Kentucky Rural Development Mortgage Guide

- 30 year fixed rate only for Purchases and Existing USDA loans Refinances.

- Zero down Mortgage loan with no loan limits!

- Upfront funding fee is 1.0% and annual mi fee is .35% (very low compared to FHA)

- Typically cannot own other real estate. There are exceptions to this.

- You do not have to be a first-time home buyer in Kentucky

- Can refinance existing USDA loan as long as lowering rate by 1% and can do without an appraisal. There are overlays to this by lenders.

- Closing costs and prepaids can be paid by seller but must be put into contract

- Closing costs may be financed into the loan up to the appraised value.

- You will need two credit trade lines reporting at least for 12 months on your credit file. They don’t have to be open and active. Just reporting on your credit report.

- All Guaranteed Mortgage Loans are ran through GUS. GUS stands for the Guaranteed Underwriting System. USDA and their underwriters use this system to pre-approve you. They review credit score/history, income, debt to income ratio and assets to determine your loan eligibility. If your credit score is below 640 or your debt to income ratio is over 45%, it will get a refer and you will find most lenders will not approve the loan.

- Some lenders will do a credit score down to 600, but they will want a lot of documentation to overturn the refer and compensating factors for the lower credit score. They typically will need to verify rent for last 12 months, with no lates, cash payments are not acceptable, and debt to income ratios are set at 29% and 41% respectively. Reserves are typically helpful too on lower credit scores, so keep in that in mind, if you have money in a savings account, for a rainy day fund, this will help sometimes get the loan approved.

- If you have access to 20% down payment you cannot use the USDA Program. Money in a retirement account does not account toward the 20% rule.

