Minimum Credit Score Requirements for a Kentucky Mortgage Loan Approval Loan

Here are the most common loan programs and their general guidelines on credit scores:

FHA Loans in Kentucky

FHA mortgage loans are issued by federally qualified lenders and insured by the U.S. Federal Housing Authority, a division of the U.S. Department of Housing and Urban Development. These loans are an attractive option for many borrowers, not just first-time homeowners.

FHA loans are available to borrowers with credit scores as low as 500. Borrowers with scores under 580 will need to have a 10% down payment.

VA Loans In Kentucky

VA Loans are designed to offer long-term financing to American Veterans. These loans are issued by federally qualified lenders and are guaranteed by the United States Veterans Administration. The Veterans Administration determines eligibility and issues a certificate to qualifying applicants to submit to their mortgage lender of choice.

The Veterans Administration does not set a minimum credit score; however, lenders do impose their own limits. Some lenders will go down to a 500 credit score and will also do loans for borrowers without a credit score.

Conventional Loans In Kentucky

Conventional loans are mortgage loans offered by private lenders that are not guaranteed or insured by a government agency. These loans may also be referred to as conforming loans.

Conventional loans are available to borrowers with credit scores as low as 620.

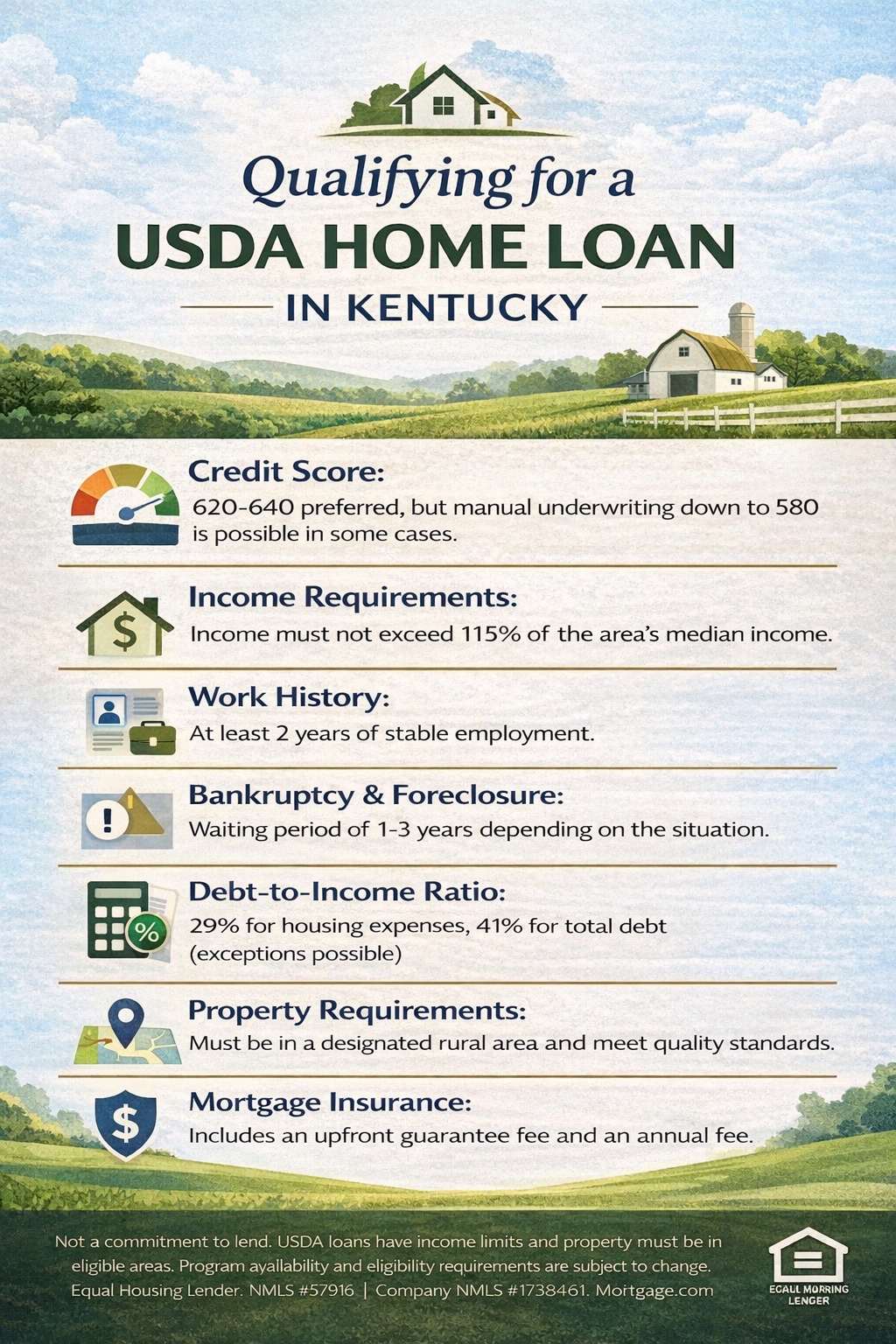

USDA Loans in Kentucky

The United States Department of Agriculture offers a home loan program designed to help individuals living in small towns or rural areas. This loan program is designed to help qualifying applicants, who may not be able to qualify for other types of mortgage loans, purchase homes as their primary residences.

USDA Guaranteed loans are available to borrowers with credit scores as low as 581 and borrowers with no credit scores.

A note for Borrowers with No and Low Credit Scores

While it’s not impossible to qualify for a home loan with a low credit score or no credit score, it does make it harder to qualify. If you have a low credit score or you do not have a credit score, lenders will look more critically at other risk factors that you may have. This includes recent late payments, collection accounts, the amount of funds you have saved up, employment history and the time at your current job, etc.

If you do not have a credit score, it means that the credit bureaus do not have enough information about you to give you a score. While there are some options available to borrowers without a credit score, most lenders will require that you provide proof of payment history on “alternative trade lines”. These are lines of credit or utilities that do not report to the credit bureaus, such as rent, cell phone, electric, cable/internet, car insurance, etc. Acceptable “alternative trade line” accounts must meet certain criteria. The account must be in your name, it must be 12 months old, every payment must have been made on time every single month, and proof of payment must be provided on the creditor’s letterhead.

GETTING APPROVED WITH LOW OR NO CREDIT SCORES

You are more likely to be approved with low or no credit scores if you:

Make a larger down payment than is required.

Have sufficient reserves in checking and/or savings accounts.

Have low debt-to-income ratios, which is the percentage of your income that needs to be used towards paying your proposed mortgage and other lines of credit such as auto loans, student loans, credit cards, etc. Paying down existing debt will improve your debt-to-income ratio.

The best part about credit scores is that they aren’t set in stone! It’s never too late start working on improving your credit. If our team can’t pre-approve you today, we’ll come up with a custom plan to help you get to where you need to be. There’s nothing to lose, so apply today!

Joel Lobb Mortgage Loan Officer NMLS 57916

EVO Mortgage

911 Barret Ave, Louisville, KY 40204

Company NMLS ID # 173846

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS 57916 | Company NMLS #173846

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval

, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people.

NMLS ID# 57916, (

http://www.nmlsconsumeraccess.org).

I can answer your questions and usually get you pre-approved the same day.

Call or Text me at 502-905-3708 with your mortgage questions.

Email Kentuckyloan@gmail.com

Call/Text: 502-905-3708

Call/Text: 502-905-3708 Email: kentuckyloan@gmail.com

Email: kentuckyloan@gmail.com Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave, Louisville, KY 40204

Address: 911 Barret Ave, Louisville, KY 40204