Understanding Kentucky Mortgage underwriting guidelines

All lending institutions have different Underwriting Guidelines set in place when reviewing a borrower’s financial history to determine the likelihood of receiving on-time payments. The primary items reviewed are the following 5 areas below:

1. Income

2. Debt

3. Credit History

4. Savings

5. Debt vs Income Ratio

Income

Income is one of the most important variables a lender will examine because it is used to repay the loan. Income is reviewed for the type of work, length of employment, educational training required, and opportunity for advancement. An underwriter will look at the source of income and the likelihood of its continuance to arrive at a gross monthly figure.

Salary and Hourly Wages – Calculated on a gross monthly basis, prior to income tax deductions.

Part-time and Second Job Income – Not usually considered unless it is in place for 12 to 24 straight months. Lenders view part-time income as a strong compensating factor.

Commission, Bonus and Overtime Income – Can only be used if received for two previous years. Further, an employer must verify that it is likely to continue. A 24-month average figure is used.

Retirement and Social Security Income – Must continue for at least three years into the future to be considered. If it is tax free, it can be grossed up to an equivalent gross monthly figure. Multiply the net amount by 1.20%.

Alimony and Child Support Income – Must be received for the 12 previous months and continue for the next 36 months. Lenders will require a divorce decree and a court printout to verify on-time payments.

Notes Receivable, Interest, Dividend and Trust Income – Proof of receiving funds for 12 previous months is required. Documentation showing income due for 3 more years is also necessary. Rental Income – Cannot come from a Primary Residence roommate. The only acceptable source is from an investment property. A lender will use 75% of the monthly rent and subtract ownership expenses. The Schedule E of a tax return is used to verify the figures. If a home rented recently, a copy of a current month-to-month lease is acceptable.

Automobile Allowance and Expense Account Reimbursements – Verified with 2 years tax returns and reduced by actual expenses listed on the income tax return Schedule C.

Education Expense Reimbursements – Not considered income. Only viewed as slight compensating factor.

Self-Employment Income – Lenders are very careful in reviewing self-employed borrowers. Two years minimum ownership is necessary because two years is considered a representative sample. Lenders use a 2-year average monthly income figure from the Adjusted Gross Income on the tax returns. A lender may also add back additional income for depreciation and one-time capital expenses. Self-employed borrowers often have difficulty qualifying for a mortgage due to large expense write offs. A good solution to this challenge used to be the No Income Verification Loan, but there are very few of these available any more given the tightened lending standards in the current economy. NIV loan programs can be studied in the Mortgage Program section of the library.

2. Debt

An applicant’s liabilities are reviewed for cash flow. Lenders need to make sure there is enough income for the proposed mortgage payment, after other revolving and installment debts are paid.

All loans, leases, and credit cards are factored into the debt calculation. Utilities, insurance, food, clothing, schooling, etc. are not.

If a loan has less than 10 months remaining, a lender will usually disregard it.

The minimum monthly payment listed on a credit card bill is the figure used, not the payment made.

An applicant who co-borrowed for a friend or relative is accountable for the payment. If the applicant can show 12 months of on-time cancelled checks from the co-borrower, the debt will not count.

Loans can be paid off to qualify for a mortgage, but credit cards sometimes cannot (varies by lender). The reasoning is that if the credit card is paid off, the credit line still exists, and the borrower can run up debt after the loan is closed.

A borrower with fewer liabilities is thought to demonstrate superior cash management skills.

Most lenders require a residential merged credit report (RMCR) from the 3 main credit bureaus: Trans Union, Equifax, and Experian. They will order one report which is a blending of all three credit bureaus and is easier to read than the individual reports. This “blended” credit report also searches public records for liens, judgments, bankruptcies and foreclosures. See our credit report index.Credit report in hand, an underwriter studies the applicant’s credit to determine the likelihood of receiving an on-time mortgage payment. Many studies have shown that past performance is a reflection of future expectations. Hence, most lenders now use a national credit scoring system, typically the FICO score, to evaluate credit risk. If you’re worried about credit scoring, see our articles on it.