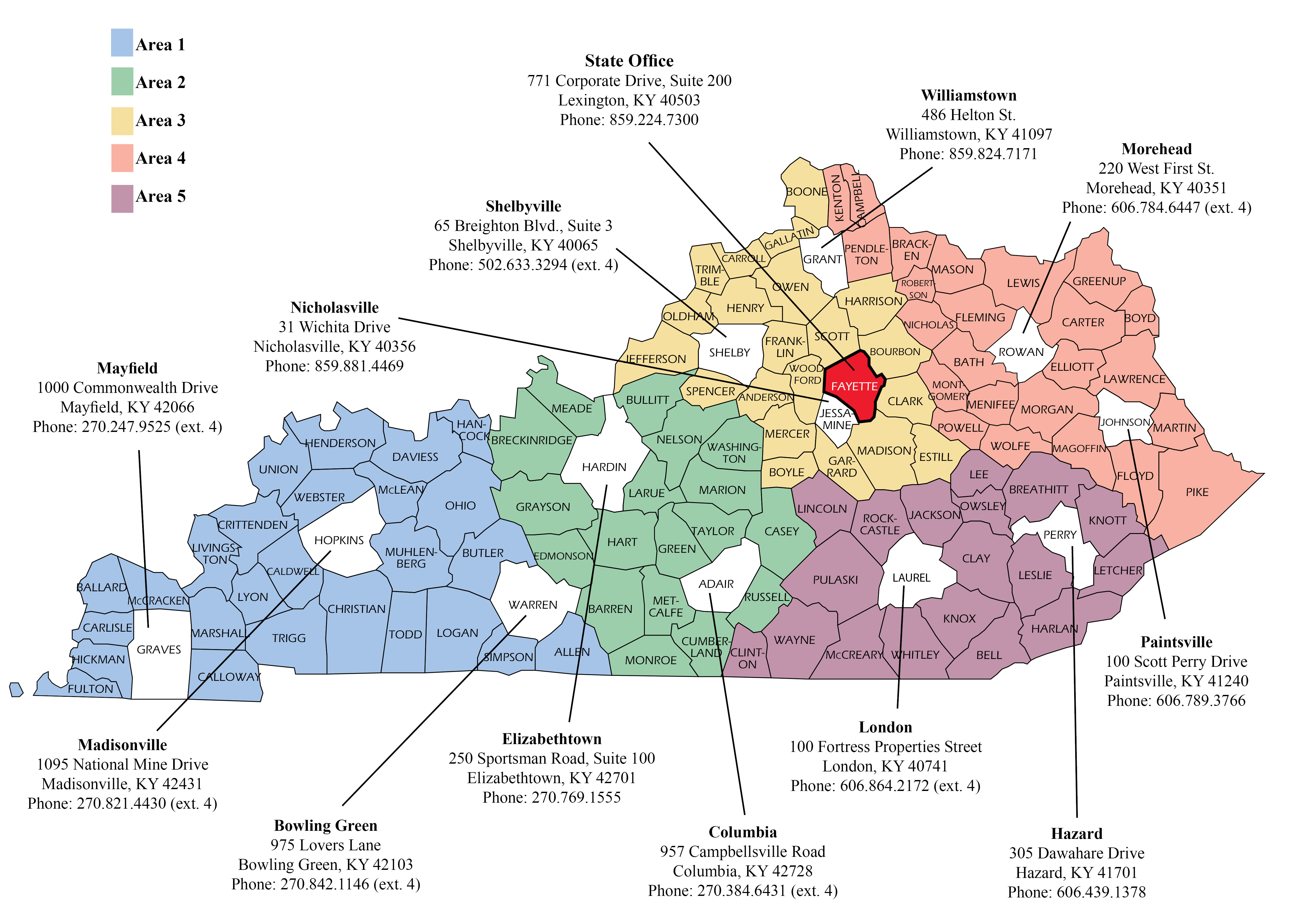

- Properties must be located in an eligible area of Kentucky. Typically the large metro areas of Kentucky including the following: all of Jefferson County, all of Fayette County, Owensboro, Paducah, Hopkinsville, Bowling Green, Richmond, Frankfort and Northern KY cities of Covington, Florence, Erlanger, Beechwood, Richwood are not eligible

USDA Eligible Areas In Northern Kentucky for Boone, Kenton, Campbell, Grant Counties

- Independence

- Burlington

- Hebron

- Highland Heights

- Walton

- Alexandria

- Cold Springs

- All Of Grant County, Pendleton County And Owen County

Notice of changes to eligible area maps for USDA Rural Development housing programs

USDA Rural Development has completed its 2020 decennial United States census review for all areas under its jurisdiction to identify areas that no longer qualify as rural for Kentucky USDA Rural Housing programs.

Based on the review of the areas within the state of Kentucky, using 2020 US census data, and rural area guidance located in Handbook HB-1-3550, Chapter 5, the rural eligibility designation has changed for the following areas:

Areas whose rural eligibility designations are changing from ineligible to eligible (these areas now qualify as rural for USDA Housing Programs):

- The area/towns currently outside the city of Ashland, KY (Catlettsburg, West Fairview, Fairview, Westwood, Russell).

- The areas/towns currently outside the city of Paducah, KY (Hendron and Farley).

- The cities of Ashland, KY and Paducah, KY will remain ineligible.

Areas whose rural eligibility designation is changing from eligible to ineligible (these areas no longer qualify as rural for USDA Housing Programs):

- Georgetown, KY – The city of Georgetown, KY, will no longer be eligible due to the population exceeding 35,000.

Changes become effective October 1, 2023.

The updated rural area map can now be viewed on our eligibility website. Users will need to click on the program, for example: “Single Family Housing Direct,” and then click on “Proposed Eligibility Areas” from the menu options.

Search for Kentucky USDA Eligible Properties

A property must be located in an eligible area in order to use a USDA loan to purchase a home. Contrary to belief, Rural Development loans are not only for farms or very rural homes.

Actually, a property with an operating and income producing farm is not eligible for these loans!

Some More Facts about a Kentucky USDA loan:

It’s a two step approval process. The chosen USDA lender must first underwrite the file and get it approved based on the income, assets, and credit report submitted. Then, the lenders must submit to USDA for a “conditional commitment”. This conditional commitment is the final loan approval paperwork you are looking for.

Even though the lender may have approved the file, it still must go to USDA office in Lexington for an assignment to SFH underwriter for the final approval process. They typically are checking the appraisal and income at this stage. There have been instances where the lender would approve the file but USDA would not due to appraisal issues or income and job history.

