$2500 Grant from Fannie Mae and Freddie Mac To Buy a home in Kentucky

Kentucky Homeownership just got more affordable for low-to-moderate income Kentucky residents! If you’re planning to buy a home in 2025, you could qualify for a $2,500 grant.

This grant is available through Freddie Mac’s Home Possible® and Fannie Mae’s HomeReady® programs. This limited-time offer can help cover your down payment. It also assists with closing costs. This makes the dream of homeownership more accessible. Let’s break it down!

What Are HomeReady® and Home Possible® Programs?

HomeReady®:

Offered by Fannie Mae, this program provides:

- Low down payments as little as 3%.

- Flexible mortgage options for borrowers with household incomes below the area median income.

- Reduced mortgage insurance requirements, making homeownership more affordable.

- 620 credit scores or higher

- lower mortgage insurance

- 3 percent down payment

- 4 years removed from bankruptcy

Home Possible®:

Freddie Mac’s Home Possible® program offers:

- 3% down payment options for eligible buyers.

- Flexible credit terms and lower mortgage insurance premiums.

- Special features to assist low-income buyers achieve their homeownership goals.

- 620 credit scores or higher

- lower mortgage insurance

- 3 percent down payment

- 4 years removed from bankruptcy

The $2,500 Grant: What You Need to Know

This $2,500 credit can be used toward:

- Down payment costs and prepaids for taxes, home insurance and prepaid interest

- Closing costs, helping to reduce the financial burden of purchasing a home.

Eligibility Criteria

- Property Types: The grant applies to purchases of 1-4 unit properties.

- Income Limits: Borrower’s income must not exceed 50% of the Area Median Income (AMI).

- Loan Programs: The credit is available exclusively through Fannie Mae’s HomeReady® and Freddie Mac’s Home Possible® loan programs.

Program Duration

- Loans must achieve “purchase-ready” status by February 28, 2026.

- For loans delivered into mortgage-backed securities (MBS), the deadline is February 1, 2026.

Why Take Advantage of This Program?

This grant is a game-changer for first-time and low-income homebuyers in Kentucky. The financial relief offered helps bridge the gap for individuals and families working toward their goal of owning a home.

Get Started Today!

If you’re ready to make your move, contact an experienced loan officer who specializes in HomeReady® and Home Possible® programs. They can guide you through the eligibility process. They will help you take the next step toward achieving your dream of homeownership with this incredible grant opportunity.

If you’re in Kentucky, don’t miss this chance to access $2,500 in grant assistance. Make your homeownership dream a reality in 2025. For more information, get in touch with a local expert today!

What You Need to Know:

- Eligibility: Your income must be ≤ 50% of the Area Median Income (AMI) to qualify.

👉 Check the AMI Map for Your Area - Property Types: Applies to 1-4 unit properties.

- Programs: Available through HomeReady® and Home Possible® loan programs.

- Deadlines: Loans must achieve “purchase-ready” status by February 28, 2026.

Don’t miss this opportunity to reduce your upfront homebuying costs. Find out if you qualify and connect with a local loan officer today. These grants are limited and offered for a short time—act before the deadlines pass!

Eligibility Requirements for the $2,500 Grant

This $2,500 credit is available exclusively through Fannie Mae’s HomeReady® mortgage. Here’s what you need to qualify:

1. Mortgage Insurance

- If you put less than 20% down, you’ll need mortgage insurance. However:

- HomeReady® mortgage insurance premiums are reduced once your loan-to-value ratio reaches 90%.

- The insurance is canceled when you reach 80% equity. Unlike FHA loans, they often require mortgage insurance for the loan’s life.

2. Kentucky First-Time or Repeat Homebuyers

- You don’t need to be a first-time Kentucky homebuyer to qualify for HomeReady®.

- If all borrowers on the loan are first-time buyers, at least one must complete a homeownership education course. This course can be Fannie Mae HomeLier.

