The Kentucky Rural Housing USDA home loan program offers an excellent opportunity for eligible homebuyers in rural and suburban areas of Kentucky to secure affordable financing with no down payment. To qualify, applicants must meet specific requirements related to credit score, income, work history, bankruptcy, foreclosure, debt-to-income ratio, property requirements, and mortgage insurance. Here’s a detailed guide to help you understand these qualifications:

Credit Score Required For Kentucky Rural Housing Approval

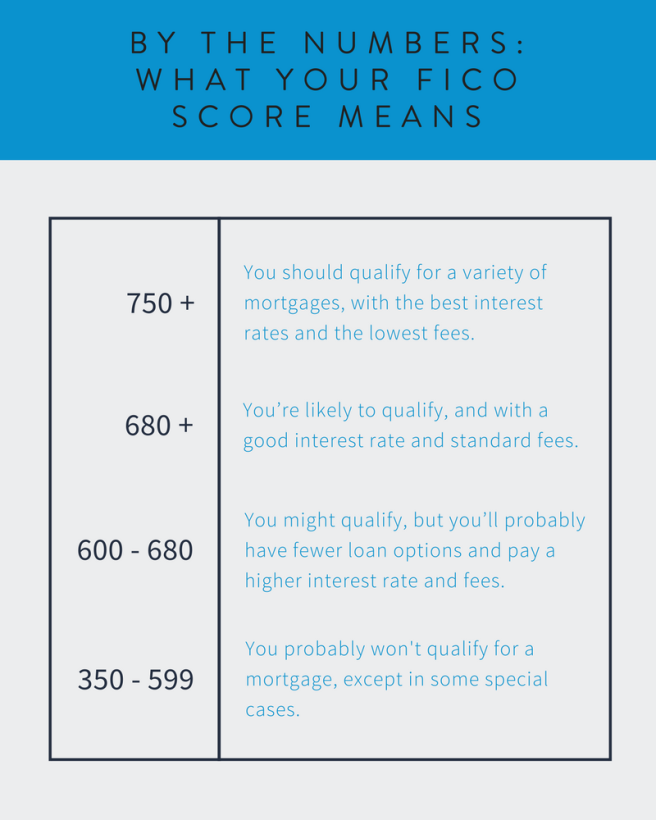

A minimum credit score of 640 is generally required to qualify for a USDA loan. This score allows for streamlined processing through the Guaranteed Underwriting System (GUS). Applicants with scores below 640 may still qualify but will need to undergo manual underwriting, which requires additional documentation and scrutiny.

Income Requirements for Kentucky USDA Rural Housing Approval

USDA loans have income limits that vary by county and household size. These limits are designed to ensure the program assists low- to moderate-income families. Generally, your household income should not exceed 115% of the median income for your area. The USDA provides an online tool to check income eligibility based on your location and household size.

Work History requirements for Kentucky USDA loan Approval

A stable work history is essential for Kentucky USDA loan approval. Lenders typically look for at least two years of consistent employment. Any gaps in employment need to be explained and documented. For self-employed applicants, a minimum of two years of tax returns is required to verify income stability.

Kentucky USDA Rural Housing Bankruptcy and Foreclosure Guidelines

While past financial difficulties like bankruptcy or foreclosure can affect your eligibility, they do not automatically disqualify you. Here are the typical waiting periods:

- Chapter 7 Bankruptcy: At least three years from the discharge date.

- Chapter 13 Bankruptcy: At least one year of the payout period must be completed with satisfactory payment history and court approval for a new loan.

- Foreclosure: At least three years from the completion date.

Kentucky USDA Debt-to-Income Ratio (DTI) Requirements

The Kentucky USDA loan program has specific DTI requirements to ensure borrowers can manage their mortgage payments. The front-end ratio (housing expenses) should not exceed 29% of your gross monthly income, and the back-end ratio (total monthly debt obligations) should not exceed 45%. Exceptions can be made for borrowers with compensating factors, such as higher credit scores or additional cash reserves.

Kentucky USDA Property Requirements

USDA loans are intended for properties in designated rural areas. The USDA provides an online tool to check property eligibility. The home must be used as the primary residence and meet certain quality standards according to Kentucky FHA Appraisal HUD Guidelines including:

- Adequate and functional heating, plumbing, and electrical systems

- Structurally sound foundation and roof

- Safe water supply and waste disposal systems

- Must have an undamaged exterior, foundation and roof

- Must have safe and reasonable property access

- Must not contain loose wiring and exposed electrical systems

- Must have all relevant utilities, including gas, electricity, water and sewage functioning properly.

- Must have a working, permanent heating system that can heat the property adequately

- Must have surfaces free of chipping or peeling lead-based paint

- Must have adequate access to attic spaces and natural ventilation in crawl spaces

- Must have access to potable water

- Must be free from wood-destroying insect infestations

- Must not have interior and exterior health and safety hazards, such as no handrails on steep staircases

- Must be a marketable property

Mortgage Insurance Required For Kentucky USDA loan Approval

Kentucky Rural Housing USDA loans require mortgage insurance, which includes an upfront guarantee fee and an annual fee. The upfront fee is typically 1% of the loan amount, which can be financed into the loan. The annual fee, usually 0.35% of the loan balance, is paid monthly as part of the mortgage payment. These fees help protect lenders and the USDA in case of borrower default.

Summary

Qualifying for a USDA home loan in Kentucky involves meeting specific criteria in several areas:

- Credit Score: Minimum 640 for streamlined processing; lower scores may require manual underwriting.

- Income Requirements: Must not exceed 115% of the median income for your area.

- Work History: At least two years of stable employment.

- Bankruptcy and Foreclosure: Waiting periods of 1-3 years depending on the situation.

- Debt-to-Income Ratio: 29% for housing expenses, 41% for total debt; exceptions possible.

- Property Requirements: Must be in a designated rural area and meet quality standards.

- Mortgage Insurance: Includes an upfront guarantee fee and an annual fee.

By understanding and meeting these requirements, you can take advantage of the USDA loan program to achieve homeownership in Kentucky’s rural areas. For personalized assistance, consider consulting with a mortgage broker or lender experienced in USDA loans, like Joel Lobb in Louisville, who can guide you through the process and help you qualify.

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/