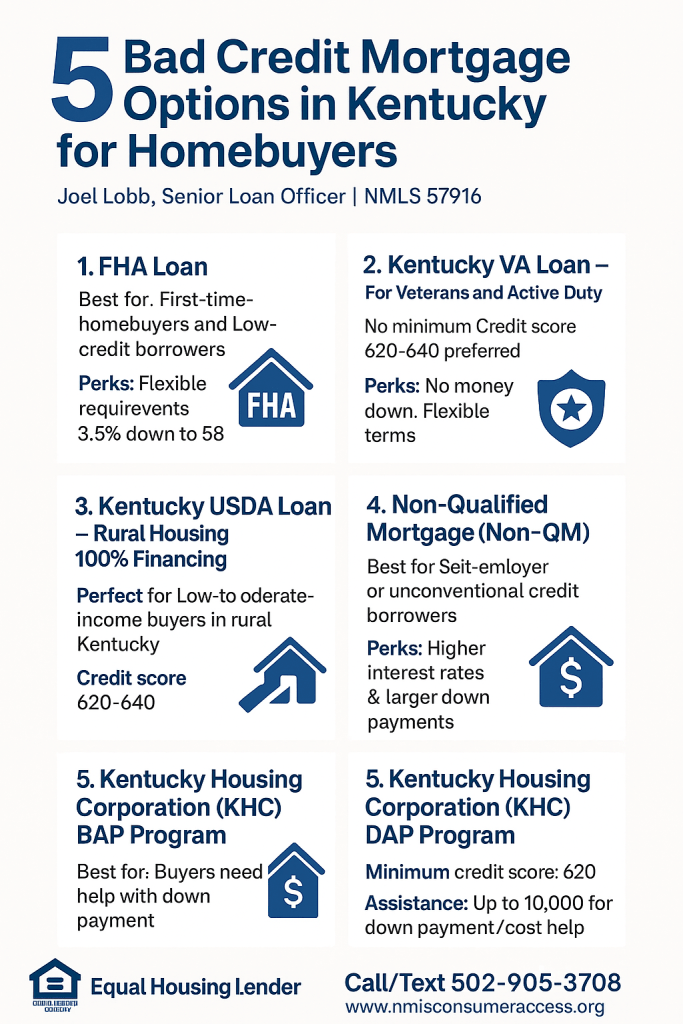

5 Bad Credit Mortgage Options in Kentucky for Homebuyers

By Joel Lobb, Senior Loan Officer | NMLS #57916 | Louisville, KY

Bad Credit Mortgage Options in Kentucky | FHA, VA, USDA, and More

Discover 5 bad credit mortgage solutions in Kentucky. Learn about FHA, VA, USDA, Non-QM loans, and KHC Down Payment Assistance with Joel Lobb, Mortgage Loan Officer.

