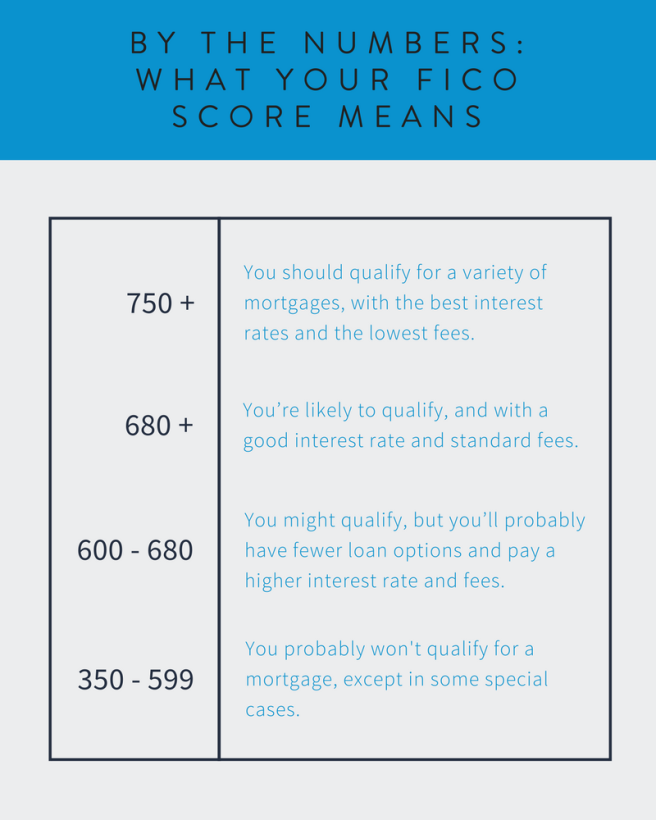

- Kentucky USDA loans Credit Score Requirements:

- While Kentucky USDA loans are known for their lenient credit score requirements compared to conventional loans, having a good credit score can still improve your chances of approval. Aim for a credit score of 640 or higher for smoother processing. On paper USDA says there is no minimum score, but it is very difficult to get approved with lenders with no score.

- Kentucky USDA loans Income Eligibility:

- USDA loans have income eligibility criteria based on the area’s median income. To qualify, your household income should fall within the USDA’s income limits for the specific county or area in Kentucky where you plan to buy a home.

- Kentucky USDA loans Work History:

- Lenders typically look for a stable work history, preferably with at least two years of consistent employment in the same field or industry. This demonstrates your ability to repay the loan.

- Kentucky USDA loans Property Location (Counties 120 in Kentucky):

- USDA loans are specifically designed for properties located in eligible rural areas or designated suburban areas. Before applying, ensure that the property you’re interested in is within a USDA-eligible location in Kentucky.

- Kentucky USDA loans Income Ratio:

- Your debt-to-income (DTI) ratio is an important factor in loan approval. Generally, USDA loans require a DTI ratio of 41% or lower, although some lenders may allow higher ratios with compensating factors.

- Kentucky USDA loans Income Limits:

- USDA loans have income limits based on family size and county location. These limits vary by area, so check the current income limits set by USDA for the county where you plan to purchase your home.

- Kentucky USDA loans Property Type:

- USDA loans are intended for primary residences, including single-family homes, townhouses, and eligible condominiums. Investment properties and vacation homes are not eligible.

- Kentucky USDA loans Bankruptcy and Foreclosure Requirements:

- Having a bankruptcy or foreclosure in your financial history doesn’t necessarily disqualify you from a USDA loan. However, there are waiting periods after these events before you can apply:

- Chapter 7 bankruptcy: 3 years from the discharge date.

- Chapter 13 bankruptcy: 1 year of on-time payments and court approval.

- Foreclosure: 3 years from the sale date.

- Having a bankruptcy or foreclosure in your financial history doesn’t necessarily disqualify you from a USDA loan. However, there are waiting periods after these events before you can apply:

- Kentucky USDA loans Closing Time:

- USDA loans typically take around 30 to 45 days to close, although this timeline can vary based on factors such as application volume and the efficiency of document processing.

- Kentucky USDA loans Appraisal Requirements:

- A professional appraisal is required for USDA loans to determine the fair market value of the property. The appraisal ensures that the property meets USDA standards and is worth the loan amount.

- Kentucky USDA loans Termite Inspections:

- USDA loans may require a termite inspection, especially in areas where termite infestations are common. The inspection aims to identify and address any termite-related issues in the property.

- Kentucky USDA loans GUS (Guaranteed Underwriting System):

- GUS is a tool used by lenders to process USDA loan applications. It evaluates the borrower’s credit, income, and other factors to determine eligibility and streamline the underwriting process.

- Kentucky USDA loans Manual Underwriting:

- In some cases, USDA loans may undergo manual underwriting, especially if the borrower’s application doesn’t meet automated approval criteria. Manual underwriting involves a more thorough review of the borrower’s financial situation by the lender.

To get a Kentucky USDA loan, potential Kentucky rural housing borrowers must follow this sequence of steps:

- Determine eligibility by consulting online USDA maps.

- Decide whether you want a guaranteed or direct loan. Guaranteed loans will have higher income limits, which you’ll work out with the lending institution.

- Submit all applicable paperwork, including income, debts, and credit reports.

- After pre-approval, begin searching for new homes (or launch renovations on your current home).

Keep in mind that you’ll have fees associated with your loan. Guaranteed loans require an upfront 1% fee and annual fees of 0.35% for as long as the mortgage is active.

USDA program for properties located outside urban areas of Kentucky areas where you can secure a no money down loan at a fixed rate of on 30 years.

The max household income limits usually are between $110,500 to $146,000 for most rural area counties depending on household family size.

This changes every year so make sure you are using updated USDA Income Limits for this year

A 620-640 middle credit score is needed for loan approval on this program. They’re no max loan limits on USDA loans. You just need to qualify based on your debt to income ratio (see below under income section)—–USDA will go down to 580 on scores but it has to pass 👉 USDA Manual Underwriting guidelines

Need to be 3 years removed from a Chapter 7 Bankruptcy and 3 years from a foreclosure

10602 Timberwood Circle

Louisville, KY 40223

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/