Loan Program Comparison

Kentucky First-Time Homebuyer Loan Comparison (Quick View)

| Program | Down Pmt | Min Credit* | DTI Limit | MI/PMI | Termite | AUS |

|---|---|---|---|---|---|---|

| FHA | 3.5% | 580+ | 31/43%+ | Yes | Optional | DU |

| VA | 0% | 580–620 | 41% + Residual | No | Required | DU |

| USDA | 0% | 640+ | 29/41%+ | Yes | Optional | GUS |

| KHC DPA | 0%† | 620+ gov 660+ conv | ≤ 50% | Based on primary | Optional | DU/GUS |

† When used with FHA, VA, or USDA

*Lender overlays may apply

Credit Score Requirements

. Minimum scores vary significantly by program:

- Conventional Loans: Require a minimum credit score of 620, with higher scores (660+) needed for Kentucky Housing Corporation (KHC) assistance programs

- FHA Loans: Permit scores as low as 500 with a 10% down payment or 580 with 3.5% down, though lenders often impose stricter floors (580–620) due to risk assessments.

- USDA Loans: Typically mandate 640+ scores for automated underwriting. However, manual reviews may accept 620–640 with compensating factors like stable employment

- VA Loans: While the U.S. Department of Veterans Affairs does not set a minimum, most lenders require 580–620 for favorable terms

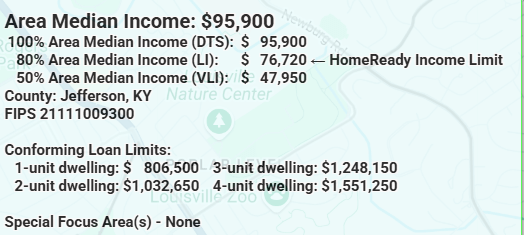

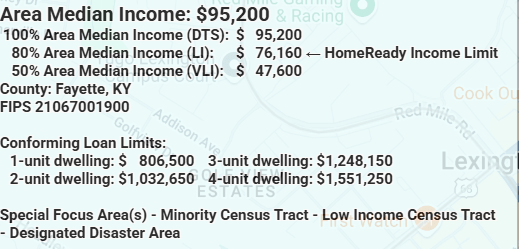

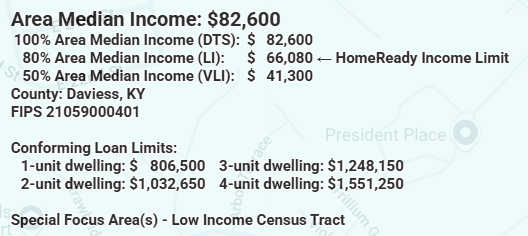

Income Limits

Income restrictions apply primarily to state-assisted programs:

- KHC Programs: Income caps

- USDA Loans: Target low-to-moderate income households, with limits adjusted by county and household size

Debt-to-Income (DTI) Ratios

Lenders evaluate borrowers’ ability to manage monthly payments relative to income:

- Conventional Loans: Maximum DTI of 43%, though KHC programs extend this to 50% with strong credit profiles

- FHA Loans: Allow DTIs up to 57% if justified by Automated Underwriting System (AUS) approvals

- VA Loans: Cap DTI at 41%, supplemented by residual income requirements

Property Requirements

- Primary Residence: All programs mandate occupancy within 60 days of closing

- Purchase Price Limits: KHC-imposed ceilings of $510,939 for single-family homes, adjusted periodically for inflation

- Geographic Restrictions: USDA loans apply only to properties in rural areas, as defined by the U.S. Department of Agriculture

Kentucky Housing Corporation (KHC) Programs

Conventional Preferred and Plus 80

These flagship programs offer 30-year fixed-rate mortgages with reduced mortgage insurance premiums:

- Down Payment: Minimum 3%, sourced from personal savings, gifts, or KHC assistance

- Credit Score: 660+ for Conventional Preferred; slightly lower scores may qualify for Plus 80 with higher income thresholds

- Income Limits: Up to 80% of AMI for Conventional Preferred; Plus 80 accommodates incomes up to $183,400 in designated counties

- Education: Completion of a HUD-approved homebuyer education course is mandatory for conventional loans

Mortgage Revenue Bond Program

This initiative provides below-market interest rates for government-backed loans:

- Eligibility: First-time buyers in non-targeted areas; repeat buyers permitted in targeted zones

- Combined Assistance: This may be paired with KHC’s Down Payment Assistance (DPA). It offers up to $10,000 as a second mortgage at 3.75% interest over 10 years

Down Payment Assistance (DPA)

- Structure: Second mortgage with 10-year term, forgivable if the borrower retains the property for the duration

- Usage: Funds applicable to down payments, closing costs, and prepaid expenses

- Cannot be used to fix up house or buy stuff for home

Loan Programs

FHA Loans

Insured by the Federal Housing Administration, these loans cater to borrowers with imperfect credit:

- Down Payment: 3.5% with a 580+ credit score; 10% for scores between 500–579

- Mortgage Insurance: Upfront premium of 1.75% plus annual premiums of 0.45–1.05%

- Flexibility: Higher DTIs permitted with compensating factors like significant cash reserves

USDA Loans

Designed for rural homebuyers, USDA loans offer 100% financing:

- Income Limits: 115% of AMI for most counties, adjusted for household size

- Credit Requirements: 640+ for automated approval; manual underwriting required for scores 620–640

- Property Eligibility: Must be located in USDA-designated rural zones,

VA Loans

Exclusive to veterans, active-duty personnel, and eligible spouses:

- Down Payment: 0% required, with no private mortgage insurance (PMI)

- Funding Fee: 1.25–3.3% of the loan amount, varying by service category and down payment

- Credit Standards: Most lenders require 580–620 scores, though the VA itself imposes no minimum

Income and Purchase Price Limitations

- KHC Programs: Income limits fluctuate by county;

- USDA Income limits fluctuate by county;

- VA has no income limits

- FHA had no income limits

Employment Verification

- Stability: Most programs require two years of steady employment, with exceptions for graduates entering the workforce

- Self-Employment: Requires two years of tax returns to verify income consistency

Call/Text – 502-905-3708

Joel Lobb

Mortgage Loan Officer – Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Kentucky Local Home Loan Lender Services

First-Time Home Buyers Welcome

FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans

Conventional Loan Options Available

Fast Local Decision-Making

Experienced Guidance Through the Home Buying Process

COMPANY NMLS# 1738461

COMPANY NMLS# 1738461