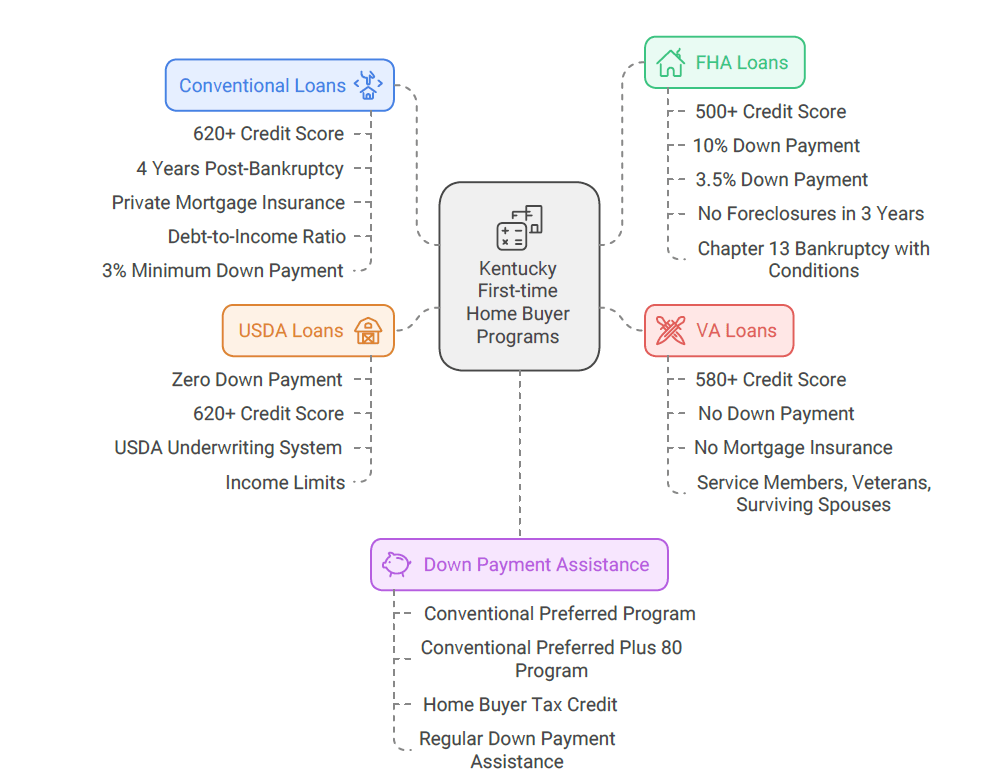

Can You Get a Mortgage with Bad Credit in Kentucky?

Absolutely. As a mortgage broker who has helped over 1,300 Kentucky families achieve homeownership, I can assure you that bad credit doesn’t have to be a deal-breaker. With the right loan program and personalized guidance, you can buy a home even with less-than-perfect credit.

Several government-backed and alternative loan programs are designed specifically for buyers facing credit challenges. Let’s dive into the top 5 options available in Kentucky today.

1. FHA Loan – Credit Scores from 500+

Best For: First-time homebuyers and low-credit borrowers

Key Features:

- Minimum Credit Score: 500 (requires 10% down) or 580+ (requires 3.5% down)

- Loan Type: HUD-backed

- Down Payment: 3.5% for scores 580+, 10% for 500-579

- Benefits: Flexible credit standards, low down payments

- Considerations: Mortgage insurance premium (MIP) required

Other Requirements:

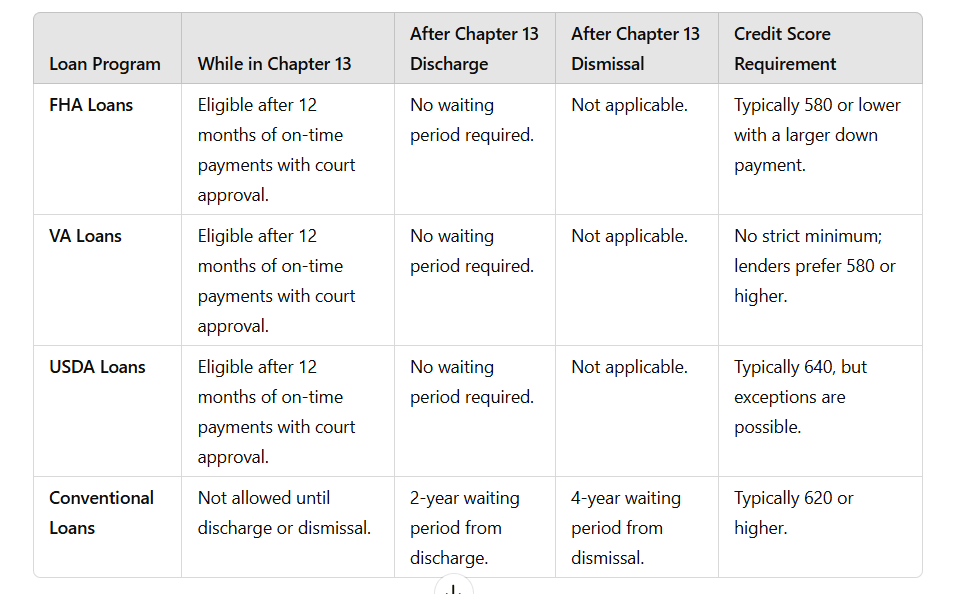

- No bankruptcies in the past 2 years

- No foreclosures in the past 3 years

- Stable 2-year work history

- 1-3 months’ reserves recommended

Bonus: Down payment assistance programs may be available for scores 580+

FHA loans are a great option if you’ve overcome past credit issues but have stable income and rental history.