This is very rare instances, so keep that in mind when it comes to final loan approval.

This two-step approval process usually adds 4-6 days to the final loan approval process, so keep that in mind when you are writing up your contract because it takes a little longer to close these loans vs FHA, VA, and Fannie Mae loans.

Well Test Treatments: Properties with a well as the primary drinking source will require a well water test. There are local labs to perform this test and the water must pass.

Septic Test: Sometimes they will require the septic tank to be inspected if called for in the appraisal report or home inspection.

Older Homes: As a general rule, USDA does not like homes older than 100 years old. They will sometimes require a home inspection in addition to the mandatory appraisal on older homes.

USDA Loan After a Short Sale: A short sale is not the end of the world. So it is very possible to obtain a USDA loan if 3 years have passed after the short sale. But a buyer would need re-established good rent and other credit history.

Bankruptcy and Foreclosure: If the mortgage debt that was foreclosed, was included in a Bankruptcy – then the USDA Home Loan waiting periods after foreclosure “waiting period” of 3 years, starts from the date of the discharge of the Bankruptcy. Because it can take 6 months or more for Banks to process the Foreclosure, and transfer title, this is a tremendous plus.

- Fixed Payment Loans: A permanent amortized, fixed payment may be used when it can be documented that the payment is fixed, the interest rate is fixed, and the repayment term is fixed.

- Non-Fixed Payment Loans (i.e. deferred, income based, graduated, adjustable, etc.): The payment should be calculated as the greater of 0.5% of the loan balance or the actual payment reflected on the credit report. No additional documentation is required.

As a reminder, annual income differs from repayment income. Annual income for the household will be used to calculate the adjusted annual household income to determine eligibility for a USDA-guaranteed loan. The main purpose of the following revisions in paragraph 9.3 is to ensure that lenders are aware that they are to calculate and properly document all adult household members’ income for annual income eligibility purposes…not just parties to the loan note.

It’s important to be aware of income sources that are counted and NOT counted as well as how to properly determine both “annual” and “repayment” income. I recommend that you thoroughly read Chapter 9 and refer to Attachment 9-A and Attachment 9-D in HB-1-3555 to review income and asset types, guidance for annual and repayment purposes, and documentation options acceptable to verify the income or asset source.

Paragraph 9.3 is being revised as follows:

- To clarify that lenders must verify the income of each adult household member for the previous 2 years.

- To clarify, under “full income documentation”, the lender must obtain W-2s or IRS Wage and Income transcripts in addition to paystubs.

- To change the term “streamlined documentation” to “alternative income documentation” to remove confusion with the streamlined refinance product.

- To clarify under “self-employed income documentation,” if ownership interest is less than 25%, neither the “Business Owner” nor “Self-Employed” options should be selected in GUS (Guaranteed Underwriting System).

- To clarify the Verbal Verification of Employment must be obtained within 10 business days of loan closing, and confirmation a self-employment business remains operational must be obtained within 30 days of loan closing.

- Restructured guidance on tax transcripts to emphasize a failure to timely file tax returns is not an eligible explanation to forgo obtaining tax transcripts.

Paragraph 9.8: STABLE AND DEPENDABLE INCOME

Gaps In Employment: The Agency clarifies that it is the lender’s responsibility to analyze any gaps in employment to make a final determination of stable and dependable income. The Agency does not impose specific criteria regarding when a gap in employment is acceptable. It is the approved lender’s responsibility to analyze the complete employment history to determine stable and dependable income.

Business loss from a closed business:

The Agency clarifies that any loss incurred by a self-employed business (full-time or part-time) that is closed may be removed from consideration when the applicant provides a letter of explanation and documentation to the lender which details:

- When the business was closed;

- Why the business was closed;

- How the business was closed; and

- Evidence satisfactory to the lender to support the closure of the business.

Attachment 9-A: INCOME AND DOCUMENTATION MATRIX

Considerations for Income Calculations: The Agency added additional considerations to the “Considerations for All Income Calculations” section of the matrix to provide important reminders to lenders regarding reviewing and calculating income. The full text of the revision is as follows:

- Annual and adjusted annual income calculations must include all eligible income sources from all adult household members, not just parties to the loan note.

