By Joel Lobb, Kentucky Mortgage Loan Officer | NMLS ID: 57916

If you’re planning to buy your first home in Kentucky with a USDA loan, big changes are coming that could affect your buying power. Starting November 4, 2025, the USDA Single Family Housing Guaranteed Loan Program (SFHGLP) will tighten its affordability standards.

As a Kentucky mortgage loan officer who has helped more than 1,300 families become homeowners, I want to break down what this means, who it impacts, and how you can prepare.

What’s Changing with USDA Loans in 2025?

The USDA is updating its affordability guidelines by setting the maximum PITI ratio at 29%.

What’s PITI? It stands for Principal, Interest, Taxes, and Insurance—your total monthly housing payment compared to your gross monthly income.

Here’s the key difference:

- Before November 4, 2025 – USDA allowed more flexible debt-to-income ratios.

- After November 4, 2025 – Borrowers will be capped at 29% of gross monthly income for their housing payment.

Translation for Kentucky homebuyers: On the same income, you may qualify for a smaller loan amount than you would under current rules.

Exceptions: How Strong Borrowers Can Still Qualify Above 29%

The 29% cap isn’t a hard stop for everyone. If you have strong credit and compensating factors, you may still qualify for a higher PITI ratio.

Two Main Pathways:

1. Automated Approval (GUS Accept)

The USDA’s automated underwriting system (GUS) looks at your entire financial picture. If it issues an “Accept,” higher PITI ratios may still be allowed.

2. Ratio Waiver (Up to 32%)

You may qualify for a waiver allowing up to a 32% PITI ratio if:

- All borrowers have credit scores of 680 or higher

- Your application shows approved compensating factors, such as:

- Verified cash reserves

- Stable employment history

- Low overall debt-to-income ratio

- Past successful homeownership (per HB-1-3555, Chapter 11, Section 11.3)

This gives responsible Kentucky first-time homebuyers with solid credit extra flexibility—even under the new rule.

Why November 4, 2025, Is a Critical Deadline

The implementation date is firm, and here’s how it works:

- Loans with a Conditional Commitment before November 4, 2025 will follow current guidelines.

- Loans without a Conditional Commitment by November 4, 2025 must meet the new 29% PITI rule.

- Important caveat: Even if you had a Commitment before the deadline, if your file is released or resubmitted after November 4, the new guidelines apply.

f you’re planning to use a USDA loan in Kentucky, timing matters.

What This Means for Kentucky First-Time Homebuyers

For Standard Borrowers:

- Expect to qualify for less house after November 4, 2025

- Consider accelerating your home search timeline

- Focus on credit score improvement to boost eligibility

For Strong-Credit Borrowers (680+ scores):

- You may still qualify up to 32% PITI with a waiver

- Strong credit management gives you more options

- Use this as leverage to maintain your buying power

For All Kentucky Homebuyers:

- Act sooner rather than later if considering a USDA loan

- Work with an experienced Kentucky mortgage lender who knows both USDA and local programs

