Chapter 13 Bankruptcy and Mortgage Loans: Buying a Home in Kentucky

Are you currently in or have recently completed a Chapter 13 bankruptcy and want to buy a home in Kentucky? Navigating the mortgage process after bankruptcy can feel overwhelming, but it’s entirely possible to qualify for a home loan with the right knowledge and preparation. Here’s what you need to know about how Chapter 13 bankruptcy impacts your ability to qualify for popular mortgage loan programs like FHA, VA, USDA, and Fannie Mae.

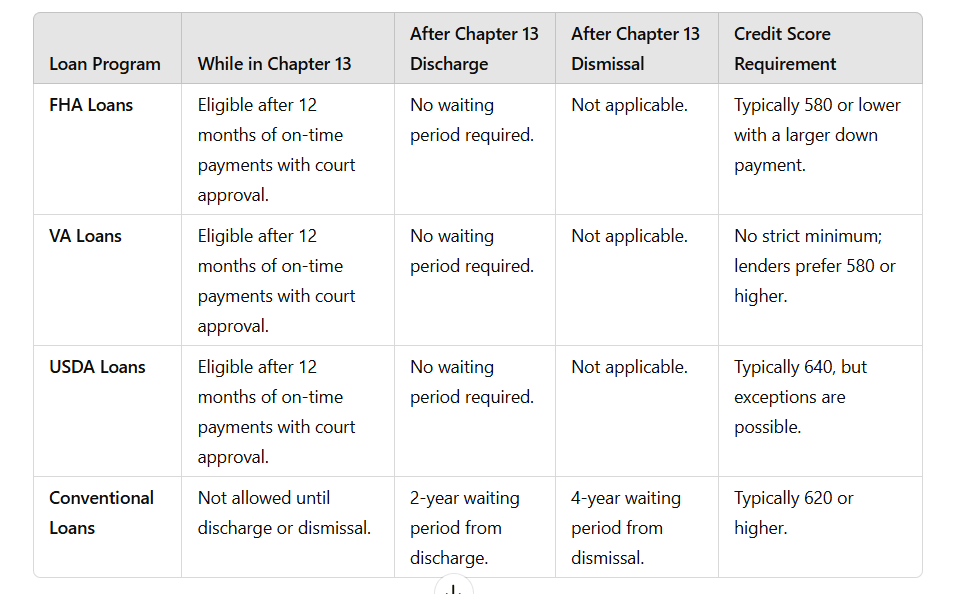

Chapter 13 bankruptcy can impact your ability to qualify for various mortgage loan programs like FHA, VA, USDA, and Fannie Mae. Here are the details for each program regarding waiting times, credit score requirements, down payment, and qualification criteria after a Chapter 13 bankruptcy:

-

Kentucky FHA Loan after Chapter 13 Bankruptcy:

- Waiting Time: Typically, you’ll need to wait at least two years after the discharge date of your Chapter 13 bankruptcy before applying for an FHA loan.

- Credit Score: FHA loans are known for their flexibility with credit scores. While there’s no specific minimum score, a higher score (usually around 580 or above) can help you qualify for better terms.

- Down Payment: The down payment requirement for an FHA loan after Chapter 13 bankruptcy is relatively low, usually starting at 3.5% of the purchase price.

- Qualification with Chapter 13 Bankruptcy: To qualify, you must demonstrate that you’ve made all Chapter 13 payments on time for at least one year and receive approval from the bankruptcy court to take on new debt.

-

Kentucky VA Loan after Chapter 13 Bankruptcy:

- Waiting Time: The waiting time for a VA loan after Chapter 13 bankruptcy is generally two years from the discharge date.

- Credit Score: VA loans also have flexible credit score requirements, with many lenders looking for scores around 620 or higher.

- Down Payment: VA loans are known for offering zero-down financing, but eligibility depends on your military service record and whether you’ve used your VA loan benefits before.

- Qualification with Chapter 13 Bankruptcy: Similar to FHA, you’ll need to demonstrate a consistent payment history under your Chapter 13 plan and receive approval from the bankruptcy court.

-

Kentucky USDA Loan after Chapter 13 Bankruptcy:

- Waiting Time: USDA loans typically require a waiting period of three years from the discharge date of your Chapter 13 bankruptcy.

- Credit Score: While there’s no official minimum credit score, most lenders look for scores of 640 or higher for USDA loans.

- Down Payment: USDA loans offer low to no down payment options, making them attractive for eligible borrowers in rural areas.

- Qualification with Chapter 13 Bankruptcy: You’ll need to show that you’ve been making timely payments under your Chapter 13 plan for at least one year and obtain approval from the bankruptcy court.

-

Kentucky Fannie Mae Loan after Chapter 13 Bankruptcy:

- Waiting Time: Fannie Mae typically requires a waiting period of two years from the discharge date of your Chapter 13 bankruptcy.

- Credit Score: Fannie Mae loans often have stricter credit score requirements compared to FHA, VA, and USDA loans. A score of around 620 or higher is generally needed.

- Down Payment: Down payment requirements vary based on the type of Fannie Mae loan you apply for, but they can range from 3% to 20%.

- Qualification with Chapter 13 Bankruptcy: You’ll need to demonstrate responsible financial management after bankruptcy, including rebuilding your credit and showing a stable income.

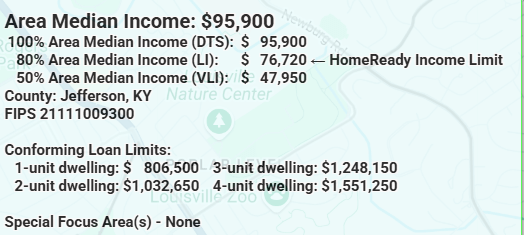

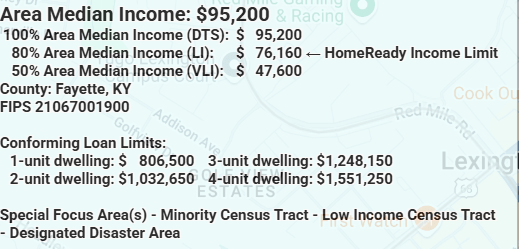

In all cases, it’s essential to work with a knowledgeable mortgage broker like Joel Lobb, who can guide you through the specific requirements and help you navigate the loan application process after a Chapter 13 bankruptcy.

1 – Email – kentuckyloan@gmail.com

2. Call/Text – 502-905-3708

.jpg)

Joel Lobb

Mortgage Loan Officer – Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

COMPANY NMLS# 1738461

COMPANY NMLS# 1738461