- Annual income is calculated for the ensuing 12 months based on income verifications, documentation, and household composition.

- Include only the first $480 of earned income from adult full-time students who are not the applicant, co-applicant, or spouse of an applicant in annual and adjusted annual income.

- Income from assets that meet the criteria of Section 9.4 must be included in annual and adjusted annual income.

- Repayment income calculations include the income sources of the applicants who will be parties to the note that meet the minimum required history identified in this matrix and have been determined to be stable and dependable income by the approved lender.

- Income used in repayment income calculations must be confirmed to continue a minimum of three years into the mortgage. If the income is tax-exempt, it may be grossed up to 25 percent for repayment income. “Documentation Source Options” lists eligible documentation. Every item listed is not required unless otherwise stated. Lenders must obtain and maintain documentation in the loan file supporting the lender’s income calculations.

Automobile Allowance:Revised “Automobile Allowance” guidance to allow the full allowance to be included as repayment income and the full expense (debt) counted in DTI, as well as updating the required history to two years.

Comment: Previously, a 1-year history was required. The wording in this section is much better in that it clarifies the intent of the agency to allow for the automobile allowance to be counted as income and the debt associated with that income, if any (such as a car payment), counted in the DTI.

Boarder Income: The Agency clarified that “Boarder Income” refers to rental income received from an individual renting space inside the dwelling, making the property income-producing and, therefore, ineligible.

Comment: This revision to attachment 9-A, “Boarder Income,” makes it clear that boarder income will render the property ineligible for a guaranteed loan. The previous guidance made it somewhat appear as if boarder income was acceptable. It’s not.

Bonus Income: Revised “Bonus” income to clarify the one-year history must be in the same or similar line of work.

Comment: This is a significant revision in that previously, the guidance made it appear the income had to be on the same job…not the same or similar line of work. This gives the lender greater flexibility in counting this type of income.

Child Support: Revised the “Child Support” guidelines to simplify the guidance and remove inconsistencies. The Agency stated that child support that meets the minimum history but the payment amounts are not consistent must use an average consistent with the payor’s current ability/willingness to pay.

Comment: While perhaps not readily apparent, the wording in this revised guidance is significant in that it gives lenders greater latitude in using “Child Support” income.

Employee Fringe Benefits: The Agency clarified that employer-provided fringe benefits that are reported as taxable income may be included in repayment income. The actual guidance states the following: Employer-provided fringe benefit packages documented on earning statements as taxable income may be included.

Expense Allowance: Revised “Expense Allowance” guidance to allow the full allowance to be included as repayment income and the full expense (debt) counted in DTI, as well as updating the required history to two years.

Comment: Previously, a 1-year history was required. The wording in this section is much better in that it clarifies the intent of the agency to allow for the expense to be counted as income and the debt associated with that income, if any, counted in the DTI.

Guardianship/Conservatorship Income: The Agency added a category providing guidance on “Guardianship/Conservatorship Income.” This guidance does not apply to income earned from foster care. Include amounts that will be received in the ensuing 12 months. Exclusions may apply under 7 CFR 3555.152(b)(5).

Required History: None; the income must be received at the time of submission to the Agency. Lenders must document:

- The applicant is currently receiving the income; and

- The amount of income received each month.

Continuance: Benefits that do not include expiration dates on the documentation will be presumed to continue.

Documentation Source Options:

- Documentation to support payment amounts and duration, such as a court order, legal documents, or other supplemental information

- Online payment schedule from the Agency, bank statements, etc.

- Federal income tax returns or IRS tax transcripts with all schedules.

Individual Retirement Account (IRA) Distributions: The Agency added a category providing guidance on “Individual Retirement Account (IRA) Income.” Include amounts that will be received in the ensuing 12 months. Lump sum withdrawals or sporadic payments may be excluded under 7 CFR 3555.152(b)(5).

Required History: None; the income must be received at the time of submission to the agency. The lender must document:

- The applicant is currently receiving the income; and

- The amount of income received each month.

Documentation Source Options:

- IRA documents, IRS 1099, evidence of current receipt, bank statements, etc.

