- Annual Qualifying Income – The requirement for calculations to be included on the Income Calculation worksheet have been removed and should now be included on Attachment 9-B, the underwriter transmittal summary, FNMA form 1008/Freddie form 1077, or equivalent

- 4506-T – The requirement for asset statements to be reviewed to ensure borrowers have no additional income sources has been removed.

- Repayment Income – MCC income must now be included in repayment income.

- Boarder Income – USDA now considers a boarder as a household member and a boarder’s income must now be included in annual income calculation. Rent paid by boarders that is reported on tax returns must also be included in annual income.

- Capital Gains – USDA removed requirement from Repayment Income to provide evidence showing borrowers own additional property or assets that may be sold if additional income is needed to support the mortgage obligation

- Commission – The borrower must now show one year history in same or similar line of work to include commission in repayment income.

- Fellowship, Stipend, Scholarship – Scholarship award letters must now provide date of termination and USDA will no longer presume benefits with no expiration date will continue. USDA also added guidelines for GI Bill income and stated it cannot be included in annual or repayment income.

- MCC – This income must now be included in repayment income, but no history is required. A copy of the W-4 from employer is required to verify borrower is taking tax credit on monthly basis. Note: MCC’s are ineligible with FWL as qualifying income.

- Unreimbursed Business Income – only taxable income is allowed to be included in repayment income

- Section 8 – USDA removed requirement for section 8 income to be deducted from the monthly PITI to determine DTI if it is paid directly to the loan servicer when included in the repayment income.

- Self Employed Income – Federal tax returns must now be reviewed to determine gross income for annual calculations. Removed requirement to deduct business loss before entering as repayment income into GUS or on loan application. Clarified documentation requirements as most recent 2 years of federal tax returns / transcripts & YTD P&L may be audited or unaudited

- Social Security Income – clarified documentation options and will allow social security benefit statement or form SSA-1099/1042S to source

- Temporary Leave – The history requirements for repayment income has been changed and now income must be received by loan closing.

- Cash on Hand – The underwriter must review the reasonableness of accumulation based upon income stream, spending habits, etc. and cash on hand can no longer be included in reserves

- Gift Funds – Clarification provided on how gift funds must be sourced when gift funds have been deposited into borrower’s account, not deposited into borrower’s account, or if funds are being wired directly to the settlement agent.

- Large Deposits – USDA no longer addresses lump sum additions.

Category: DIRECT LOANS

502 Direct USDA Loan in Kentucky:

There are two types of Kentucky USDA Rural Housing Home loans available to rural Kentucky Home buyers through Rural Development:

Direct homeownership loans and guaranteed home ownership loans.

