Kentucky USDA Rural Housing Eligibility Map 2026 – Zero-Down Home Loan Guide

USDA Rural Development offers one of the best zero-down mortgage options available for Kentucky homebuyers in eligible rural and semi-rural areas.

This 2026 guide explains how the USDA eligibility map works, how to check a property address, which Kentucky counties are fully or partially eligible, and how to get pre-approved.If you are looking for a no down payment home loan in Kentucky, the USDA Rural Housing program can be a great fit when the property location, income, and credit all meet the guidelines.

Check a Kentucky Property on the Official USDA Eligibility Map

Use the official USDA map below to check if a specific Kentucky address is located in an eligible area:

🔍 Check USDA Property Eligibility (Official USDA Map)

Opens the official USDA Rural Development eligibility map in a new tab.

How to Use the USDA Eligibility Map

- Click the button above to open the USDA eligibility map.

- Accept any disclaimer notices from USDA.

- Select the Single Family Housing Guaranteed program if asked.

- Type the full property address into the search box and hit Enter.

- The map will clearly mark the address as either Eligible or Ineligible.

- You can zoom in and out to view broader areas and county boundaries.

If you are unsure about the result, you can always screenshot or copy the address and I will double-check the eligibility for you.

USDA Income Limits for Kentucky in 2026

In addition to the property being in an eligible area, USDA loans also have household income limits. These limits are based on:

- Number of people in the household

- County where the property is located

- Certain allowable deductions (childcare, dependents, etc.)

USDA updates these income limits periodically. Rather than relying on outdated numbers, I will calculate your current USDA income eligibility based on the latest guidelines and your full financial picture.

Need help? Call or text me at 502-905-3708 and I will run the USDA income calculation for you at no cost.

Which Kentucky Counties Are Eligible for USDA Loans in 2026?

Most counties in Kentucky remain highly favorable for USDA Rural Housing loans. However, some urban and high-density areas are excluded, and other counties are classified as partially eligible with only certain pockets qualifying.

Fully Ineligible Counties (No USDA Areas)

These counties currently have no USDA-eligible areas:

- Jefferson County – Louisville Metro (entire county ineligible)

- Fayette County – Lexington Metro (entire county ineligible)

Partially Eligible Counties – Northern Kentucky

These Northern Kentucky counties contain a mix of ineligible metro areas and eligible rural pockets:

- Boone County – Partial

- Kenton County – Partial

- Campbell County – Partial

In these counties, dense suburban areas near the Cincinnati metro core are generally ineligible, while more outlying rural and semi-rural zones may still qualify. Each address must be checked on the USDA map.

Hardin County – Partial USDA Eligibility (Corrected)

Hardin County includes notable non-eligible areas related to the military base and adjoining communities. The general pattern is:

- Non-Eligible Areas: Radcliff, Vine Grove, and the Fort Knox area

- Typically Eligible Areas: Rural portions of Hardin County outside of Radcliff, Vine Grove, and Fort Knox (such as many areas around Rineyville, Cecilia, Glendale, Sonora, and rural Elizabethtown outskirts)

If you are looking near Fort Knox or in the Radcliff / Vine Grove area, we will need to be especially careful to verify each address on the USDA map.

Bullitt County – Partial USDA Eligibility (Corrected)

Bullitt County is largely USDA-friendly, but certain more suburbanized pockets are not eligible. The general pattern is:

- Non-Eligible Areas: Zoneton, Hillview, Maryville, Pioneer Village, and Brooks

- Generally Eligible: Most of the remaining rural and semi-rural areas in Bullitt County outside the communities listed above

If you are shopping in Bullitt County, I can help you focus your home search in USDA-approved zones and avoid properties that will not qualify.

Other Partially Eligible Kentucky Counties

The following counties also tend to have a mix of eligible rural areas and ineligible city cores or higher-density zones:

- Warren County – Bowling Green area (core city typically ineligible, rural edges more likely eligible)

- Madison County – Richmond area (city core ineligible, rural outskirts potentially eligible)

- McCracken County – Paducah area (urban core ineligible, outlying areas may qualify)

- Christian County – Hopkinsville and surrounding rural areas (partial eligibility)

- Boyd County – Ashland area (partial eligibility)

- Scott County – Georgetown area (partial eligibility)

- Henderson County – partial eligibility

- Franklin County – Frankfort area (partial eligibility)

- Daviess County – Owensboro area (partial eligibility)

In each of these counties, the urban core is usually ineligible while many rural and semi-rural zones just outside the main city limits remain eligible. Always confirm with the USDA map or let me check for you.

Fully Eligible Kentucky Counties

Many of Kentucky’s more rural counties remain fully USDA-eligible with no excluded areas.

If you are looking in small towns or in more remote parts of the state, you often have a strong chance of qualifying for USDA location-wise.If you share which county or town you are interested in, I can quickly tell you if the whole county is eligible or if there are ineligible pockets to avoid.