- Federal income tax returns or IRS tax transcripts with all schedules.

Mileage: The Agency is simplifying the guidance on considering mileage income and deductions. For deductions claimed on tax returns, the Agency now refers to IRS guidance when a mileage deduction is claimed on income tax returns.

Mortgage Credit Certificate: The Agency removed the requirement to obtain a copy of the IRS W-4 document when an applicant uses a Mortgage Credit Certificate as income.

Comment: THANK GOODNESS!!! This was one of the biggest pains ever. No other agency required evidence that a new W4 form was filed with the employer in order to use a Mortgage Credit Certificate as additional income. This is a common-sense welcome revision.

Non-Occupant Borrower: The Agency removed the “Non-Occupant Borrower” category on the matrix since non-occupant borrowers are not permitted anyway.

Overtime: Revised “Overtime” income to clarify the one-year history must be in the same or similar line of work.

Comment: This is a significant revision in that previously, the guidance made it appear the income had to be on the same job…not the same or similar line of work. This gives the lender greater flexibility in counting this type of income.

Rental Income: Updated “Rental Income” guidelines regarding corresponding mortgage liabilities to be consistent with the guidance in Chapter 11.

Secondary Employment: Revised “Secondary Employment” guidance to clarify that the applicant must have a one-year history of working the primary and secondary jobs concurrently for the lender to be able to consider the secondary employment for repayment income.

Section 8 Housing Vouchers: Revised “Section 8 Housing Vouchers” to permit Section 8 vouchers to be treated as a reduction of the PITI when the benefit is paid directly to the servicer rather than solely an addition to repayment income. Subsequently, the Agency provided clarification that a manual file submission is required in this instance, and clarified that when lenders use the benefit as a reduction of the PITI, they must maintain documentation in their permanent loan file to support the benefit is paid directly to the servicer.

Comment: Wow! I cannot stress how significant this change is. Allowing for the Section 8 Voucher amount paid directly to the servicer to be a direct reduction to PITI instead of counted as additional income will help a tremendous amount of applicants obtain an agency-guaranteed loan.

Separate Maintenance/Alimony: Revised the “Separate Maintenance/Alimony” guidelines to simplify the guidance and remove inconsistencies. The Agency stated that “Separate Maintenance/Alimony” that meets the minimum history, but the payment amounts are not consistent, must use an average consistent with the payor’s current ability/willingness to pay.

Comment: While perhaps not readily apparent, the wording in this revised guidance is significant in that it gives lenders greater latitude in using “Separate Maintenance/Alimony” income.

Unreimbursed Employee or Business Expenses: Revised the “Unreimbursed Employee or Business Expenses” guidance to reflect instances where the IRS continues to allow these deductions.

Variable Income: The Agency added a category providing guidance on “Variable Income.” i.e., piece rate, union work, and other similar types of pay structures.

Annual Income: Include amounts that will be received in the ensuing 12 months. Exclusions may apply under 7 CFR 3555.152(b)(5).

Repayment Income:

Required History: One year in the same or similar line of work. Underwriters must analyze variable income earnings for the current pay period and YTD earnings. Significant variances (increase or decrease) of 20 percent or greater in income from the previous 12 months must be analyzed and documented (i.e., variances due to seasonal/holiday, etc.) before considering the income stable and dependable.

Continuance: Income will be presumed to continue unless there is documented evidence the income will cease.

Required Documentation:

- Paystub(s), Earning Statement(s)

- W-2s

- Written VOE or Electronic Verifications

- Federal Income Tax Returns or IRS Tax Transcripts with all Schedules

- Section 9.3E provides additional information on employment verification options.

Assets and Reserves: In the “Assets and Reserves” portion of the matrix, the Agency reiterated that lenders have the option to underwrite to the most conservative approach, with no consideration of assets entered into GUS. The full wording of the text is as follows: “Although all household assets must be verified and documented in the permanent loan file, the lender may underwrite to the most conservative approach with no consideration of assets entered into GUS.”

