Minimum Credit Score Requirements for a Kentucky Mortgage Loan Approval Loan

Here are the most common loan programs and their general guidelines on credit scores:

FHA Loans in Kentucky

FHA mortgage loans are issued by federally qualified lenders and insured by the U.S. Federal Housing Authority, a division of the U.S. Department of Housing and Urban Development. These loans are an attractive option for many borrowers, not just first-time homeowners.FHA loans are available to borrowers with credit scores as low as 500. Borrowers with scores under 580 will need to have a 10% down payment.

VA Loans In Kentucky

VA Loans are designed to offer long-term financing to American Veterans. These loans are issued by federally qualified lenders and are guaranteed by the United States Veterans Administration. The Veterans Administration determines eligibility and issues a certificate to qualifying applicants to submit to their mortgage lender of choice.The Veterans Administration does not set a minimum credit score; however, lenders do impose their own limits. Some lenders will go down to a 500 credit score and will also do loans for borrowers without a credit score.

Conventional Loans In Kentucky

Conventional loans are mortgage loans offered by private lenders that are not guaranteed or insured by a government agency. These loans may also be referred to as conforming loans.Conventional loans are available to borrowers with credit scores as low as 620.

USDA Loans in Kentucky

The United States Department of Agriculture offers a home loan program designed to help individuals living in small towns or rural areas. This loan program is designed to help qualifying applicants, who may not be able to qualify for other types of mortgage loans, purchase homes as their primary residences.USDA Guaranteed loans are available to borrowers with credit scores as low as 581 and borrowers with no credit scores.

A note for Borrowers with No and Low Credit Scores

While it’s not impossible to qualify for a home loan with a low credit score or no credit score, it does make it harder to qualify. If you have a low credit score or you do not have a credit score, lenders will look more critically at other risk factors that you may have. This includes recent late payments, collection accounts, the amount of funds you have saved up, employment history and the time at your current job, etc.If you do not have a credit score, it means that the credit bureaus do not have enough information about you to give you a score. While there are some options available to borrowers without a credit score, most lenders will require that you provide proof of payment history on “alternative trade lines”. These are lines of credit or utilities that do not report to the credit bureaus, such as rent, cell phone, electric, cable/internet, car insurance, etc. Acceptable “alternative trade line” accounts must meet certain criteria. The account must be in your name, it must be 12 months old, every payment must have been made on time every single month, and proof of payment must be provided on the creditor’s letterhead.

GETTING APPROVED WITH LOW OR NO CREDIT SCORES

You are more likely to be approved with low or no credit scores if you:Make a larger down payment than is required.

Have sufficient reserves in checking and/or savings accounts.

Have low debt-to-income ratios, which is the percentage of your income that needs to be used towards paying your proposed mortgage and other lines of credit such as auto loans, student loans, credit cards, etc. Paying down existing debt will improve your debt-to-income ratio.The best part about credit scores is that they aren’t set in stone! It’s never too late start working on improving your credit. If our team can’t pre-approve you today, we’ll come up with a custom plan to help you get to where you need to be. There’s nothing to lose, so apply today!

Joel Lobb Mortgage Loan Officer NMLS 57916

EVO Mortgage

911 Barret Ave, Louisville, KY 40204

Company NMLS ID # 173846Text/call: 502-905-3708

email: kentuckyloan@gmail.comhttp://www.mylouisvillekentuckymortgage.com/

NMLS 57916 | Company NMLS #173846The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people.

NMLS ID# 57916, (http://www.nmlsconsumeraccess.org).I can answer your questions and usually get you pre-approved the same day.

Call or Text me at 502-905-3708 with your mortgage questions.Email Kentuckyloan@gmail.com

Tag: rhs kentucky

Kentucky USDA Rural Housing Loans Direct Programs Interest Rates

What is the interest rate and payback period?

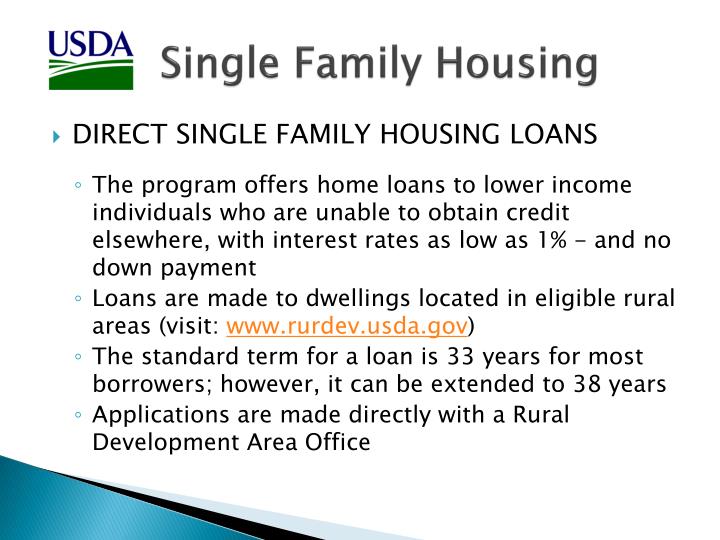

- Effective January 1, 2024, the current interest rate for Single Family Housing Direct home loans is 5.125% for low-income and very low-income borrowers.

