By Joel Lobb, Kentucky Mortgage Loan Officer | NMLS ID: 5791

Dreaming of homeownership in Kentucky but think a past bankruptcy or foreclosure has you permanently sidelined? Think again! USDA Rural Housing loans offer a powerful pathway to homeownership, even after financial setbacks. I have over 20 years of experience in helping Kentucky families achieve their homeownership dreams. I’ve guided hundreds of clients through this exact situation.

In this comprehensive guide, you’ll discover how to qualify for a USDA loan after bankruptcy. You will understand the credit requirements and navigate income limits. You’ll also find your perfect Kentucky home in an eligible rural area.

Table of Contents

- Why USDA Loans Are Perfect for Kentucky Homebuyers

- Bankruptcy & Foreclosure Requirements

- Credit Score Essentials

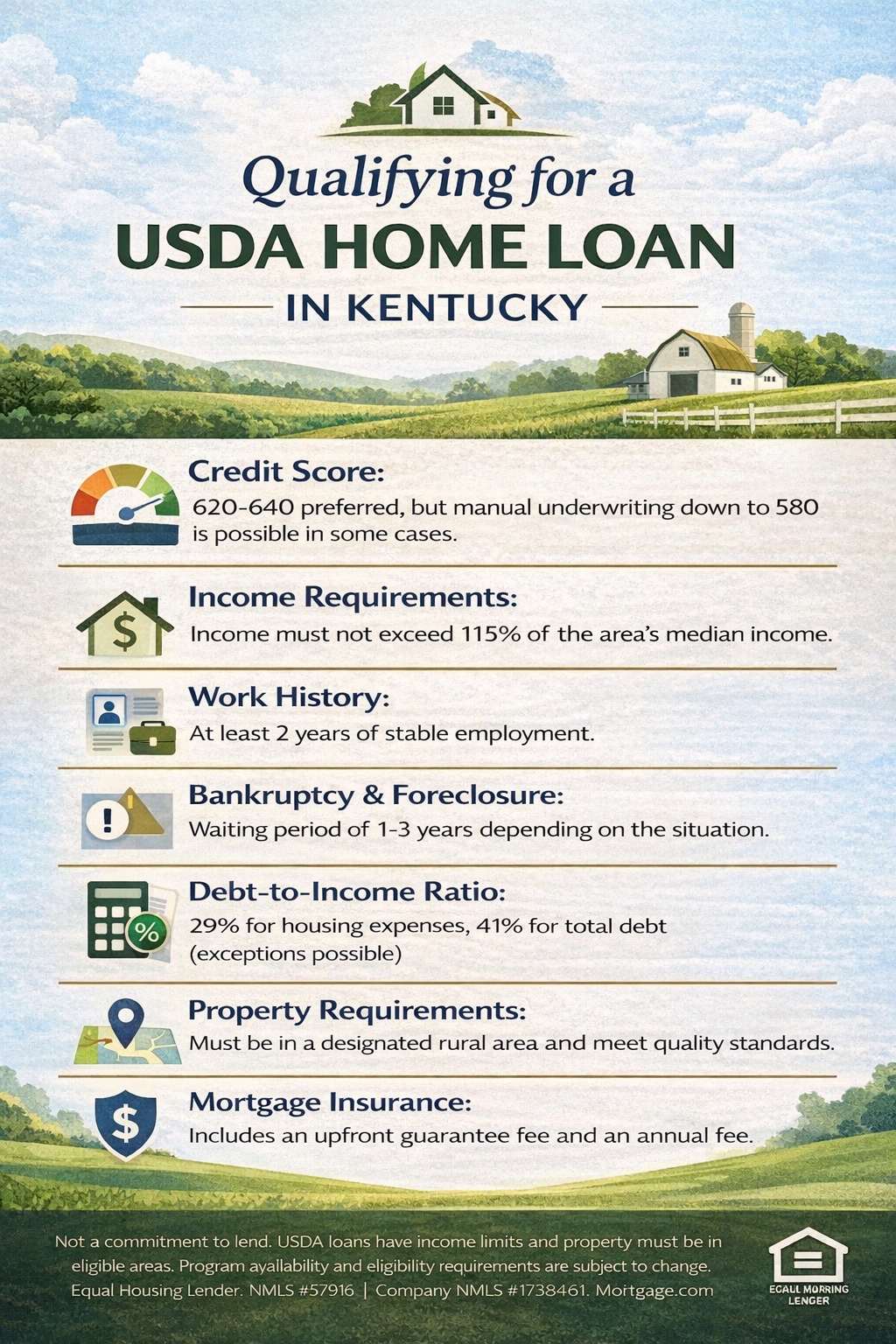

- Understanding Income Limits in Kentucky

- The New 29% DTI Rule & Property Eligibility

- Key Features & Fees of USDA Loans

- The Application Process & Required Documents

- Pros & Cons of USDA Loans

- How to Get Started Today

Why USDA Loans Are Perfect for Kentucky Homebuyers {#why-usda-loans}

USDA Rural Housing loans aren’t just for farmers! These government-backed mortgages are designed to promote homeownership in rural America. Under USDA guidelines, 97% of Kentucky qualifies as “rural”.