Let’s first look at the 502 Direct USDA Loan in Kentucky

502 Direct USDA Loan in Kentucky:

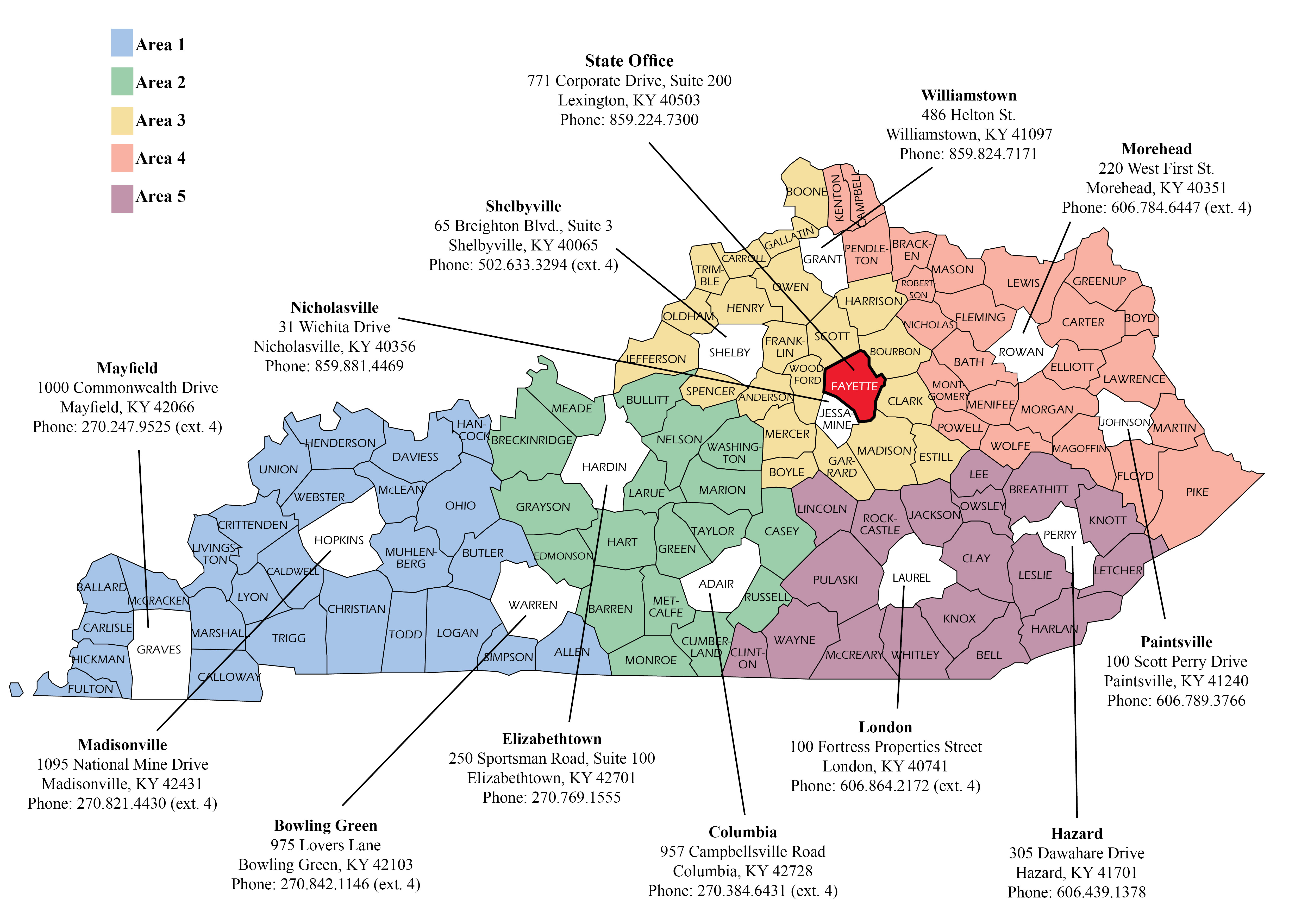

With a Kentucky Direct Loan 502, the applicant applies directly to the USDA office serving their location in Kentucky. There are about 13 different locations . They lend the money direct from USDA , 100 percent financing, for the low rate currently at 3 percent on a 33 year term.

For a direct home loan, the purchase, construction, repair and rehabilitation of a single family home in rural areas must be used for the applicant’s permanent residence. “For manufactured housing, only new construction can be funded,” he explained.

Credit scores of 640 or greater are typically acceptable with a minimum number of trade lines (2 usually for 12 months can be opened or closed) that have been open and active.

No down payment typically is required- Loans may be up to 100 percent of the appraised value. Homebuyer education is required prior to closing for the Direct USDA Loan 502 program

Rural Home Loans (Direct Program)

What does this

program do?

Also known as the Section

502 Direct Loan Program, this

program assists low- and

very-low-income applicants

obtain decent, safe, and sanitary

housing in eligible rural areas by

providing payment assistance

to increase an applicant’s

repayment ability. Payment

assistance is a type of subsidy

that reduces the mortgage

payment for a short time.

The amount of assistance is

determined by the adjusted

family income.

Who may apply for this program?

A number of factors are considered

when determining an applicant’s

eligibility for Single Family Direct Home

Loans. At a minimum, applicants

interested in obtaining a direct loan must

have an adjusted income that is at or

below the applicable low-income limit

for the area where they wish to buy a

house and they must demonstrate a

willingness and ability to repay debt.