- Fixed interest rate based on current market rates at loan approval or loan closing, whichever is lower

- Interest rate when modified by payment assistance, can be as low as 1%

- Up to 33 year payback period – 38 year payback period for very low income applicants who can’t afford the 33 year loan term

- Fixed interest rate based on current market rates at loan approval or loan closing, whichever is lower

- Interest rate when modified by payment assistance, can be as low as 1%

- Up to 33 year payback period – 38 year payback period for very low income applicants who can’t afford the 33 year loan term

Not the same as the USDA Rural Housing Guaranteed Program. These rates follow the secondary market and change daily like FHA, VA, Conventional Mortgage Loans and set by individual lenders based on lock period, credit score, loan amount, state, and other incentives

The USDA 502 Direct Loan Program helps low- and very-low-income applicants in federally-determined rural areas of the state obtain decent, safe and sanitary housing in eligible rural areas by providing payment assistance to increase an applicant’s repayment ability. This payment assistance is a type of subsidy that reduces the mortgage payment. The amount of assistance is determined by the adjusted family income.

A number of factors are considered when determining an applicant’s eligibility for this loan. At a minimum, applicants interested in obtaining a direct loan must have an adjusted income that is at or below the applicable low-income limit for the area where they wish to buy a house and they must demonstrate a willingness and ability to repay debt.

This is a zero down payment loan.

Click here for the current rate for the USDA 502 Direct Loan Program

Rural Housing Requirements For USDA Loans In Kentucky

Kentucky Rural Housing Loans

Kentucky USDA loans are mortgages made by lenders and guaranteed by the U.S. Department of Agriculture. They are available to moderate- and low-income borrowers to build, rehabilitate, improve or relocate a primary residence in eligible rural and suburban areas. The income limit is 115 percent of the median income in your area. You can check the income limits for your area here.

It can be closed with zero down. USDA loans do have a monthly insurance requirement, but the upfront fee is significantly lower than on the VA loan and the mortgage premiums are lower than on the FHA loan.

The problem is that the number of buyers who qualify for a USDA loan is much smaller. Unlike on other loans where more income is better, a USDA loan has strict income maximums.

Fees for Kentucky USDA Loans

USDA loan borrowers pay an upfront fee of 1 percent of the loan amount, and this fee can be added to the loan balance. Borrowers also pay a mortgage insurance premium of 0.35 percent of the loan balance per year in 12 equal installments. This fee is based on the current balance and added to the monthly payment.

Down Payment Requirements for Kentucky USDA Loans

USDA loans are available with up to 100 percent financing (zero down).

Credit Score Required for Kentucky Rural Housing Loans

There is no minimum credit score for a USDA loan, but you are automatically ineligible if you are presently delinquent on a nontax federal debt.

Automated approval is available if you have two tradelines reported on your credit history and acredit score of 640 or higher.

If you do not have sufficient credit data, the underwriter can assess your creditworthiness other ways, such as by examining your history with rent payments. Applicants with a credit score lower than 640 will undergo additional underwriting steps.

Loan Limits for Kentucky USDA Loans

They are no loan limits for Kentucky USDA loans backed-up the guarantee loan program. The Direct USDA loan program does have loan limits.

Senior Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

Louisville, KY 40223

Company ID #1364 | MB73346

Text/call 502-905-3708

kentuckyloan@gmail.com

Kentucky USDA Rural Development Loan Program:

The following is a list of the “nuts and bolts” of the Kentucky USDA Rural Development Loan Program:

- The house has to be located in a Kentucky USDA Rural Development Loan Program: area designated as an USDA eligible area.

- To determine the USDA approved designated areas, reference the following USDA map instructions:

- Go the USDA Rural Development Website

- On the top left hand side, click “Single Family Housing Guaranteed”

- Click “Accept”

- Enter the property address to determine if a specific house or general area is located in an USDA eligible area

- The household income must be moderate as determined by USDA. The USDA Loan evaluates household income, which includes the combined income of all adults living in the household; even if they are not on the mortgage loan. Click here to determine your household income eligibility.