The mortgage lending process, once very forgiving, has tightened lending standards considerably. A person with excellent credit, good stability, and sufficient documentable income to make the payments comfortably will usually qualify for an “A” paper loan. “A Paper”, or conforming loans, make up the majority of loans in the U.S. and are loans that must conform to the guidelines set by Fannie Mae or Freddie Mac in order to be saleable by the lender. Such loans must meet established and strict requirements regarding maximum loan amount, down payment amount, borrower income and credit requirements and suitable properties. Loans that do not meet the credit and/or income requirements of conforming “A-paper” loans are known as non-conforming loans and are often referred to as “B”, “C” and “D” paper loans depending on the borrower’s credit history and financial capacity.

Here are some rules of thumb most lenders follow:

12 plus months positive credit will usually equal an A paper loan program, depending on the overall credit. FHA loans usually follow this guideline more often than conventional loans.

Unpaid collections, judgments and charge offs must be paid prior to closing an A paper loan. The only exception is if the debt was due to the death of a primary wage earner, or the bill was a medical expense.

If a borrower has negotiated an acceptable payment plan and has made on time payments for 6 to 12 months, a lender may not require a debt to be paid off prior to closing.

Credit items usually are reported for 7 years. Bankruptcies expire after 10 years.

Foreclosure – 5 years from the completion date. From the fifth to seventh year following the foreclosure completion date, the purchase of a principal residence is permitted with a minimum 10% down and 680 FICO score. The purchase of a second or investment property is not permitted for 7 years. Limited cash out refinances are permitted for all occupancy types.

Pre-foreclosure (Short Sale) – 2 years from the completion date (no exceptions or extenuating circumstances).

Deed-in-Lieu of Foreclosure – 4-year period from the date the deed-in-lieu is executed. From the fifth to the seventh year following the execution date the borrower may purchase a property secured by a principal residence, second home or investment property with the greater of 10 percent minimum down payment or the minimum down payment required for the transaction. Limited cash out and cash out refinance transactions secured by a principal residence, second home or investment property are permitted pursuant to the eligibility requirements in effect at that time.

Chapter 7 Bankruptcy – A borrower is eligible for an A paper loan program 4 years after discharge or dismissal, provided they have reestablished credit and have maintained perfect credit after the bankruptcy.

Chapter 13 Bankruptcy – 2 years from the discharge date or 4 years from the dismissal date.

Multiple Bankruptcies- 5 years from the most recent dismissal or discharge date for borrowers with more than one filing in the past 7 years.

The good credit of a co-borrower does not offset the bad credit of a borrower.

Credit scores usually range from 400 to 800. Changes to lending standards are occurring on a daily basis as a result of tightening lending standards and can vary from lender-to-lender– so this information should be considered simply a guideline. For conforming loans, most lenders will lend down to a FICO of 620, with additional rate hits for the lower-end credit scores and loan-to-values. When you are borrowing more than 80%, they typically will not lend if you have a FICO below 680. The FHA/VA program just changed their minimum required FICO to 620, unless you are qualifying a borrower with non-traditional credit. The few non-conforming loan programs that are still available typically require 30% down payment with a minimum FICO of 700 for self-employed and 650 for W-2 employees, and the loan-to-value will change with the loan amount.

Lenders evaluate savings for three reasons.

The more money a borrower has after closing, the greater the probability of on-time payments.

Most loan programs require a minimum borrower contribution.

Lenders want to know that people have invested their own into the house, making it less likely that they will walk away from their life’s savings. They analyze savings documents to insure the applicant did not borrow the funds or receive a gift.

Lenders look at the following types of accounts and assets for down payment funds:

Checking and Savings – 90 days seasoning in a bank account is required for these funds. Gifts and Grants – After a borrower’s minimum contribution, a gifts or grant is permitted.

Sale of Assets – Personal property can be sold for the required contribution. The property should be appraised, and a bill of sale is required. Also, a copy of the received check and a deposit slip are needed.

Secured Loans – A loan secured by property is also an acceptable source of closing funds.

IRA, 401K, Keogh & SEP – Any amount that can be accessed is an acceptable source of funds.

Sweat Equity and Cash On Hand – Generally not acceptable. FHA programs allow it in special circumstances.

Sale Of Previous Home – Must close prior to new home for the funds to be used. A lender will ask for a listing contract, sales contract, or HUD 1 closing statement.

