Kentucky USDA Mortgage Loan Guide

Your Complete Roadmap to Zero-Down Financing in 2026

Quick Navigation

What Is a USDA Mortgage Loan?

The USDA Rural Development Guaranteed Loan Program is designed to help Kentucky families purchase homes in eligible rural areas. With over 20 years of experience assisting more than 1,300 Kentucky families, I’ve successfully guided hundreds through USDA loans across all 120 counties.

If you’re a first-time homebuyer looking for a true no-money-down option without VA benefits, USDA is your strongest choice.

Property Eligibility

The property must be located in a USDA-eligible rural zone. The excellent news for Kentucky buyers: most of the state qualifies. While Louisville and Lexington city centers are ineligible, surrounding suburban areas typically qualify.

Typically Eligible Areas

- Most of Hardin, Meade, Breckenridge, Grayson, Nelson, Spencer, and Shelby Counties

- Large portions of Bullitt County outside immediate Louisville limits

- Nearly all of Eastern and Western Kentucky

- Suburban pockets around Lexington, Georgetown, Winchester, and Nicholasville

Income Limits for 2026

Your total household income must not exceed the USDA county limit for your family size. USDA counts all household income, including spouses, adult children, part-time earnings, and bonuses.

| Household Size | 2026 Income Limit Range |

|---|---|

| 1–4 People | Up to approximately $119,850 for 1-4 members and $158,250 for 5-8 members |

| 5–8 People | Up to approximately $ $119,850 for 1-4 members and $158,250 for 5-8 members |

Note: Limits vary by county. Contact me for your specific county’s limits.

Credit Score Requirements

While USDA doesn’t publish a minimum credit score, Kentucky lenders follow these general guidelines:

640+ Credit Score — Easiest Path to Approval

- Eligible for automated approval through GUS (USDA’s system)

- More flexible debt-to-income ratios

- Faster underwriting timeline

580–639 — Possible With Manual Underwriting

Approvals in this range require strong supporting documentation:

- Perfect rental history

- No late payments in the past 12 months

- Low overall debt

- Stable employment history

Below 580 — Case-by-Case Review

Not impossible, but uncommon. Success requires significant compensating factors and strong manual underwriting review.

Employment Rules

Underwriters typically require a 2-year work history, though it doesn’t need to be at the same job. USDA is flexible about career transitions within reason.

USDA Accepts

- Job changes within the same field or industry

- Recent graduates working in their trained field

- 12+ months of consistent income

- Self-employed borrowers (with 2 years of tax returns)

Red Flags to Avoid

- Job gaps longer than 60 days

- Declining income trends over time

- Multiple unrelated job switches

Debt-to-Income Ratio Requirements

Your DTI is calculated as a percentage of your gross monthly income.

| DTI Type | Standard Limit | With Strong Credit (GUS Approve) |

|---|---|---|

| Front-End (Housing Only) | 29% | Up to 29–34% |

| Back-End (All Debt) | 41% | 44%+ |

Manual underwriting files must stay closer to standard limits, while automated approvals offer more flexibility.

Bankruptcy & Foreclosure Waiting Periods

If you’ve experienced financial hardship, USDA has established waiting periods before approval:

| Credit Event | Waiting Period |

|---|---|

| Chapter 7 Bankruptcy | 3 Years from Discharge |

| Chapter 13 Bankruptcy | 12 Months of On-Time Payments + Trustee Approval |

| Foreclosure | 3 Years from Sale Date |

| Short Sale | 3 Years (Typical) |

Property Condition & Appraisal Requirements

Your home must be safe, sound, and sanitary. The USDA appraiser evaluates:

- Roof condition and remaining lifespan

- Foundation stability and integrity

- Electrical system safety

- Plumbing functionality

- Adequate heating system for the entire home

- Absence of active termite damage

- No peeling lead-based paint

Most repairs can be handled by the seller before closing. This is a negotiation point in your offer.