Comment: the agency has always said Lenders must use caution and not overstate assets utilized for reserves. It’s good practice not to overstate assets, as that could lead to a GUS finding that will ultimately be determined to be in error. The bottom line, excess assets utilized for reserves can lead to a Gus “Accept” finding that could potentially move to a “Refer” finding with the corrected entry of borrower assets. Don’t fall into the trap of overstating assets/reserves.

Depository Accounts: Checking, Money Market Accounts, and Savings: The Agency revised guidance for sourcing deposits in depository accounts. I’m going to start off by simply providing a clip of the exact wording for this revision.

Documentation:

Two months of recent bank statements; or

- Verification of Deposit (VOD) and a recent bank statement; or

- Alternate evidence (i.e., statement printouts stamped by the lender) to support account activity and monthly balances.

- Investigate all recurring deposits on the account statements that are not attributed to wages or earnings to confirm the deposits are not from undisclosed income sources. There is no tolerance or percentage of the amount of a recurring deposit that is not required to be investigated.

- Investigate individual (non-recurring) deposits greater than $1,000 on the account statements that are not attributed to wages or earnings to confirm the deposits are not from undisclosed income sources.

- If the source of a deposit is readily identifiable on the account statement(s), such as a direct deposit from an employer, the Social Security Administration, an IRS or state income tax refund, or a transfer of funds between verified accounts, and the source of the deposit is printed on the statement, the lender does not need to obtain further explanation or documentation. However, if the source of the deposit is printed on the statement, but the lender still has questions as to the source of the deposit, the lender should obtain additional documentation.

Reserves: Eligible

Lenders must use the lesser of the current month’s balance or the previous month’s ending balance when calculating reserves. Deposited gift funds require further documentation and calculation. Refer to the “Gift Funds” section of the attachment for further guidance.

Funds to Close: Eligible

Comment: Holy cow! It’s about time. I’ve been preaching for years that this guidance needed to be revised. I’m literally dancing with joy along with every mortgage processor and underwriter. Previously a lender had to investigate all deposits on the account statements that were not attributed to wages or earnings. Since a USDA Guaranteed Housing loan has income eligibility limits, the Agency wanted lenders to confirm that deposits were not from undisclosed income sources. They gave us no tolerance or percentage of the deposit amount that was not required to be investigated. This means that lenders were required to have the borrower’s address/document every single non-payroll deposit…no matter how small… even deposits as little as $1. In a world of cash payment apps such as Zelle, Venmo , and PayPal, where a borrower can have numerous cash deposits, this became a daunting task. In other words…it really sucked.

This revision, while still requiring analysis and possible explanation/documentation, will give us some well-deserved relief.

Under the new guidance, lenders now have to investigate all “RECURRING” deposits on the account statements that are not attributed to wage and earnings to confirm that the deposits are not from undisclosed income sources. As before, the agency has provided no tolerance or percentage of the amount of a recurring deposit that is not required to be investigated. The key here is the word “recurring”. When analyzing the account statements, a lender now has to simply address “recurring” deposits. This will simplify the analysis and process tremendously.

As for “NON-RECURRING” deposits…the Agency requires lenders to investigate individual “non-recurring” deposits greater than $1,000 on the account statements that are not attributed to wages or earnings to confirm the deposits are not from undisclosed income sources.

They go on to say that if the source of a deposit is readily identifiable on the account statement(s), such as a direct deposit from an employer, the Social Security Administration, an IRS or state income tax refund, or a transfer of funds between verified accounts, and the source of the deposit is printed on the statement, the lender does not need to obtain further explanation or documentation. However, if the source of the deposit is printed on the statement, but the lender still has questions as to the source of the deposit, the lender should obtain additional documentation.

Bottom line, this will make all our lives much easier. Thank goodness! God bless USDA.

Gift Funds: The Agency revised additional guidance for Gift Funds as follows:

Documentation:

- Gift funds are considered the applicant’s own funds; therefore, excess gift funds are eligible to be returned to the applicant at loan closing.

- Gift funds may not be contributed from any source that has an interest in the sale of the property (seller, builder, real estate agent, etc.).

- Gift Funds must be properly sourced.

