Kentucky Rural Housing Loans

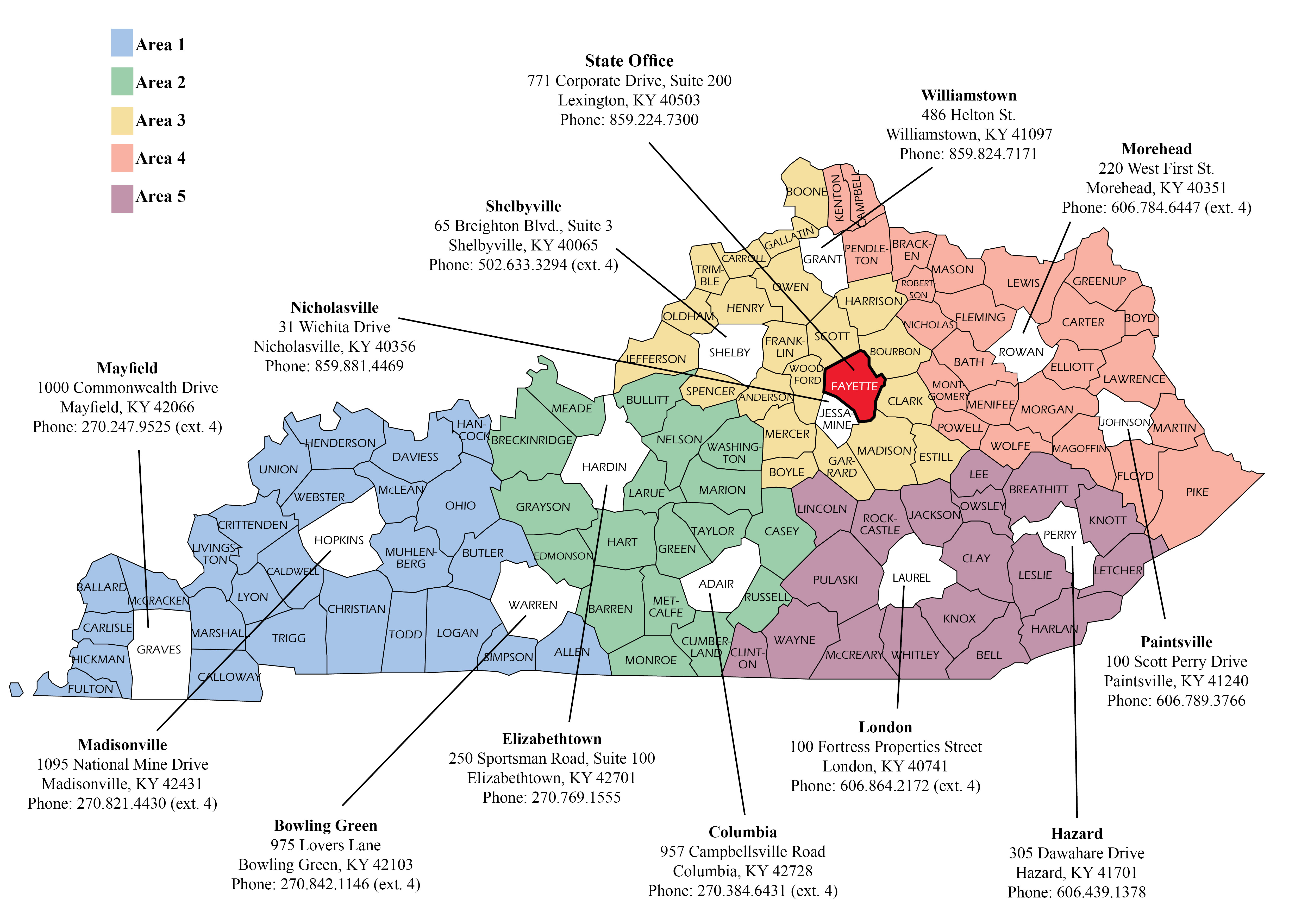

Kentucky USDA loans are mortgages made by lenders and guaranteed by the U.S. Department of Agriculture. They are available to moderate- and low-income borrowers to build, rehabilitate, improve or relocate a primary residence in eligible rural and suburban areas. The income limit is 115 percent of the median income in your area. You can check the income limits for your area here.

It can be closed with zero down. USDA loans do have a monthly insurance requirement, but the upfront fee is significantly lower than on the VA loan and the mortgage premiums are lower than on the FHA loan.

The problem is that the number of buyers who qualify for a USDA loan is much smaller. Unlike on other loans where more income is better, a USDA loan has strict income maximums.

Fees for Kentucky USDA Loans

USDA loan borrowers pay an upfront fee of 1 percent of the loan amount, and this fee can be added to the loan balance. Borrowers also pay a mortgage insurance premium of 0.35 percent of the loan balance per year in 12 equal installments. This fee is based on the current balance and added to the monthly payment.

Down Payment Requirements for Kentucky USDA Loans

USDA loans are available with up to 100 percent financing (zero down).

Credit Score Required for Kentucky Rural Housing Loans

There is no minimum credit score for a USDA loan, but you are automatically ineligible if you are presently delinquent on a nontax federal debt.

Automated approval is available if you have two tradelines reported on your credit history and acredit score of 640 or higher.

If you do not have sufficient credit data, the underwriter can assess your creditworthiness other ways, such as by examining your history with rent payments. Applicants with a credit score lower than 640 will undergo additional underwriting steps.

Loan Limits for Kentucky USDA Loans

They are no loan limits for Kentucky USDA loans backed-up the guarantee loan program. The Direct USDA loan program does have loan limits.

Senior Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

Louisville, KY 40223

Company ID #1364 | MB73346

Text/call 502-905-3708

kentuckyloan@gmail.com