Key USDA Loan Features for Kentucky Homebuyers

- 100% financing – no down payment required

- 30-year fixed-rate mortgage

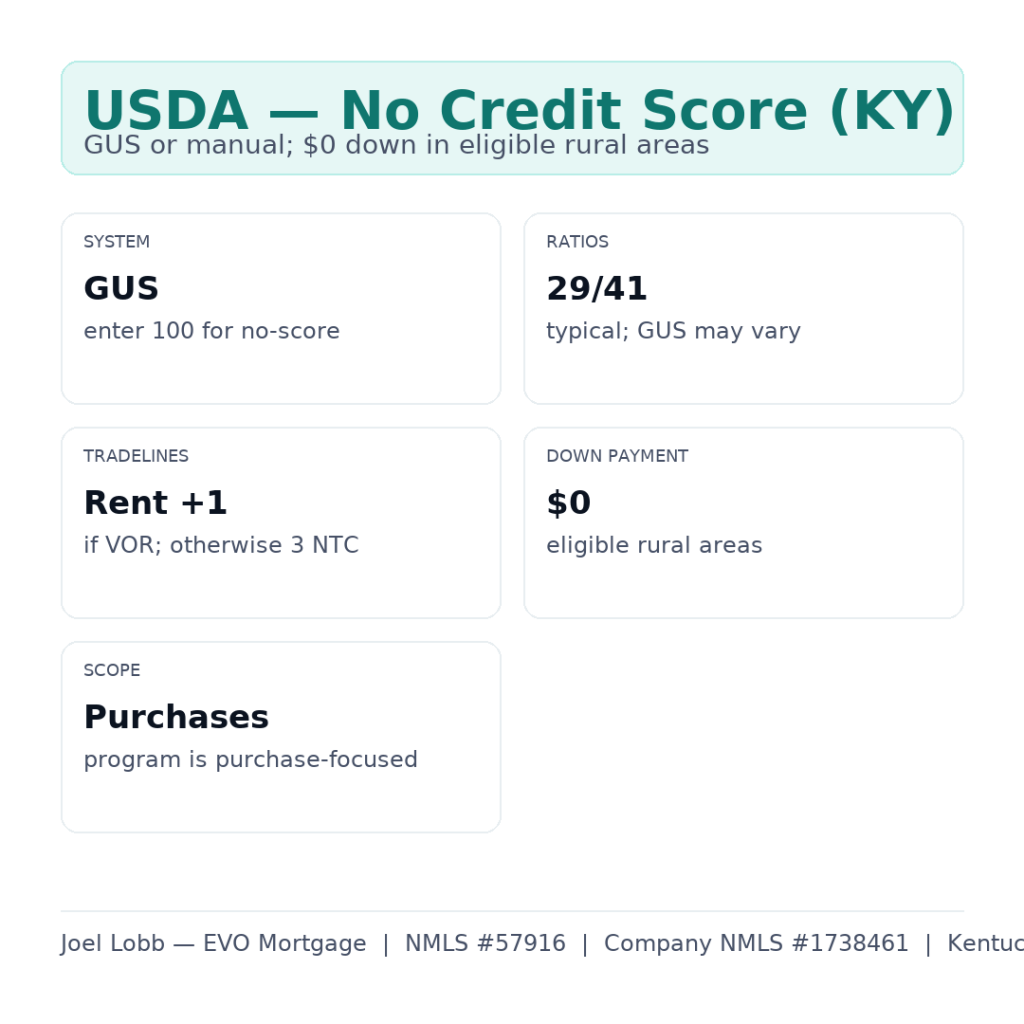

- Flexible credit guidelines compared to some conventional loans

- Reduced monthly mortgage insurance compared to FHA in many cases

- Seller can help pay closing costs within program rules

- Available to owner-occupants buying a primary residence

If you are a Kentucky first-time homebuyer (or even a repeat buyer) looking to minimize out-of-pocket costs, USDA should be on your list of options to review.

USDA vs. FHA vs. VA vs. Conventional in Kentucky

USDA is just one of several strong mortgage options in Kentucky. In many cases, I will compare USDA with:

- FHA loans (3.5% down, more flexible credit)

- VA loans (0% down for eligible Veterans and service members)

- Conventional loans (as low as 3–5% down)

- Kentucky Housing Corporation (KHC) down payment assistance

The goal is to find the combination of payment, cash-to-close, and long-term benefits that best fits your situation, not just the first program that approves you.

Get a Free USDA Eligibility Review for Your Kentucky Home Purchase

If you are thinking about using a USDA loan to buy a home in Kentucky, I can help you with:

- Checking property eligibility by address

- Reviewing your income vs. USDA limits

- Pulling and reviewing your credit profile

- Comparing USDA with FHA, VA, Conventional and KHC options

- Providing a clear, written pre-approval and payment breakdown

Call or Text: 502-905-3708

Email: joel@kentuckylender.comWhether you are just starting to research or you are ready to write an offer, I am happy to walk you through the USDA process step-by-step for any area in Kentucky.

NMLS #57916 | Company NMLS #1738461

Equal Housing Lender

This is not a commitment to lend. All loans are subject to credit approval and program guidelines. USDA availability and eligibility are subject to change; always verify current maps and income limits.

Louisville Kentucky Mortgage Loans

How to determine if property is in an eligible USDA area in Kentucky

| Click on link below to see if the address is in a Kentucky USDA Property Eligibility

👇👇👇👇 Kentucky Rural Housing USDA Loans Map link |