- If the funds have been deposited to the borrower’s account, obtain a gift letter to state the funds do not have to be repaid and a bank statement as evidence of funds from the donor’s account. Cash on hand is not an acceptable explanation for the source of funds.

- If the funds have not been deposited in the borrower’s account, obtain a gift letter to state the funds do not have to be repaid, a certified check, money order, or wire transfer, and a bank statement showing the withdrawal from the donor’s account. Cash on hand is not an acceptable explanation for the source of funds.

- If the gift funds will be sent directly to the settlement agent, the lender must obtain a gift letter to state the funds do not need to be repaid, a bank statement as evidence of funds from the donor’s account, and verification that the funds have been received by the settlement agent. Cash on hand is not an acceptable explanation for the source of funds.

Reserves: Ineligible

Funds to Close: Eligible

GUS Instructions: • Gift funds should be entered in the “Gifts or Grants You Have Been Given or Will Receive for This Loan” section of the “Loan and Property Information” GUS application page. If the funds have already been deposited into an asset account, select “deposited” and include the amount of the gift in the applicable asset account on the “Assets and Liabilities” GUS application page. If the funds have not been deposited into an asset account, select “not deposited” and do not include the gift in an asset account on the “Assets and Liabilities” GUS application page. • Gift funds applied as Earnest Money should not be reflected in the “Gifts or Grants You Have Been Given or Will Receive for This Loan” section of the “Loan and Property Information” GUS application page.

Comment: You need to read this one thoroughly. This is much better guidance than previously provided, offering details for sourcing gift funds as well as how to enter gift funds into the Agency’s Guaranteed Underwriting System (GUS).

Lump Sum Additions: IRS Refunds, Lottery Winnings, Inheritances, Withdrawals from Retirement Accounts: The Agency added a category providing guidance on “Lump Sum Additions.”

Documentation:

- Document the applicant’s receipt of funds.

- Verify where the proceeds are held and confirm they are available to the applicant.

- One-time deposits may not require annual income considerations under 7 CFR 3555.152(b)(5)(vi).

- Do not enter into GUS separately if it is already included in the borrower’s depository account.

Reserves: Eligible

Funds to Close: Eligible

Comment: Note that it says that withdrawals from retirement accountsare eligible as cash reserves; however, under the “Retirement: 401(k), IRA, etc.” section of the matrix, the Agency says that funds borrowed on retirement accounts are NOT allowed for cash reserves. To be clear, apparently, the term withdrawal does not include borrowing funds from the retirement account. In order to be able to use 401(k) funds as cash reserves, a borrower would have to either withdraw funds from the retirement account (not borrow) or leave the money in the retirement account so that 60% of the vested amount available to the borrower could be counted as cash reserves.

Retirement: 401(k), IRA, etc.: The Agency clarified that funds borrowed against retirement accounts (e.g., 401(k), IRA, etc.) are eligible for funds to close but are not considered in reserves.

Documentation:

- Recent account statement (monthly, quarterly, etc.) to evidence the account balance, vested balance available for withdrawal, and early withdrawal penalty, if applicable.

- Funds borrowed against these accounts may be used for funds to close but are not considered in reserves. The borrowed funds should not be reflected in the balance of any asset entered on the “Assets and Liabilities” application page.

Reserves: Eligible

- 60% of the vested amount available to the applicant may be used as reserves.

- Funds borrowed against these accounts are not eligible for reserves. The borrowed funds should not be reflected in the balance of any asset entered on the “Assets and Liabilities” application page.

Funds to Close: Eligible

Comment: I personally think this guidance is kind of weird. I can use 60 % of a vested 401(k), IRA, etc., as cash reserves, but if I borrow against it and put the cash into the bank, I can’t use any of those borrowed retirement funds beyond the amount of cash needed to close as cash reverse? Maybe it’s just me…but that does not totally make sense to me…but it’s their call.

Strategically, if you need cash to close from your retirement account and you need cash reserves, then you would need to only borrow just enough cash to close and leave the remaining funds in your retirement account, so it could be classified as cash reserves once the proper percentages (less the amount borrowed) are calculated.

