If you are looking to buy a home in Northern Kentucky, to either own a home on acreage in the country with 100% financing on your home loan with zero down, then you need to look at the Kentucky USDA Rural Housing Loan Program.

How Does the USDA Home Loan Work in Northern Kentucky?

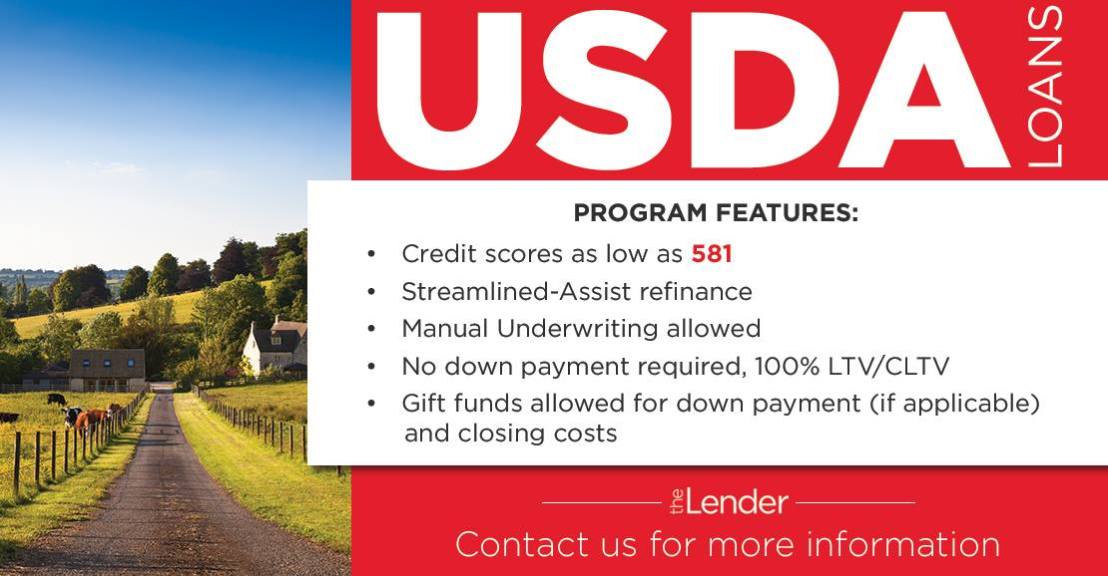

Here are some of the Key Financial Elements of the USDA Home Loan in Northern Kentucky:

- Low to Middle-Income Households are generally eligible – If the Household Income is too high, you may be ineligible.

- 30 Year Fixed Term Loans at Today’s Low Interest Rates compared to FHA, USDA and other government mortgage loans

- Qualifying rations are 29% for Housing and 41% for total debt. or possibly higher with a credit score over 640.

- Rural Development Loan Guarantee Fee applies, currently 1% USDA funding fee and .35% monthly mi premium

- Zero Cash required for the Down Payment. If access to 20% down payment, then you cannot use this program.

- Flexible Credit Guidelines, where non-traditional histories may be accepted. USDA will do a no score loan, but it is very difficult to qualify for so your best bet is to get your credit scores to 620 to 640 range and go from there. You will need two trade lines on the credit report for last 12 months, so no limited credit history is allowed on this program.

- Eligible properties include: Existing Homes, New Construction, New Manufactured Homes, Modular Homes, and eligible Condos!—No used mobile homes.

- Eligible Repairs may be included in the loan as well! If home appraises for more than sales price, sometimes you can finance these repairs into the loan.

- They’re are two income tests. Compliance income and repayment income. See pic below for answers about Northern Kentucky Counties with max income limits for household

- Home must be in an eligible area. See map below of Northern Kentucky Eligibility for USDA Rural Housing Loans

What Parts of Northern Kentucky Are Eligible for the USDA Home Loan?

With Northern Kentucky being part of the metro area of Cincinnati, the USDA has provided a map of the Ineligible Northern part of the Counties of Boone, Kenton, Campbell counties which means, the remaining southern part of the counties of Boone, Kenton, Campbell being eligible. Here is the Northern Kentucky rural housing map courtesy of the USDA:

What are the income limits for a Rural Housing Loan in Northern Kentucky?

Households with 1-4 members have different limits as households with 5-8. Similarly, applicants living in high-cost counties will have a higher income limit than those living in counties with a more average cost of living.

| Northern Kentucky Counties Boone, Kenton, Campbell, Bracken and Pendleton, Gallatin *** |

Cincinnati (OH, KY, IN FMR) | Household income of 4 or less:

***$99,250

|

Household income of 5 or more:

***$130,000

|

| All Other Areas | $90,300 | $119,200 |

Here are a few more items to check off before looking into this loan or at a particular property:

- Must be Owner Occupied as the Primary Residence;

- Home must not be used to produce Income, nor can there be Income Producing Buildings or other Accessories that produce Income on the property; i.e. no working farms or cows, livestock, crops etc. Can be a small hobby farm.

- No foreclosed homes that that need a lot of work.

- Home must be structurally sound and in reasonably good repair and pass FHA standards on an appraisal.

- Home cannot be used for a Rental Property or, be a major fixer

Senior Loan Officer

Text/call 502-905-3708

kentuckyloan@gmail.com