Category: debt ratios

USDA Mortgage Benefits for First Time Buyers in Kentucky

Kentucky USDA Mortgage Benefits for First Time Buyers in Kentucky

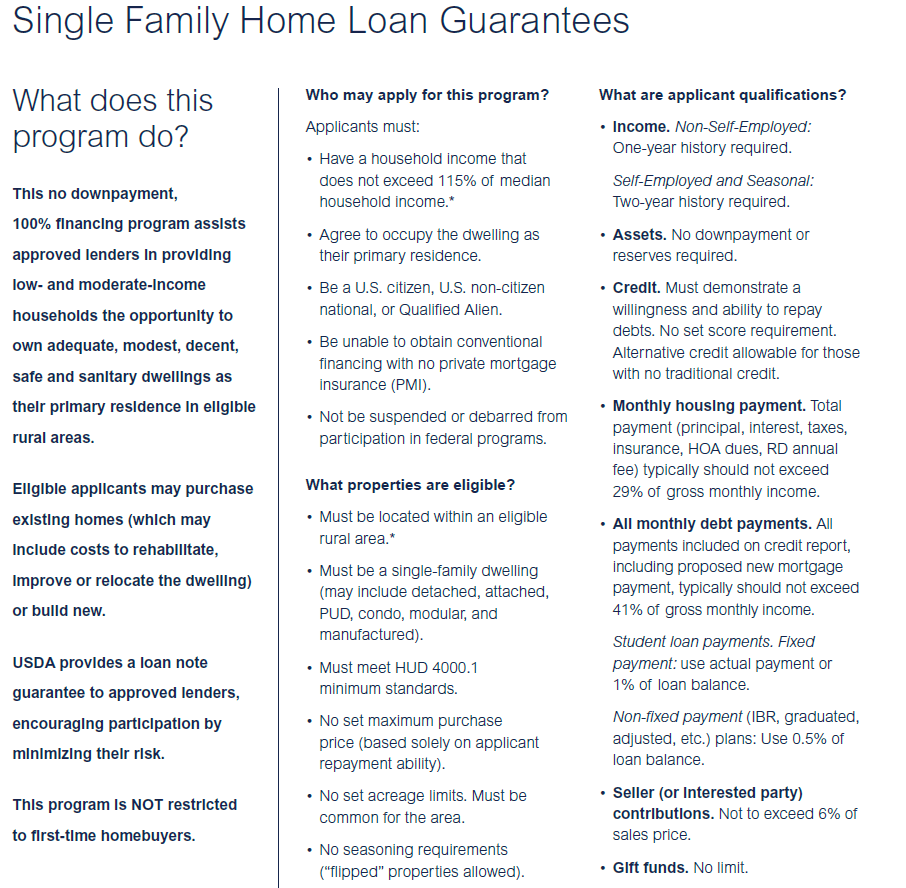

100% mortgage financing at competitive fixed interest rates with USDA home loans Credit score requirements (620 to 640) are less restrictive than most conventional home loan programs.

Kentucky USDA loans also offer a single upfront mortgage insurance premium which may be financed. Currently only 1% of the loan and a monthly mi premium of .35% which is very cheap considering the lower credit score requirements and no money down financing. The mortgage insurance is the same for everyone, does not matter what your credit score is or how much down payment you have.

You can look up individual properties on USDA’s website here for Kentucky eligible areas.

You can also research single family housing income eligibility for Kentucky here.

.

You may qualify if your Chapter 7 bankruptcy was discharged three years prior.

USDA loans can be used to finance most types of single family properties although some exception may apply. Homes must be used as borrowers’ primary residences and not used as second homes or rental properties.

Farms and commercial properties are not eligible through USDA Rural Housing Development Guaranteed Loans.

In many cases USDA permits sellers to contribute borrowers’ closing costs and can be financed up to the appraised value if home appraises for more.

Mortgage Loan Officer

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

Kentucky Rural Housing Loan Program Update for 2021 Single Family Housing USDA Guaranteed Loan

Student Loan Changes to Kentucky Rural Housing Loans Approvals

RHS temporarily modified the calculation of non-fixed student loan payments for purposes of determining debt-to-income ratios. Per the modified requirements, lenders must now use the higher of .50% of the loan balance or the actual payment reflected on the credit report as the monthly payment (rather than 1% of the loan balance). The modified requirements went into effect September 23, 2019 and will be permanently incorporated into Chapter 11 of the Single Family Housing Loan Program Technical Handbook (HB-1-3555) in the near future.

BIG change announced for Kentucky Rural Housing USDA loans today regarding how minimum payments on your Student Loans are calculated. Reach out to see if you qualify for this awesome loan!

Have you or someone you know been turned down for a USDA loan recently because of student loans?

New guidelines effective today may allow you to qualify (or qualify for a little higher loan amount)

**This is not an offer for extension of credit or a commitment to lend. All loans must satisfy company underwriting guidelines. Information and pricing are subject to change at any time and without notice. Not all applicants will qualify for all loan products offered. This is not an offer to enter into a rate lock agreement under any applicable law. Not endorsed or part of USDA Federal Government Agency.

Gaps in Employment for KY USDA Rural Housing Loans

- Any gaps in employment must be analyzed in order to make a final determination of stable and dependable income. An employment gap does not automatically render an applicant ineligible. Applicants with job gaps due to maternity leave, medical leave, relocation, etc. are considered to have employment continuity. Applicants returning to the workforce after leaving a previous job to care for a child/family member, complete education, etc. will require a 12 month employment history.