The percentage of one’s debt to income is one of the most important factors when underwriting a loan. Lenders have determined that a house payment should not exceed approximately 30% of Gross Monthly Income. Gross Monthly Income is income before taxes are taken out. Furthermore, a house payment plus minimum monthly revolving and installment debt should be less than 40% of Gross Monthly Income (this figure varies from 35%-41% contingent on the source of financing).

Example

An applicant has $4,500 gross monthly income. The maximum mortgage payment is:

$4500 X .30 = $1350

Their total debts come to:

$500 Car

$20 Visa

$30 Sears

$75 Master Card

—————-

$625 per month.

Remember, their total debts (mortgage plus other debts) must be less than or equal to 40% of their gross monthly income.

$2,800 X .40 = $1800

$1800 is the maximum debt the borrower can have, debts and mortgage payments combined. Can the borrower keep all their debts and have the maximum mortgage payment allowed? NO!

In this case, the borrower, since they have high debts, must adjust the maximum mortgage payment downward, because:

$625 debts

$1350 mortgage

————-

$1975 – which is more than the $1800 (40% of gross debt) we calculated above.

The maximum mortgage payment is therefore:

$1800 – $625 (monthly debt) = $1175.

This communication is provided to you for informational purposes only and should not be relied upon by you.

|

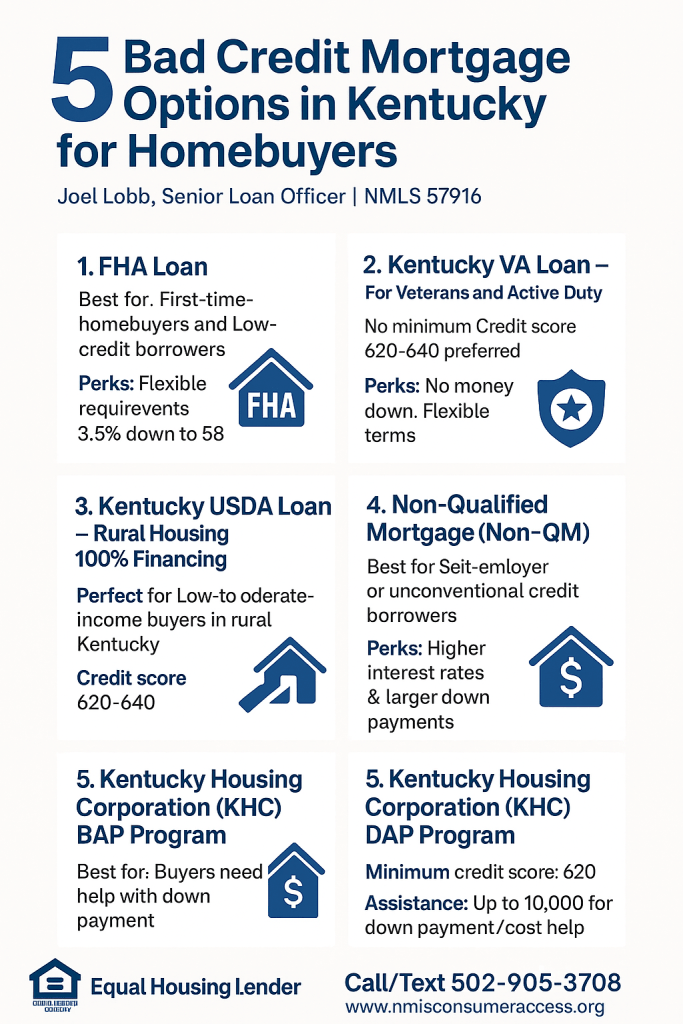

Joel Lobb

Mortgage Broker – FHA, VA, USDA, KHC, Fannie Mae

EVO Mortgage • Helping Kentucky Homebuyers Since 2001

|

Call/Text: 502-905-3708 Call/Text: 502-905-3708 Email: kentuckyloan@gmail.com Email: kentuckyloan@gmail.com Website: www.mylouisvillekentuckymortgage.com Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave, Louisville, KY 40204 Address: 911 Barret Ave, Louisville, KY 40204NMLS #57916 | Company NMLS #1738461 |

| Free Info & Homebuyer Advice → |

|

Kentucky Mortgage Loan Expert

FHA | VA | USDA | KHC Down Payment Assistance | Fannie Mae

Equal Housing Lender. This is not a commitment to lend. All loans are subject to credit approval and program requirements.

|