2. VA Loan – For Veterans and Active-Duty Service Members

Best For: Veterans, active-duty personnel, and eligible surviving spouses

Key Features:

- Minimum Credit Score: No VA-mandated minimum; most lenders prefer 620+

- Down Payment: 0%

- Loan Type: VA-backed

- Benefits: No PMI, competitive rates, flexible DTI ratios

Other Requirements:

- Must meet VA residual income requirements

- Requires a Certificate of Eligibility (COE)

- 2 years stable employment history

- No bankruptcies or foreclosures within the past 2 years

- Termite inspection required

As a veteran myself, I’ve closed over 300 VA loans across Kentucky. You’ve earned these benefits — let’s use them.

3. USDA Loan – Rural Housing with 100% Financing

Best For: Low- to moderate-income buyers in rural areas

Key Features:

- Minimum Credit Score: 620-640 (varies by lender)

- Down Payment: 0%

- Loan Type: USDA-backed

- Benefits: No money down, competitive rates, flexible underwriting

Other Requirements:

- Income limits apply ($112,450 for 1-4 household members; $148,450 for 5+)

- 3 years removed from bankruptcy/foreclosure

- Primary residence only

- Upfront mortgage insurance (1%) and monthly (0.35%) for life of loan

USDA loans are perfect for buyers in eligible Kentucky counties seeking affordable paths to homeownership.

[View USDA Eligible Areas and Income Limits Here]

4. Non-Qualified Mortgage (Non-QM)

Best For: Self-employed, investors, recent credit events

Key Features:

- Flexible Income Documentation: Use bank statements, rental income (DSCR), or asset depletion

- Waiting Period: As little as 1 year after bankruptcy or foreclosure

- Down Payment: 10%-20% typically required

- Benefits: Alternative income accepted, flexible underwriting

- Considerations: Higher rates, not government-backed

If you’re a 1099 contractor, truck driver, gig worker, or recovering from a bankruptcy, Non-QM loans open new doors.

5. Kentucky Housing Corporation (KHC) Down Payment Assistance (DAP)

Best For: Buyers needing help with down payment or closing costs

Key Features:

- Loan Amount: Up to $10,000 assistance

- Credit Score: Minimum 620 (FHA/VA/USDA); higher for conventional

- Interest: 0% loan

- Forgiveness: Potential after set time period

Other Requirements:

- Primary residence only

- Income and purchase price limits apply

- Homebuyer education course completion

- No recent bankruptcy or foreclosure

Combine KHC DAP with FHA, VA, or USDA loans for an even stronger path to affordable homeownership in Kentucky.

Who These Programs Help

- First-time homebuyers

- Low- to moderate-income families

- Borrowers with prior collections or credit dings

- Self-employed or gig workers

- Veterans and rural buyers

What’s Next?

Don’t guess which loan fits you best. Let’s build a personalized mortgage plan based on your unique credit profile, income, and homeownership goals.

📞 Call or Text: (502) 905-3708

📧 Email: kentuckyloan@gmail.com

🌐 Website: www.mylouisvillekentuckymortgage.com

Joel Lobb — Mortgage Loan Officer

911 Barret Ave., Louisville, KY 40204

Evo Mortgage | Company NMLS# 1738461 | Personal NMLS# 57916

#BadCreditMortgage #KentuckyHomeLoans #FirstTimeHomebuyerKY #FHAloanKY #VALoanKY #USDALoanKY #KHC #MortgageHelpKY

.jpg)

Website:

Website:  Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204