There are two types of Kentucky USDA Rural Housing Home loans available to rural Kentucky Home buyers through Rural Development:

Direct homeownership loans and guaranteed home ownership loans.

Let’s first look at the 502 Direct USDA Loan in Kentucky

502 Direct USDA Loan in Kentucky:

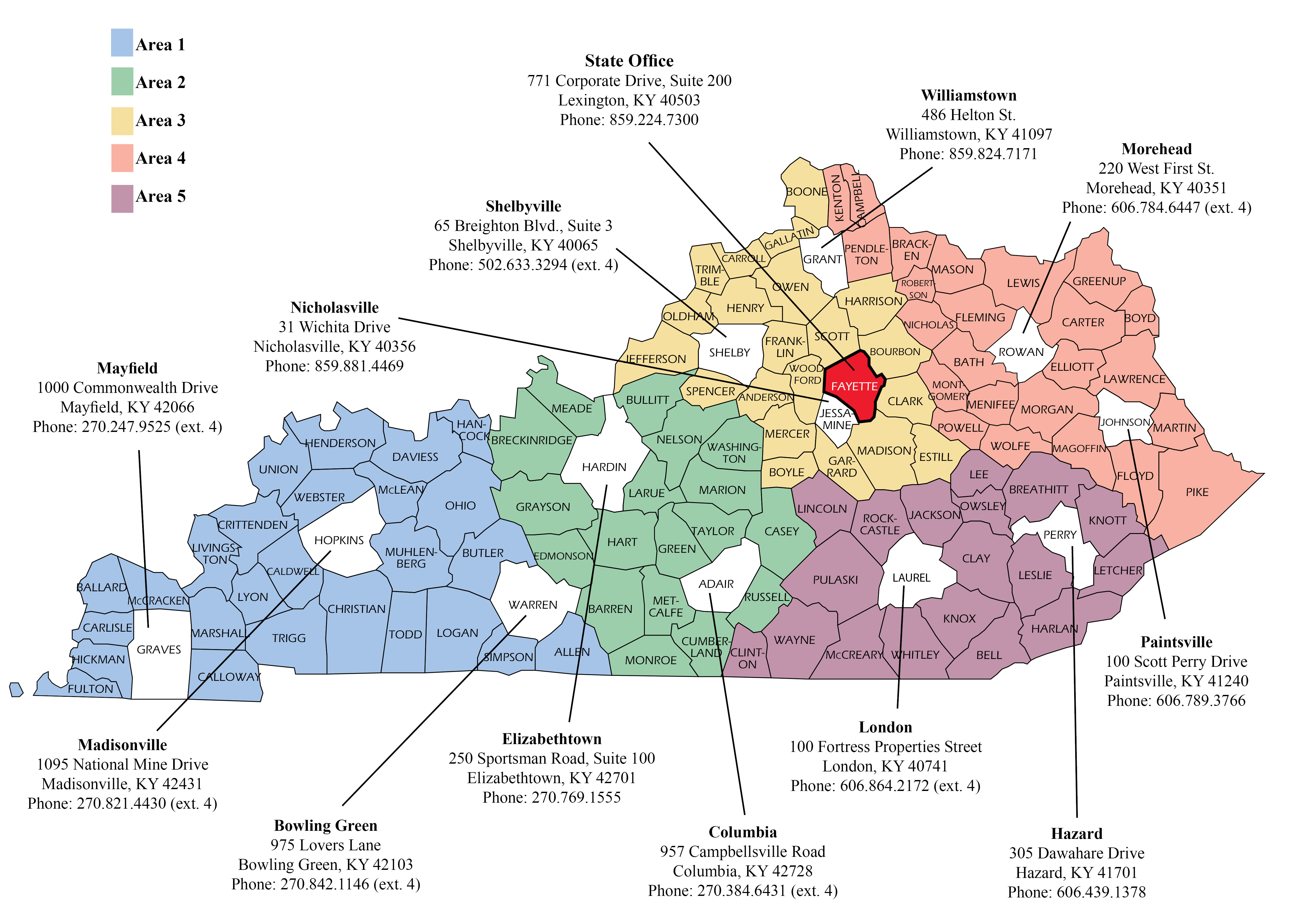

With a Kentucky Direct Loan 502, the applicant applies directly to the USDA office serving their location in Kentucky. There are about 13 different locations . They lend the money direct from USDA , 100 percent financing, for the low rate currently at 3 percent on a 33 year term.