- If it appears that the household income exceeds the moderate income thresholds established by USDA, do not throw in the towel just yet. USDA allows for deductions for child care and medical expenses as well as for children, students, and elderly members of the household that will be living in the USDA financed property.

- This is not a farmer’s loan. As a matter of fact, the property cannot have any income producing capabilities, and when the land value of the property exceeds 30% of the appraised value additional requirements must be met.

- The house has to be in fairly good condition. The appraisal type being utilized is an FHA appraisal, so make sure that there are not any safety related challenges(i.e. missing banisters, peeling paint, exposed electric).

- This is a true no money down loan program. Or stated differently, you do not need a down payment.

- While there is a monthly mortgage insurance premium (or prorated portion of an Annual Fee), the cost of the monthly mortgage insurance is 59% less than a comparable FHA Loan. This makes the USDA loan more affordable than an FHA Loan when analyzing down payment requirements and monthly mortgage payments.

- The seller can pay all closing costs and pre-paids (i.e. escrows). Often the home buyer’s only out-of-pocket cost as part of the purchase transaction is approximately $550 for the appraisal report.

- If the house appraises for more than the purchase price, the difference can be used to pay for closing costs and pre-paids (i.e. escrows). Only the USDA Loan program allows for closing costs to be rolled on top of the purchase price.

- USDA has no restriction on whether you are a first time home buyer or move-up home buyer.

- This loan program is only for primary residence (i.e. no second home or investment properties).

- You should not own any other functional property; although there are some circumstances under which USDA may waive this requirement.

- The preferred minimum credit score is 640. However, if you have a documented rent history, no late payments on your credit cards, and no new collections within the last 12 months, a credit score as low as 620 may be considered.

- All property types including single family homes, town homes, modular, and even condominiums qualify for this loan program. Manufacture homes such as single and doublewides constructed prior to January 1, 2006 do not qualify.

- There is no maximum mortgage amount, but the house does have to be considered moderate in a size

Kentucky Rural Development Loans 100% Financing.

USDA Loans in Kentucky. Updated Qualifying Guidelines

What is Kentucky USDA Rural Development Guarantee?

Kentucky USDA Rural Development Guarantee USDA loans offer 100% financing options on home purchases in rural areas of Kentucky. Properties though can be located within city limits and in subdivisions depending on the population density of that particular County of Kentucky. Jefferson and Fayette Counties, the two largest counties of Kentucky are not eligible for Rural Development Loans.

Full Credit Guidelines below ….click on link for USDA Mortgage Credit Guidelines

👇

Some highlights of the KY Rural Housing loan program are:

- 100% financing on purchases with no down payment

- Low 30 year fixed rates. No prepayment penalty.

- Rural Housing monthly guarantee fee of .35%

- Upfront Rural Housing funding fee of 1% of the loan amount and is financed into new loan

- No Minimum credit scores but helpful to have 620 or higher with most USDA lenders with a 640 and get an automated underwriting approval thru Rural Housing’s underwriting engine – GUS-GUS Stands for the automated Underwriting system they use online to pre-approve you for a loan.

- Each lender will set their own credit and debt to income criteria

- No rental verification needed with GUS approval

- No foreclosures in the last 36 months,

- A bankruptcy discharged at least 36 months

For a USDA eligible areas in Kentucky, see the property and income eligibility search, please click HERE.

Things to look for in your Rural Housing property search in Kentucky below:

- Avoid homes in flood zones – RD is very restrictive for homes in flood zones. They will do them in flood zones just watch out for the costly premiums.

- Avoid homes with cisterns – they are extremely difficult to get financed

- Be aware that homes with wells and septic systems needed extra tests for contamination

- Avoid homes with any income-producing activities such as working farms, detached buildings with offices or car lifts for auto repairs, or anything else related to income-producing activities.

- Manufactured homes or doublewides must be brand new. No used mobile homes are allowed.

- Must meet FHA standards on appraisals so watch out for this on older homes with crawl spaces.

- Must have a permanent heat source and no wood stoves as permanent heat sources

- Homes that are in need of major repairs.

Put my experience of originating KY USDA loans to work for you. I have successfully originated over 200 Rural Housing Mortgage Loans in Kentucky. I offer free pre-approvals and will help you from start to finish and I usually attend all my closings in Kentucky.

Get Qualified for a Kentucky USDA Loan Now!

Mortgage Loan Officer

Text/call: 502-905-370

email: kentuckyloan@gmail.com

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people. NMLS ID# 57916, (www.nmlsconsumeraccess.org). Mortgage loans only offered in Kentucky.

All loans and lines are subject to credit approval, verification, and collateral evaluation and are originated by lender. Products and interest rates are subject to change without notice. Manufactured and mobile homes are not eligible as collateral.