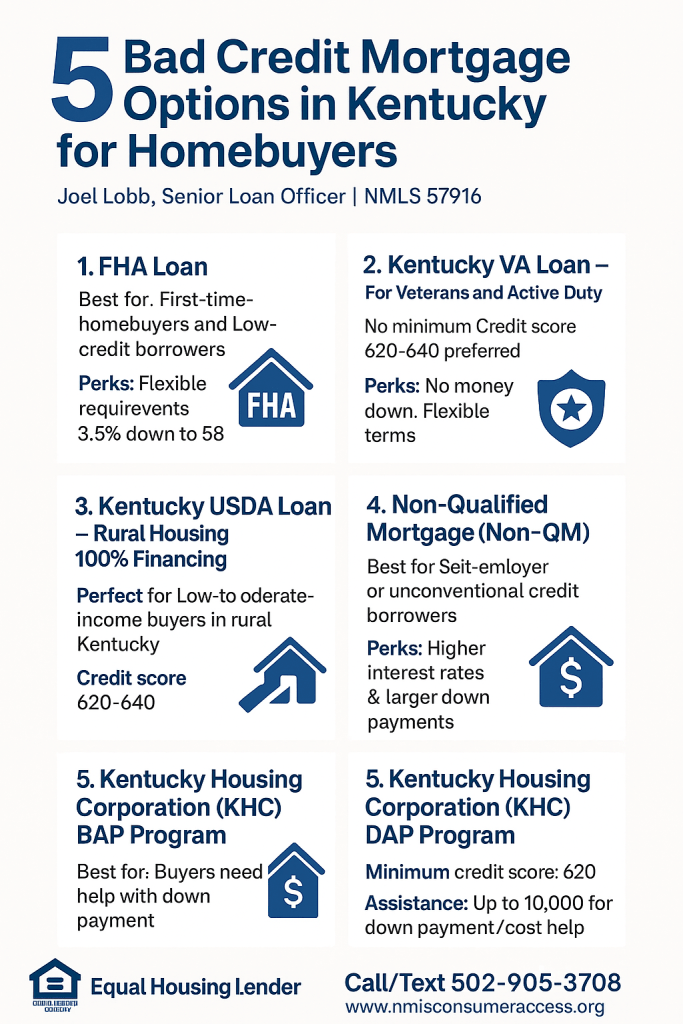

- Explore other Kentucky first-time homebuyer programs like FHA, VA, or KHC loans

Kentucky-Specific Considerations

- Kentucky Housing Corporation (KHC): Down payment assistance remains available to first-time homebuyers. This can help offset stricter USDA guidelines.

- Rural Housing Benefits: USDA loans are still a top option for rural Kentucky families, offering low rates and zero down payment. Use the USDA Property Eligibility Map or my Kentucky USDA property map guide to check if your dream home qualifies.

- Local Market Knowledge: From Louisville suburbs to Eastern Kentucky, each market has unique opportunities that an experienced local lender can help you navigate.

Explore Other Loan Options in Kentucky

While USDA loans are powerful, they’re not your only choice. Other strong programs include:

- FHA Loans – Low down payment FHA loans in Kentucky

- VA Loans – Excellent zero-down option for Kentucky veterans and service members

- KHC Programs – Kentucky Housing Corporation down payment assistance

- Conventional Loans – Competitive rates for buyers with good credit

The mortgage landscape is tightening, but proactive planning puts you in control. Whether you’re a first-time buyer in Kentucky or looking to upgrade, now is the time to strategize.

📞 Contact Joel Lobb, Kentucky Mortgage Loan Officer

- Email: kentuckyloan@gmail.com

- Call/Text: 502-905-3708

- NMLS ID: 57916

I offer free mortgage consultations with same-day approvals to help Kentucky families make the most of these changing guidelines. Let’s build a plan that works for you.

About the Author

Joel Lobb is a Kentucky Mortgage Loan Officer specializing in first-time homebuyer programs, including FHA, VA, USDA, and KHC loans. With over 20 years of experience, Joel has helped more than 1,300 Kentucky families achieve homeownership.

NMLS Personal ID: 57916 | Company NMLS ID: 1738461

Contact

Email: kentuckyloan@gmail.com

Call/Text: (502) 905-3708

Website: www.mylouisvillekentuckymortgage.com

EVO Mortgage • 911 Barret Ave., Louisville, KY 40204

Joel Lobb • Senior Loan Officer • Kentucky Mortgage Loan Expert

EVO Mortgage • Company NMLS #1738461 • Personal NMLS #57916

Equal Housing Lender

Disclosures: Program terms, eligibility, and pricing subject to change without notice. Not a commitment to lend. All loans subject to credit approval, acceptable collateral, and underwriting conditions. Geographic, income, and property restrictions may apply (including KHC/USDA). This content is for informational purposes only and not legal, financial, or tax advice. Verify current guidelines with your loan officer.