The USDA Loan Process

Credit check, income estimate, DTI calculation, and review of eligible areas

Gather pay stubs, W-2s, tax returns, bank statements, and photo ID

Use eligibility maps to confirm the property qualifies before making an offer

Rate lock, appraisal order, document review, and GUS findings

Conditional Commitment issued (typically 2–7 days)

Sign final paperwork, receive keys, and move into your new home

Frequently Asked Questions

Do I need a down payment?

No—USDA loans provide 100% financing with zero down payment required.

Can I buy in Louisville or Lexington?

City centers are ineligible, but many surrounding suburbs qualify. Always verify the property address on the USDA eligibility map before making an offer.

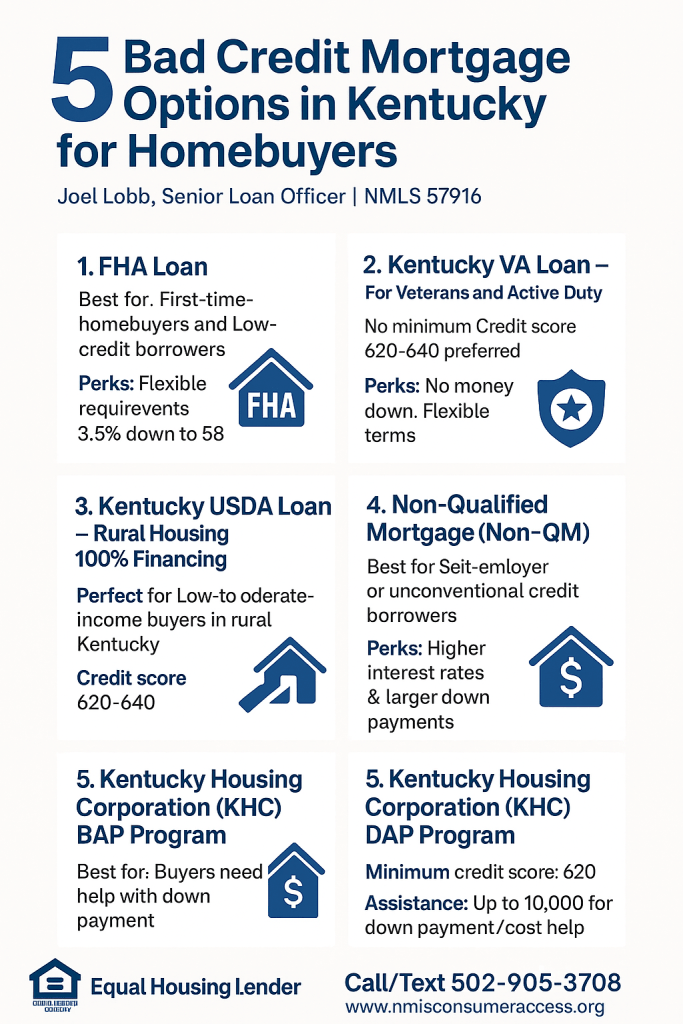

What credit score do I need?

640+ is ideal for streamlined approval. Manual underwriting may consider scores down to 580 with strong compensating factors.

Can the seller help with closing costs?

Yes—USDA allows seller concessions, and some closing costs can be financed if the appraisal supports it.

How long does the process take?

Most Kentucky USDA loans close in 30–45 days from application.

Are there down payment assistance programs?

Yes. Kentucky Housing Corporation (KHC) programs offer additional assistance for qualified first-time homebuyers to further reduce upfront costs.

Ready to Get Pre-Approved?

Let’s explore your USDA lending options with personalized guidance and same-day approvals.

Serving qualified homebuyers across all 120 Kentucky counties

Joel Lobb, Mortgage Loan Officer | Specialist in Kentucky FHA, VA, USDA, KHC & Fannie Mae Loans

EVO Mortgage — Helping Kentucky Homebuyers Since 2001

NMLS Personal ID: 57916 | Company NMLS ID: 1738461 | Equal Housing Lender

This website is not endorsed by the USDA, FHA, VA, or any government agency. It is an independent educational resource.

This is not a commitment to lend. All loans subject to credit approval and USDA program guidelines.