Key Benefits for Kentucky Residents:

✅ Zero Down Payment Required – 100% financing available ✅ No Monthly PMI – Unlike FHA loans ✅ Lower Interest Rates – Competitive rates backed by the federal government ✅ Flexible Credit Requirements – Options for borrowers rebuilding credit ✅ Forgiving After Financial Hardship – Shorter waiting periods than conventional loans ✅ Kentucky-Wide Availability – Most areas outside Louisville and Lexington qualify

Important Update: New affordability rules take effect November 4, 2025. It is crucial to apply sooner rather than later. Doing so will maximize your buying power.

Bankruptcy & Foreclosure Requirements {#bankruptcy-requirements}

One of the most common questions I hear is: “Can I still get a USDA loan after bankruptcy?” The answer is YES – but timing matters.

Chapter 7 Bankruptcy Requirements

Standard Waiting Period: 3 years from discharge date

Reduced Waiting Period: 2 years with extenuating circumstances

What counts as “extenuating circumstances”?

- Job loss beyond your control

- Serious illness or medical emergency

- Death of a primary wage earner

- Divorce resulting in loss of household income

- Military deployment affecting finances

Important Note: The waiting period begins from the discharge date, not the filing date. Make sure you have your bankruptcy discharge paperwork ready.

Chapter 13 Bankruptcy Requirements

Waiting Period: 12 months of consistent, on-time, court-approved payments

Key Requirements:

- Must have court trustee’s written approval to incur new debt

- All 12 months of payments must be verified and on-time

- Must demonstrate improved financial management

- Cannot have any late payments during the 12-month period

Pro Tip: Start preparing your USDA loan application around month 10 of your Chapter 13 payments so you’re ready to move forward immediately after meeting the 12-month requirement.

Foreclosure Requirements

USDA Waiting Period After Foreclosure: 3 years from completion date

Can Be Reduced to 2 Years If:

- The foreclosure resulted from documented extenuating circumstances

- You’ve re-established good credit since the foreclosure

- You can demonstrate the circumstances that caused the foreclosure are unlikely to recur

Short Sales and Deed-in-Lieu

Waiting Period: Generally 3 years, similar to foreclosure

Exception: May be reduced with extenuating circumstances and strong compensating factors

Credit Score Essentials

Minimum Credit Score: 620 (For Most Lenders)

While the USDA doesn’t set an official minimum credit score, most Kentucky lenders require a FICO score of at least 620 to qualify for automated underwriting approval.

What If Your Score Is Below 620?

Don’t give up! You may still qualify through manual underwriting if you can demonstrate:

Strong Compensating Factors:

- 12+ months of on-time rent payments (documented)

- Stable employment history (2+ years same employer)

- Low debt-to-income ratio (under 29% PITI)

- Cash reserves (3-6 months of housing payments)

- Previous successful homeownership

- Significant down payment (even though USDA allows 0% down)

Rebuilding Your Credit for USDA Approval

After Bankruptcy or Foreclosure, Focus On:

- Payment History (35% of score)

- Pay ALL bills on time for at least 12 months

- Set up automatic payments to avoid missed due dates

- Even small bills matter (utilities, phone, etc.)

- Credit Utilization (30% of score)

- Keep credit card balances below 30% of limits

- Pay down existing debt aggressively

- Don’t close old accounts (hurts credit age)

- New Credit (15% of score)

- Consider a secured credit card to rebuild

- Become an authorized user on someone’s card

- Avoid multiple credit applications

- Credit Mix (10% of score)

- Maintain different types of credit (installment + revolving)

- Car loans, credit cards, and personal loans help

Timeline for Credit Recovery:

- 6 months: Begin seeing improvement with on-time payments

- 12 months: Significant score increases possible

- 24 months: Approaching pre-bankruptcy score levels

Important Disclaimer

This article provides general information about USDA Rural Housing loans in Kentucky. Individual circumstances vary, and this should not be considered legal or financial advice. USDA guidelines are subject to change, and all information is current as of October 2025.

This website and its content are not endorsed by the USDA, FHA, VA, or any government agency. It is an independent platform created to educate and assist Kentucky homebuyers.

Bankruptcy and foreclosure situations require individual assessment. Always consult with a qualified mortgage professional and, if needed, legal counsel for guidance specific to your situation.

Contact Joel Lobb – Kentucky Mortgage Loan Officer

Ready to explore your USDA loan options after bankruptcy or foreclosure?

📧 Email: kentuckyloan@gmail.com 📞 Call/Text: 502-905-3708

Licensed Kentucky Mortgage Professional

- NMLS Personal ID: 57916

- Company NMLS ID: 1738461

- Equal Housing Lender

- Kentucky Mortgage Loans Only

- https://kentuckyruralhousingusdaloan.blogspot.com/

Visit: www.nmlsconsumeraccess.org

Related Kentucky Mortgage Resources

- Breaking: New USDA Loan Rules Could Limit Your Home Buying Power

- Kentucky Housing Corporation (KHC) Down Payment Assistance

- FHA Loans in Kentucky: Complete Guide

- VA Loans for Kentucky Veterans

- First-Time Homebuyer Programs in Kentucky

Website:

Website:  Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Call/Text:

Call/Text:  Email:

Email:  Address: 911 Barret Ave, Louisville, KY 40204

Address: 911 Barret Ave, Louisville, KY 40204