Applicants must:

• Be without decent, safe, and

sanitary housing

• Be unable to obtain a loan from

other resources on terms and

conditions that can reasonably be

expected to meet

• Agree to occupy the property as

your primary residence

• Have the legal capacity to incur a

loan obligation

• Meet citizenship or eligible

noncitizen requirements

• Not be suspended or debarred from

participation in federal programs

Properties financed with direct loan

funds must:

• Be modest in size for the area

• Not have market value in excess of

the applicable area loan limit

• Not have in-ground swimming pools

• Not be designed for income

producing activities

Borrowers are required to repay all or a

portion of the payment subsidy received

over the life of the loan when the title to

the property transfers or the borrower is

no longer living in the dwelling.

Applicants must meet income eligibility

for a direct loan. Please contact your

local RD office to ask for additional

details about eligibility requirements.

What is an eligible area?

Generally, rural areas with a population

less than 35,000 are eligible. Visit the

USDA Income and Property eligibility

website for complete details.

How may funds be used?

Loan funds may be used to help

low-income individuals or households

purchase homes in rural areas. Funds

can be used to build, repair, renovate,

or relocate a home, or to purchase

and prepare sites, including providing

water and sewage facilities.

How much may I borrow?

The maximum loan amount an

applicant may qualify for will depend

on the applicant’s repayment ability.

The applicant’s ability to repay a loan

considers various factors such as

income, debts, assets, and the amount

of payment assistance applicants

may be eligible to receive. Regardless

of repayment ability, applicants may

never borrow more than the area loan

limit (plus certain costs allowed to be

financed) for the county in which the

property is located.

Rural Home Loans (Direct Program)

What is the interest rate and

payback period?

• Fixed interest rate based on current

market rates at loan approval or loan

closing, whichever is lower.

• The monthly mortgage payment,

when modified by payment

assistance, may be reduced to as

little as an effective 1% interest rate.

• Up to 33 year payback period – 38 year

payback period for very low income

applicants who can’t afford the 33 year

loan term.

How much down payment

is required?

No down payment is typically required.

Applicants with assets higher than the

asset limits may be required to use a

portion of those assets.

Is there a deadline to apply?

Applications for this program are

accepted through your local RD office

year round.

How long does an application take?

Processing times vary depending on

funding availability and program demand

in the area in which an applicant is

interested in buying and completeness

of the application package.

What governs this program?

• The Housing Act of 1949 as

amended, 7 CFR, Part 3550

• HB-1-3550 – Direct Single Family

Kentucky USDA Rural Development Loan Program:

The following is a list of the “nuts and bolts” of the Kentucky USDA Rural Development Loan Program:

- The house has to be located in a Kentucky USDA Rural Development Loan Program: area designated as an USDA eligible area.

- To determine the USDA approved designated areas, reference the following USDA map instructions:

- Go the USDA Rural Development Website

- On the top left hand side, click “Single Family Housing Guaranteed”

- Click “Accept”

- Enter the property address to determine if a specific house or general area is located in an USDA eligible area

- The household income must be moderate as determined by USDA. The USDA Loan evaluates household income, which includes the combined income of all adults living in the household; even if they are not on the mortgage loan. Click here to determine your household income eligibility.

- If it appears that the household income exceeds the moderate income thresholds established by USDA, do not throw in the towel just yet. USDA allows for deductions for child care and medical expenses as well as for children, students, and elderly members of the household that will be living in the USDA financed property.

- This is not a farmer’s loan. As a matter of fact, the property cannot have any income producing capabilities, and when the land value of the property exceeds 30% of the appraised value additional requirements must be met.

- The house has to be in fairly good condition. The appraisal type being utilized is an FHA appraisal, so make sure that there are not any safety related challenges(i.e. missing banisters, peeling paint, exposed electric).

- This is a true no money down loan program. Or stated differently, you do not need a down payment.

- While there is a monthly mortgage insurance premium (or prorated portion of an Annual Fee), the cost of the monthly mortgage insurance is 59% less than a comparable FHA Loan. This makes the USDA loan more affordable than an FHA Loan when analyzing down payment requirements and monthly mortgage payments.