For a direct home loan, the purchase, construction, repair and rehabilitation of a single family home in rural areas must be used for the applicant’s permanent residence. “For manufactured housing, only new construction can be funded,” he explained.

Credit scores of 640 or greater are typically acceptable with a minimum number of trade lines (2 usually for 12 months can be opened or closed) that have been open and active.

No down payment typically is required- Loans may be up to 100 percent of the appraised value. Homebuyer education is required prior to closing for the Direct USDA Loan 502 program

Rural Home Loans (Direct Program)

What does this

program do?

Also known as the Section

502 Direct Loan Program, this

program assists low- and

very-low-income applicants

obtain decent, safe, and sanitary

housing in eligible rural areas by

providing payment assistance

to increase an applicant’s

repayment ability. Payment

assistance is a type of subsidy

that reduces the mortgage

payment for a short time.

The amount of assistance is

determined by the adjusted

family income.

Who may apply for this program?

A number of factors are considered

when determining an applicant’s

eligibility for Single Family Direct Home

Loans. At a minimum, applicants

interested in obtaining a direct loan must

have an adjusted income that is at or

below the applicable low-income limit

for the area where they wish to buy a

house and they must demonstrate a

willingness and ability to repay debt.

Applicants must:

• Be without decent, safe, and

sanitary housing

• Be unable to obtain a loan from

other resources on terms and

conditions that can reasonably be

expected to meet

• Agree to occupy the property as

your primary residence

• Have the legal capacity to incur a

loan obligation

• Meet citizenship or eligible

noncitizen requirements

• Not be suspended or debarred from

participation in federal programs

Properties financed with direct loan

funds must:

• Be modest in size for the area

• Not have market value in excess of

the applicable area loan limit

• Not have in-ground swimming pools

• Not be designed for income

producing activities

Borrowers are required to repay all or a

portion of the payment subsidy received

over the life of the loan when the title to

the property transfers or the borrower is

no longer living in the dwelling.

Applicants must meet income eligibility

for a direct loan. Please contact your

local RD office to ask for additional

details about eligibility requirements.

What is an eligible area?

Generally, rural areas with a population

less than 35,000 are eligible. Visit the

USDA Income and Property eligibility

website for complete details.

How may funds be used?

Loan funds may be used to help

low-income individuals or households

purchase homes in rural areas. Funds

can be used to build, repair, renovate,

or relocate a home, or to purchase

and prepare sites, including providing

water and sewage facilities.

How much may I borrow?

The maximum loan amount an

applicant may qualify for will depend

on the applicant’s repayment ability.

The applicant’s ability to repay a loan

considers various factors such as

income, debts, assets, and the amount

of payment assistance applicants

may be eligible to receive. Regardless

of repayment ability, applicants may

never borrow more than the area loan

limit (plus certain costs allowed to be

financed) for the county in which the

property is located.

Rural Home Loans (Direct Program)

What is the interest rate and

payback period?

• Fixed interest rate based on current

market rates at loan approval or loan

closing, whichever is lower.

• The monthly mortgage payment,

when modified by payment

assistance, may be reduced to as

little as an effective 1% interest rate.

• Up to 33 year payback period – 38 year

payback period for very low income

applicants who can’t afford the 33 year

loan term.

How much down payment

is required?

No down payment is typically required.

Applicants with assets higher than the

asset limits may be required to use a

portion of those assets.

Is there a deadline to apply?

Applications for this program are

accepted through your local RD office

year round.

How long does an application take?

Processing times vary depending on

funding availability and program demand

in the area in which an applicant is

interested in buying and completeness

of the application package.

What governs this program?

• The Housing Act of 1949 as

amended, 7 CFR, Part 3550

• HB-1-3550 – Direct Single Family