Attachment 9-E: Information for Analyzing Tax Returns for Self-Employed Applicants

Attachment 9-E was revised to reflect a two-year required history for “Capital Gain or Loss” to be consistent with the current guidance in Attachment 9-A.

Chapter 15 – Submitting the Application Package

The following updates were made to HB-1-3555, Chapter 15 to make minor grammatical and formatting changes, correct discrepancies, and provide clarification for easier understanding of guidance.

Paragraph 15.7 C: Requesting Changes in Conditions: The Agencyclarifies that Conditional Commitment change requests should be made via email.

Attachment 15-A was REVISED as follows:

- In Lender Instructions, the Agency states that electronic delivery to Rural Development is the preferred method for submission.

- The Agency removed the requirement to submit evidence of qualified alien requirements on page 1, as it is not required to be submitted to the Agency on GUS Accept files.

- The Agency changed the term “streamlined documentation” to “alternative income documentation” on page 2 to remove confusion with the streamlined refinance product.

- The Agency clarified that a Verification of Rent is required for manually underwritten loans with credit scores less than 680.

Comment: Previously, the “Loan Origination Checklist” attachment 15-A stated that verification of rent “MAY” be applicable for a manually underwritten loan with a credit score of less than 680. Now the Agency states that it “IS” required for a credit score of less than 680 on a mainly underwritten loan.

USDA Proposed Rule – Manufactured Housing Provisions

On August 16, 2023, a Proposed Rule was published in the Federal Register seeking comments on proposed changes to Handbook 1-3550 and Handbook 1-3555 that would make existing manufactured homes, which meet specific criteria, eligible for financing. In addition, the proposal reduces regulatory burdens related to manufactured housing requirements and provides flexibilities for energy efficient manufactured and modular homes located in land lease communities operating on a non-profit basis.

Changes to the Eligibility of Certain Rural Areas Effective October 1, 2023

The new ineligible areas, resulting from the rural area review process, will become effective on October 1, 2023.

On October 1, 2023, the new ineligible area maps for the Rural Development Single Family Housing (SFH) and Multi-Family Housing programs will be updated to the USDA Income and Property Eligibility Site at https://eligibility.sc.egov.usda.gov. The current maps will be moved to the “Previous Eligibility Areas” tab.

Single Family Housing Loan Guarantee Processing

On October 1, 2023, all properties for new applications must be located in an eligible rural area based on the new eligibility maps. However, a property that is located in an area being changed from rural to non-rural may be approved if all of the following conditions are met:

- The application is dated and received by the lender prior to October 1, 2023, and the Loan Estimate was issued by the lender within 3 days of application receipt.

- The applicant has a signed/ratified sales contract on a property that is dated prior to October 1, 2023.

- Applicant meets all other loan eligibility requirements.

If the property is located in an area being changed from rural to non-rural, lenders must provide Rural Development all of the following information in addition to all other required documentation. For loans submitted via the Guaranteed Underwriting System (GUS), the documentation must be uploaded into the system.

- Copy of the signed/ratified and dated sales contract.

- Copy of the Loan Estimate issued to the applicant.

- Verification that the property was located in an eligible rural area prior to October 1, 2023. Note: Maps of the “Previous Eligible Areas” (eligibility maps prior to October 1, 2023) will be available on the Eligibility site beginning October 1, 2023. A printout of the map indicating the property address was previously eligible is acceptable.

GUS underwriting recommendations will display an INELIGIBLE property determination for property that is no longer located in an eligible rural area. The INELIGIBLE property determination is the second half of the GUS underwriting recommendation. For example, an ACCEPT/INELIGIBLE underwriting recommendation will apply to a request where the applicant’s credit and capacity assessment is an ACCEPT (first part of the underwriting recommendation) however the property is located in an INELIGIBLE area (second part of the underwriting recommendation). This does not prevent the lender from completing the final submission to Rural Development. The Rural Development reviewer will be able to override the property eligibility determination when the lender has uploaded the required documentation noted above.

To assist Rural Development in processing your loan guarantee request expeditiously, lenders should ensure the documentation noted above is submitted to Rural Development for review when requesting the guarantee.

Thank you for supporting the Single-Family Housing Guaranteed Loan Program!