- The seller can pay all closing costs and pre-paids (i.e. escrows). Often the home buyer’s only out-of-pocket cost as part of the purchase transaction is approximately $550 for the appraisal report.

- If the house appraises for more than the purchase price, the difference can be used to pay for closing costs and pre-paids (i.e. escrows). Only the USDA Loan program allows for closing costs to be rolled on top of the purchase price.

- USDA has no restriction on whether you are a first time home buyer or move-up home buyer.

- This loan program is only for primary residence (i.e. no second home or investment properties).

- You should not own any other functional property; although there are some circumstances under which USDA may waive this requirement.

- The preferred minimum credit score is 640. However, if you have a documented rent history, no late payments on your credit cards, and no new collections within the last 12 months, a credit score as low as 620 may be considered.

- All property types including single family homes, town homes, modular, and even condominiums qualify for this loan program. Manufacture homes such as single and doublewides constructed prior to January 1, 2006 do not qualify.

- There is no maximum mortgage amount, but the house does have to be considered moderate in a size

Kentucky Direct Single Family Housing Program

Loan Limit Change – Effective January 31, 2020

Homes financed under the program are generally 2,000 square feet or less.

Area Loan Limits

Single Family Housing Direct

The Direct Home Loan Program assists low- and very-low- income applicants obtain decent, safe, and sanitary housing in eligible rural areas. Funds can be used to purchase, build, repair, or renovate a home. Applicants must meet income eligibility for a direct loan. Please select South Dakota from the map that displays.

Generally, rural areas with a population less than 35,000 are eligible. Visit the USDA Income and Property Eligibility website for complete details.

Remember, Direct USDA Loan Limits aren’t effective for the USDA Rural Development Single Family Guartneed Program, whereas that program has no Loan Limits, just income limits on the household income.

County or Equivalent Limit Effective 01-31-2020 for the Direct USDA Loan Program

Adair $265,400

Allen $265,400

Anderson $265,400

Ballard $265,400

Barren $265,400

Bath $265,400

Bell $265,400

Boone $265,400

Bourbon $265,400

Boyd $265,400

Boyle $265,400

Bracken $265,400

Breathitt $265,400

Breckinridge $265,400

Bullitt $266,800

Butler $265,400

Caldwell $265,400

Calloway $265,400

Campbell $265,400

Carlisle $265,400

Carroll $265,400

Carter $265,400

Casey $265,400

Christian $265,400

Clark $265,400

Clay $265,400

Clinton $265,400

Crittenden $265,400

Cumberland $265,400

Daviess $265,400

Edmonson $265,400

Elliott $265,400

Estill $265,400

Fleming $265,400

Floyd $265,400

Franklin $265,400

Fulton $265,400

Gallatin $265,400

Garrard $265,400

Grant $265,400

Graves $265,400

Grayson $265,400

Green $265,400

Greenup $265,400

Hancock $265,40

County or Equivalent Limit Effective 01-31-2020

Hardin $265,400

Harlan $265,400

Harrison $265,400

Hart $265,400

Henderson $265,400

Henry $266,800

Hickman $265,400

Hopkins $265,400

Jackson $265,400

Jessamine $265,400

Johnson $265,400

Kenton $265,400

Knott $265,400

Knox $265,400

Larue $265,400

Laurel $265,400

Lawrence $265,400

Lee $265,400

Leslie $265,400

Letcher $265,400

Lewis $265,400

Lincoln $265,400

Livingston $265,400

Logan $265,400

Lyon $265,400

McCracken $265,400

McCreary $265,400

McLean $265,400

Madison $265,400

Magoffin $265,400

Marion $265,400

Marshall $265,400

Martin $265,400

Mason $265,400

Meade $265,400

Menifee $265,400

Mercer $265,400

Metcalfe $265,400

Monroe $265,400

Montgomery $265,400

Morgan $265,400

Muhlenberg $265,400

Nelson $265,400

Nicholas $265,400

Ohio $265,400

Oldham $266,800

Owen $265,400

County or Equivalent Limit Effective 01-31-2020

Owsley $265,400

Pendleton $265,400

Perry $265,400

Pike $265,400

Powell $265,400

Pulaski $265,400

Robertson $265,400

Rockcastle $265,400

Rowan $265,400

Russell $265,400

Scott $265,400

Shelby $266,800

Simpson $265,400

Spencer $266,800

Taylor $265,400

Todd $265,400

Trigg $265,400

Trimble $265,400

Union $265,400

Warren $265,400

Washington $265,400

Wayne $265,400

Webster $265,400

Whitley $265,400

Wolfe $265,400

Woodford $265,400

Kentucky USDA Rural Housing Repair and Grant Program.

