Big News for Kentucky Mobile Home Buyers: USDA Loan Changes Coming in

Are you looking for affordable home financing options for manufactured or mobile homes in Kentucky? Big news is here! Starting March 4, 2025, the USDA will officially offer 100% financing for manufactured homes. This exciting change will make homeownership more accessible and affordable for families in Kentucky.

You can now take advantage of FHA loans with Kentucky Housing Corporation’s down payment assistance. This assistance is available on used mobile homes or new mobile homes. This assistance offers a path to 100% financing. This option is ideal for those purchasing manufactured homes in urban and rural areas alike

What Does This Mean for Kentucky Homebuyers?

For years, many buyers in Kentucky seeking affordable housing options, like mobile homes, faced limited financing choices. With the USDA’s policy changes, more Kentucky homebuyers will qualify for 100% financing on manufactured homes. This program is transformative. It is especially beneficial for those in rural areas. Many are looking to take advantage of USDA’s Rural Housing Loan Program.

Benefits of the USDA Manufactured Home Loan Program

- 100% Financing – No money down is required, making it perfect for buyers with limited savings.

- Affordable Terms – Competitive interest rates make monthly payments manageable.

- Rural Housing Opportunities – Ideal for Kentucky homebuyers in small towns and rural areas.

- Expanded Eligibility – These changes will allow more manufactured homes to qualify, opening up affordable housing options.

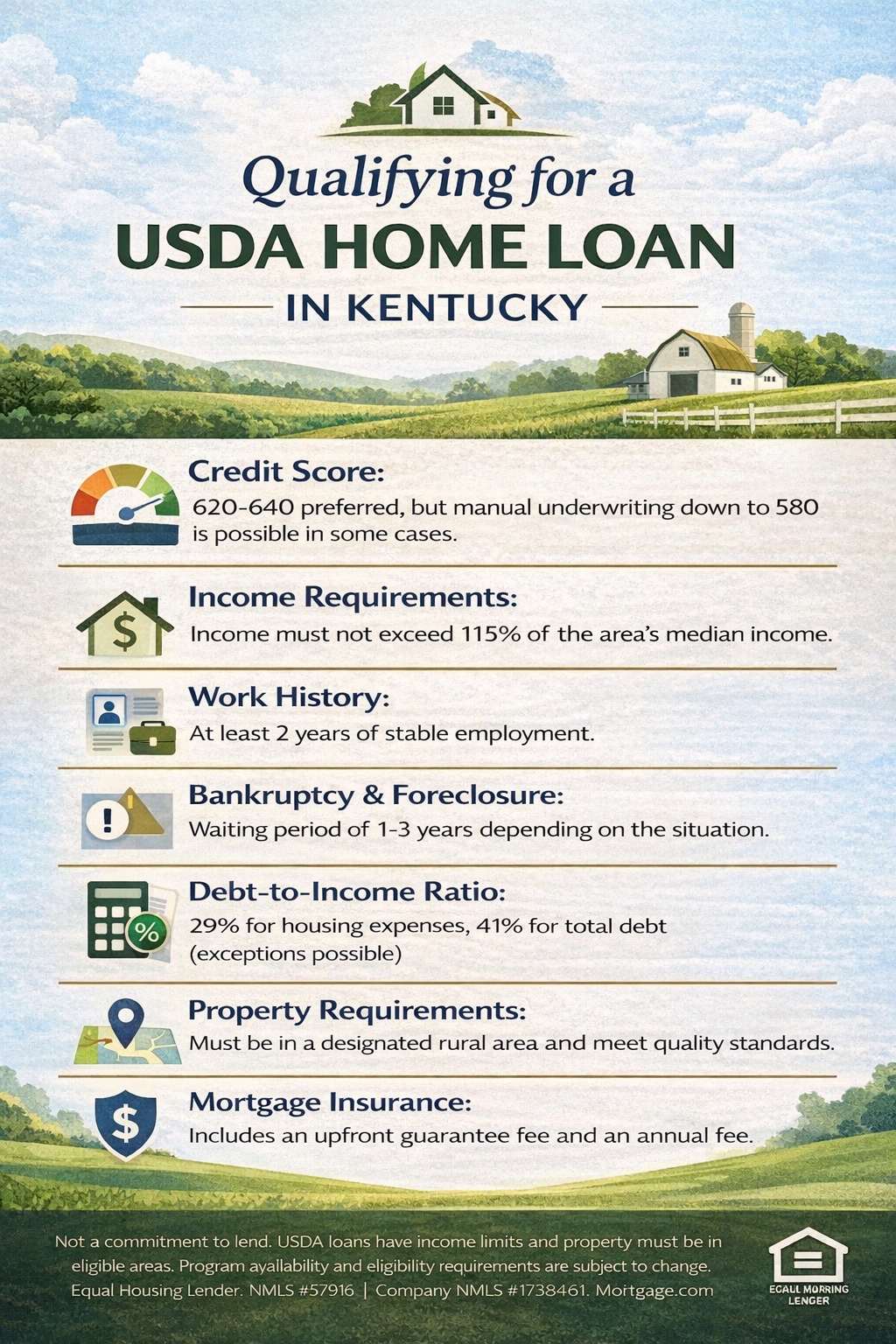

How to Qualify for a USDA Loan for Mobile Homes in Kentucky

To take advantage of this incredible opportunity, you’ll need to meet a few requirements:

- Credit Score: Typically, a score of 581 or higher is needed.

- Property Type: The home must be a manufactured or mobile home on a permanent foundation.

- Location: The home must be in a USDA-eligible rural area in Kentucky.

Why This Update Is Great for Kentucky Buyers

With rising home prices, these changes make it easier for families in Kentucky to purchase affordable housing. Manufactured homes are an excellent option for those seeking modern, energy-efficient, and affordable living solutions. This program ensures that homeownership is possible for more families across Kentucky, particularly in rural communities.

Get Pre-Approved for Your USDA Mobile Home Loan in Kentucky

Don’t wait until March 2025! Start planning now to take advantage of these USDA loan changes. Are you considering purchasing a mobile home in Kentucky? I can help you secure the best financing option for your needs.

I specialize in USDA and rural housing loans for mobile and manufactured homes across Kentucky. I have decades of experience and local expertise. I’m here to guide you through the process. I will help you achieve your dream of owning a home with no money down.

1 – Email – kentuckyloan@gmail.com 2. Call/Text – 502-905-3708

Joel Lobb

Mortgage Loan Officer – Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Tags: #MobileHomesKentucky #USDALoanMobileHome #KentuckyManufacturedHomeLoan #RuralHousingMobileHome #NoMoneyDownKentucky

Call/Text:

Call/Text:  Email:

Email:  Address: 911 Barret Ave, Louisville, KY 40204

Address: 911 Barret Ave, Louisville, KY 40204