Buying Your First House in Kentucky with the recommend mortgage loan programs below

A Guide to Buying Your First House in Kentucky: Loan Programs and Requirements

Buying your first home in Kentucky is an exciting milestone, but it can also feel overwhelming. Fortunately, there are several loan programs and resources available to make the process smoother. This guide will walk you through the most popular loan programs and their requirements, helping you take confident steps toward homeownership.

- FHA Loan: A Flexible Option for First-Time Buyers

The Federal Housing Administration (FHA) loan is popular among first-time homebuyers due to its lenient requirements.

Key Requirements:

Credit Score: Minimum of 580 with 3.5% down payment. Scores between 500-579 require a 10% down payment.

Down Payment: 3.5% minimum.

Mortgage Insurance: Requires both an upfront premium and monthly mortgage insurance.

Debt-to-Income (DTI) Ratio: Typically up to 43%.

Benefits:

Lower credit score requirements.

Smaller down payment.

Flexible income guidelines. - VA Loan: No Money Down for Eligible Veterans

The VA Loan is a fantastic option for Kentucky veterans, active-duty service members, and their spouses. It’s backed by the Department of Veterans Affairs.

Key Requirements:

Credit Score: No official minimum, but lenders often look for 580-620.

Down Payment: $0 (no down payment required).

Certificate of Eligibility (COE): Required to prove eligibility.

Mortgage Insurance: None, but a VA funding fee applies.

Benefits:

No down payment.

No private mortgage insurance (PMI).

Competitive interest rates. - USDA Loan: Ideal for Rural Homebuyers

The USDA Rural Development Loan is perfect for buyers looking to live in rural or suburban areas in Kentucky.

Key Requirements:

Credit Score: Generally 620 or higher.

Income Limits: Household income must not exceed the area’s median income.

Location: The property must be in a USDA-eligible rural area.

Debt-to-Income Ratio: Up to 41%.

Benefits:

$0 down payment.

Affordable mortgage insurance.

Competitive fixed interest rates. - Kentucky Housing Corporation (KHC) Programs

The Kentucky Housing Corporation offers down payment assistance and loan options to first-time buyers.

KHC Loan Options:

KHC FHA or Conventional Loans: Competitive rates and assistance programs.

Down Payment Assistance: Up to $10,000 in assistance for qualifying borrowers.

Key Requirements:

Credit Score: Minimum 620 for most programs.

Income Limits: Vary by program and household size.

Property Type: Must be a primary residence. - Conventional Loan: A Strong Option for Higher Credit Scores

Conventional loans, offered through private lenders, are great for buyers with stronger credit profiles.

Key Requirements:

Credit Score: Minimum 660.

Down Payment: As low as 3% with first-time buyer programs.

Mortgage Insurance: Required if down payment is less than 20%.

Benefits:

Lower interest rates for strong credit scores.

Option to cancel PMI once equity reaches 20%.

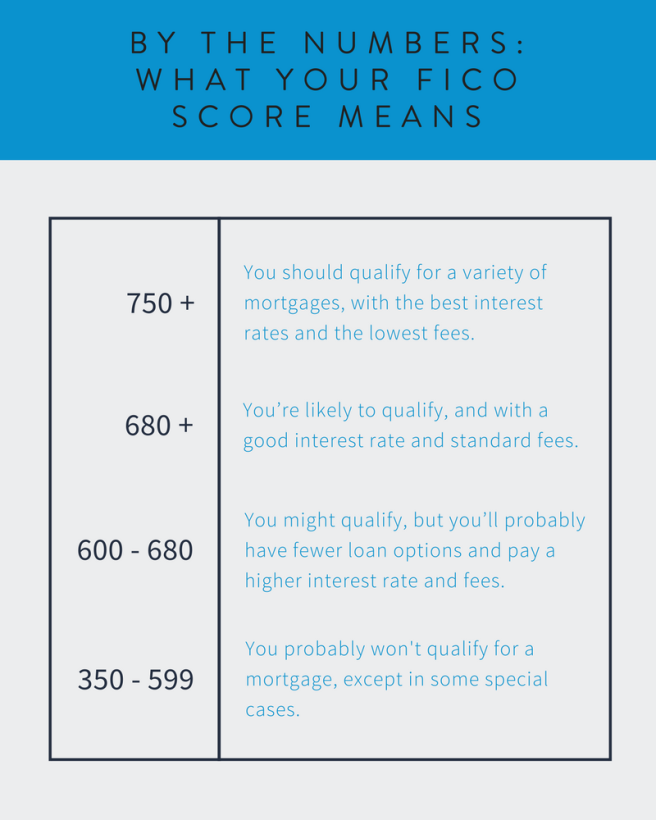

Check Your Credit Score: Understand where you stand. If needed, work on improving your score before applying.

Determine Your Budget: Get pre-approved for a mortgage to understand your price range.

Explore Loan Options: Compare FHA, VA, USDA, KHC, and Conventional loans.

Find Down Payment Assistance: Ask about programs like KHC’s assistance or grants.

Work with a Trusted Mortgage Broker: Consider partnering with someone like Joel Lobb, a Kentucky-based mortgage expert specializing in first-time buyer programs.

Conclusion

Buying your first home in Kentucky doesn’t have to be intimidating. With programs like FHA, VA, USDA, and KHC, you can find a loan that fits your financial situation and homeownership goals.

Take the first step today by getting pre-approved, exploring your options, and partnering with a knowledgeable mortgage expert.

For more details or assistance, feel free to reach out to a trusted loan officer like Joel Lobb to guide you every step of the way.

1 – Email – kentuckyloan@gmail.com 2. Call/Text – 502-905-3708

Joel Lobb

Mortgage Loan Officer – Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.