Section 504 Repair Loan and Grant Program for Kentucky USDA RHS Loans

If you missed the live webinar to learn about recent changes to the Section 504 Single-Family Housing Repair Loan and Grant Program, the presentation slides from the webinar are available on the U.S. Department of Agriculture (USDA) Rural Development’s website. This information is for individuals and organizations, including nonprofits and public agencies, who work with affordable housing products such as weatherization, home repairs, and Section 504 application packaging.

The slides will provide information on the following:

- An overview of recent changes to the Section 504 Single-Family Housing Repair Loan and Grant Program.

- Information on Procedure Notice 527 (published on August 29, 2019).

For a brief overview of the 504 program, please watch the USDA Helps You Make Home Repairs

Program Guidelines & Terms –Section 504 Loans

• Maximum outstanding 504 loan amount is $20,000

• Interest rate is fixed at 1%

• Maximum term of 20 years (term and payment is based upon the

family budget)

• Appraisal and escrow account is required for loans over $15,000

• Flood insurance is required for properties located in a flood zone

• Mortgage, title work and closing agent required for loans of

$7,500 or more

• Mortgage is filed for loans of $7,500 and over

• Assets above $15,000 ($20,000 for elderly/disabled households)

must be applied toward repairs.

• Residential Mortgage Credit Reports are ordered by Agency for

loans of $7,500 and over (RMCR fee paid by Rural Development

General Eligibility Criteria – Section 504 Loans

• Household income must not exceed “very low” income

limits; < 50% HUD median income

• Applicant must own home (to include site when

considering manufactured housing) and occupy house on a

permanent basis

• Demonstrate repayment ability based upon a family budget

• Stable and dependable source of income

• Acceptable credit – reasonable ability and willingness to

meet debt obligations

• Meet asset limitations (15K non-elderly and $20K elderly*)

Program Guidelines & Terms –Section 504 Grant

• Maximum cumulative lifetime grant assistance is $7,500

• Grantee must sign Grant Agreement requiring occupancy

of home for 3 years

• No lien on property

• Repairs to remove health and safety hazards or to make the

home accessible and useable for household members with

disabilities.

General Eligibility Criteria – Section 504 Grants

• At least one applicant must be 62 years of age or older.

• Household income must not exceed “very low” income limits;

< 50% HUD median income

• Applicant must own home (to include site when considering

manufactured housing) and occupy house on a permanent basis

• Repairs must be necessary to remove health and safety hazards or

to make the home accessible and useable for household members

with disabilities.

• Must demonstrate a lack of repayment ability based upon a

household budget.

• Meet asset limitations (15K non-elderly and $20K elderly*)

• No outstanding federal judgments

SECTION 504 PROPERTY REQUIREMENTS

• Must be modest for the area; market value cannot be in

excess of USDA established area loan limit

• Property must be located in a designated rural area

• Must not have an in-ground swimming pool

• If the property has income producing land or structures, we

may use loan/grant funds as long as repairs are used for the

residential portion of the home.

• Mobile or manufactured homes must be on a permanent

foundation or be placed on a permanent foundation with

loan or grant funds.

For additional program Information, please visit the following USDA webpages:

USDA Rural Development Housing Program

- Kentucky USDA Increased Income Limits for 2019

- USDA Rural Development Housing Program

- Kentucky Rural Housing Development Mortgage Guide for 2019 USDA Loans

- Kentucky Rural Housing Development Mortgage Guide for 2019 USDA Loans

- USDA 100% – Rural Loans

—