To get the best Kentucky mortgage rates in Kentucky for FHA, VA, USDA, and Fannie Mae conventional loans, you should consider several key factors and steps:

1. Improve Your Credit Score for best Kentucky Mortgage Loan Rate

- Kentucky Credit Score Requirements:

- Kentucky FHA Loans: Typically require a minimum score of 580, but better rates are available with scores above 780.

- Kentucky VA Loans: No official minimum, but lenders often prefer scores above 780.

- Kentucky USDA Loans: Generally require a minimum score of 780.

- Kentucky Conventional Loans: Prefer scores above 620 for competitive rates, but the best rates are usually available for scores above 780.

- Actions to Improve Your Score:

- Pay bills on time. Last 24 months weighted heavily

- Reduce credit card balances to less than 25% of outstanding balance

- Avoid opening new credit accounts before applying for a loan. Keep inquires to a minimum

2. Save for a Larger Down Payment in Kentucky

- Down Payment Impact:

- Larger down payments often result in lower interest rates and better loan terms.

- Kentucky FHA Loans: Minimum down payment of 3.5%.

- Kentucky VA Loans: Often no down payment required.

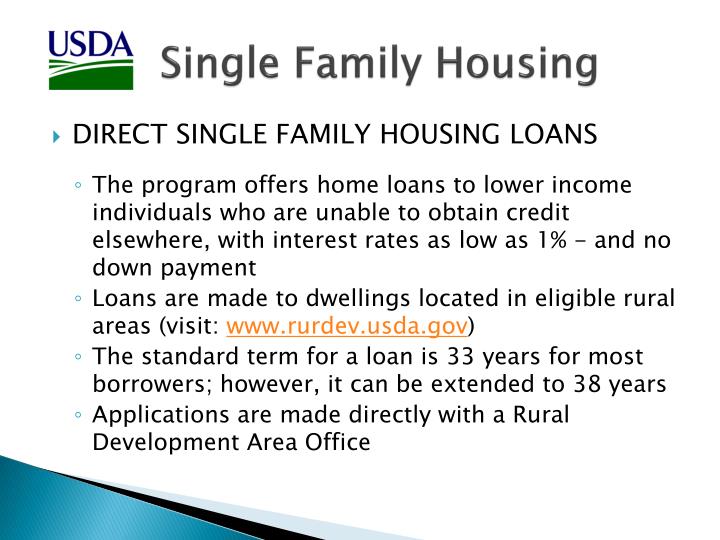

- Kentucky USDA Loans: No down payment required.

- Conventional Loans: Minimum down payment of 3%, but better rates with 40% down.

3. Shop Around for Lenders in Kentucky

- Compare Offers: Get quotes from multiple lenders, including banks, credit unions, and mortgage brokers like Joel Lobb in Louisville, Kentucky.

- Negotiate: Use the quotes to negotiate better terms.

- Consider Different Loan Types: Each loan type may offer different rates and terms, so compare FHA, VA, USDA, and conventional loans.

4. Maintain a Stable Employment History

- Employment Consistency: Lenders prefer a steady employment history of at least two years in the same field.

- Income Verification: Provide proof of stable and sufficient income to support mortgage payments.

5. Lower Your Debt-to-Income Ratio (DTI)

- DTI Requirements:

- FHA Loans: Typically require a DTI below 43%.

- VA Loans: Prefer a DTI below 41%, but can go higher with strong compensating factors.

- USDA Loans: Generally require a DTI below 41%.

- Conventional Loans: Prefer a DTI below 36%, but can accept up to 45% in some cases.

- Reducing Debt: Pay down existing debt to improve your DTI ratio.

6. Consider Mortgage Points for the best mortgage rate in Kentucky

- Buying Points: Pay for discount points to lower your interest rate. One point typically equals 1% of the loan amount and can reduce your rate by about 0.25%.

7. Lock in Your Rate for a Shorter term

- Rate Lock: Once you find a favorable rate, ask your lender about locking it in. Rate locks usually last 30 to 60 days and protect you from rate increases during the lock period. Locking in for shorter term, say 15 days or less will get you a better rate.

8. Leverage Government Programs and Assistance in Kentucky like the Mortgage Revenue Bond program

- Kentucky State Housing Programs: Kentucky offers various first-time homebuyer programs and down payment assistance, which can help you qualify for better rates.

- Federal Programs: Look into federal programs such as FHA, VA, and USDA loans that offer competitive rates and terms for eligible borrowers.

9. Work with a Knowledgeable Mortgage Broker in Kentucky to shop for the best rates with multiple lenders

- Expert Advice: Mortgage brokers like Joel Lobb can help navigate the various loan options, provide personalized advice, and negotiate the best rates on your behalf.

10. Lock in rate for shorter term.

Do a 15 year, or 20 year versus a 30 year term to get a lower rate.

By focusing on these factors and steps, you can increase your chances of securing the best mortgage rates available in Kentucky for FHA, VA, USDA, and Fannie Mae conventional loans.

—

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS 57916 | Company NMLS #1364/MB73346135166/MBR1574

Share this:

- Share on LinkedIn (Opens in new window) LinkedIn

- Share on Pinterest (Opens in new window) Pinterest

- Share on Tumblr (Opens in new window) Tumblr

- Share on Pocket (Opens in new window) Pocket

- Share on Facebook (Opens in new window) Facebook

- Share on X (Opens in new window) X

- Share on Reddit (Opens in new window) Reddit

- Share on Google Plus (Opens in new window) Google Plus

- More