Credit Fico Score for a Kentucky Mortgage FHA VA KHC

- Minimum Credit Score is 620

- You can use a conventional loan to buy a primary residence, second home, or rental property

- Conventional loans are available in fixed rates, adjustable rates (ARMs), and offer many loan terms usually from 10 to 30 years

- Down payments as low as 3% and 5% depending on Home Ready or straight conventional loan.

- No monthly mortgage insurance with a down payment of at least 20%

- Max Debt to Income Ratio of 50%

- Minimum Credit Score is 500 with at least 10% down

- Minimum Credit Score is 580 if you put less than 10% down

- Upfront and Monthly Mortgage Insurance is required regardless of the Loan to Value

- FHA Loans are only available for financing primary residences

- Maximum Debt to Income Ratio of 50% (unless mitigating factors justify allowing a higher DTI) up to 57% in some instances with strong compensating factors.

-

- 100% Financing

- Cities and towns located outside metro areas-see link (https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do?pageAction=sfp

- Do NOT have to be a First Time Home Buyer and no max loan limit just debt ratio requirements

- No Down Payment

- 30 year low fixed rate loans

- No Prepayment Penalty

- Great Low FIXED Interest Rates

- Possible to Roll Closing Costs into Loan if Appraises Higher

- No Cash Reserves Required

- UNLIMITED Seller Contribution toward Closing Costs

- 100% Gifted Closing Costs allowed

- Primary Residents only (no rentals/investment properties)

- Debt to income ratios no more than 45% with GUS approval and 29 and 41% with a manual underwrite.

- Only Need a 580 Credit Score to Apply*** Most USDA loans need a 620 or score higher to get approved through their automated underwriting system called GUS. 640 usually required for an automated approval upfront.

- No bankruptcies (Chapter 7) last 3 years and no foreclosure last 3 years. If Chapter 13 bankruptcy possible to go on after 1 year

-

KENTUCKY VA Mortgage

- 100% Financing Available

- Must be eligible veteran with Certificate of Eligibility. We can help get this for veterans or active duty personnel.

- No Down Payment Required

- Seller Can Pay ALL Your Closing Costs

- No Monthly Mortgage Insurance

- Minimum 580 Credit Score to Apply–VA does not have a minimum credit score but lenders will create credit overlays to protect their interest.

- Active Duty, Reserves, National Guard, & Retired Veterans Can Apply

- No bankruptcies or foreclosures in last 2 years and a clear CAVIRS

- Debt to income ratios vary, but usually 55% back-end ratio with a fico score over 620 will get it done on qualifying income and if it is a manual underwrite, 29% and 41% respectively

- Can use your VA loan guaranty more than once, and in some cases, can have two existing va loans out at they sametime. Call or email for more info on this scenario.

- Cost of VA loan appraisal in Kentucky now costs a minimum $475 with a termite report needed on all purchase and refinance transactions unless a condo.

- 2 year work history needed on VA loans unless you can show a legitimate excuse, ie. off work due to injury, schooling, education etc.

- You cannot use your GI Bill for income qualifying for the mortgage payment.

How the Down Payment Assistance Program (DAP) Works

Down payment assistance loans are available up to $10,000 and is paid back over a period of ten years at a current rate of 3.75%.

Regular DAP

- Purchase price up to $481,176 with Secondary Market or Mortgage Revenue Bond (MRB) income limits.

- Assistance in the form of a loan up to $10,000 in $100 increments.

- Repayable over a 10-year term at 3.75 percent.

- Available to all KHC first-mortgage loan recipients

. KHC Loan (Kentucky Housing Loan with Down Payment Assistance)

The no money-down home loan program offered by Kentucky Housing and other lenders in the state of Kentucky currently offers up to $10,000-or a 5% grant of the sales price offered by other national lenders that does not have to be repaid

—

Mortgage Loan Officer

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

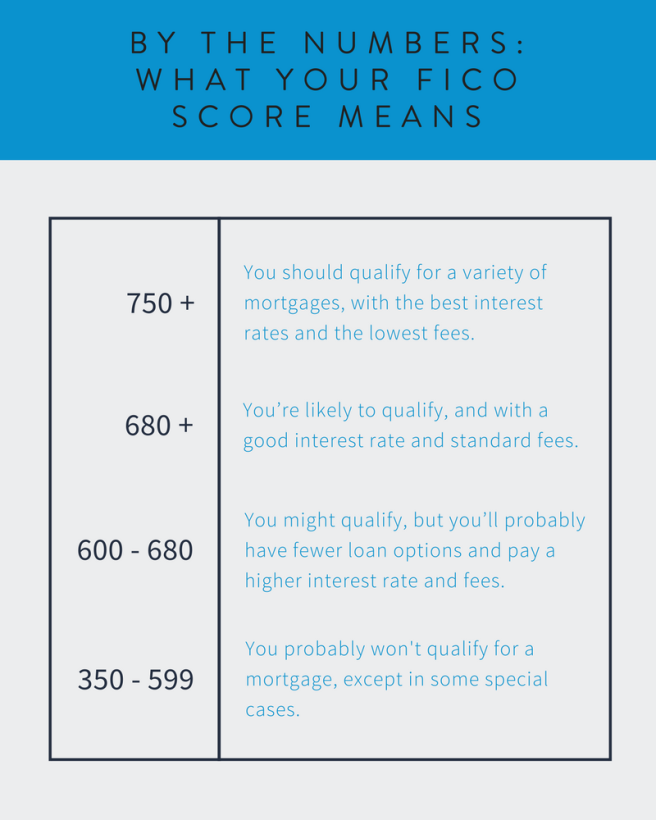

Fannie Mae According to the “Washington Post,” Fannie Mae raised its minimum credit score for conventional loans in 2009 from 580 to 620. Even if you have a 20-percent down payment, you…

Source: Credit Fico Score for a Kentucky Mortgage FHA VA KHC