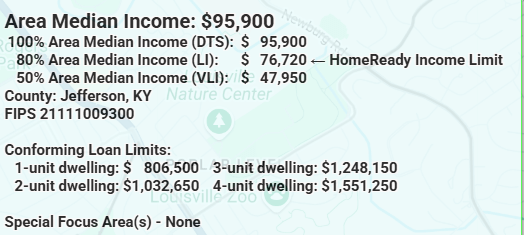

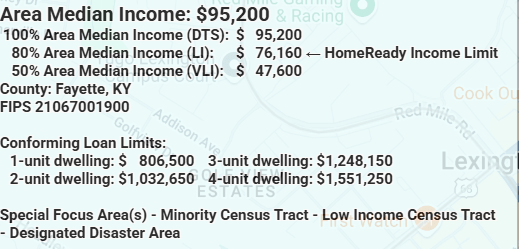

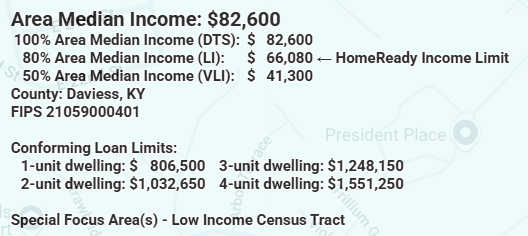

- Income limits below for Major Cities in Kentucky

Why Choose HomeReady® Over Other Loan Options?

- Lower Down Payment: Only 3% is required, compared to 3.5% for FHA loans.

- Reduced Mortgage Insurance Costs: Save money over the life of the loan.

- Flexible Eligibility: The program is open to both first-time and repeat buyers. The flexibility in household income allows multi-generational income to help you qualify.

How to Get Started

- Check Your Eligibility: Use the AMI Lookup Tool to determine if your income qualifies for the grant.

- Contact a Lender: Work with a lender who offers HomeReady® mortgages. They can guide you through the application process and help determine your grant eligibility.

- Complete a Homebuyer Education Course: If you’re a first-time homebuyer, complete the required course to meet eligibility.

Take the First Step Toward Homeownership in Kentucky

The $2,500 credit from Fannie Mae’s HomeReady® mortgage offers a fantastic way to reduce your upfront costs. It helps make homeownership more affordable. Whether you’re a first-time buyer or looking to upgrade, this grant is here to help.

Don’t miss out on this limited-time opportunity to take advantage of a program designed to help Kentucky homebuyers like you. Start your journey today and make your dream home a reality!

Below is a snapshot of current income limits for Homeready and Home Possible. These are the income limits for Jefferson, Fayette, Warren, and Daviess County. This is for 2025 household income limits.

Click on picture for more info for other Kentucky properties.

COMPANY NMLS# 1738461

COMPANY NMLS# 1738461

Advertised in: KY

ADVERTISEMENT |EVO Mortgage is an Equal Housing Opportunity Lender NMLS # 1738461 (Nationwide Multistate Licensing System –

www.nmlsconsumeraccess.org) Terms, conditions, and restrictions may apply. All information contained herein is for informational purposes only and, while every effort is made to ensure accuracy, no guarantee is expressed or implied. Not a commitment to extend credit.

Borrower must meet all loan program and eligibility requirements. Information is subject to change without any notice. This is not an offer for an extension of credit or a commitment to lend. Restrictions may apply.

TERMS AND CONDITIONS: Eligibility for the $2,500 credit is based on qualifying income at or below 50% of the Area Median Income (AMI). This is determined via Fannie Mae’s and Freddie Mac’s respective tools. The credit must be applied toward down payment and/or closing costs for eligible 1-unit properties. It is also applicable for 2-4 unit properties with LTV ≤ 80%. The program applies to FNMA HomeReady® loans with closing dates between March 1, 2024, and February 28, 2025. It also applies to FHLMC Home Possible® loans within the same dates. All loans must be approved via DU or LPA

Email – kentuckyloan@gmail.com

Call/Text – 502-905-3708

Joel Lobb

Mortgage Loan Officer – Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Website:

Website:  Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204