Get Expert Help With Your Kentucky USDA Rural Housing Loan that is a foreclosure or fixer-upper with fixed income

Are you considering a USDA rural housing loan in Kentucky to purchase a foreclosed property or fixer-upper home? This comprehensive guide walks Kentucky homebuyers through everything you need to know about USDA 502 Direct and Guaranteed loans. It is especially useful if you are living on fixed income. It’s also helpful for those on Social Security benefits, disability payments, or lower wages.

Can Kentucky Residents Use USDA Rural Housing Loans for Foreclosures or Fixer-Uppers?

Yes, with important conditions. While USDA loans offer an excellent path to affordable homeownership in rural Kentucky communities, these properties must meet specific standards:

- The home must be structurally sound

- The property must be move-in ready (safe and sanitary)

- All essential systems must be functional

- The property must be located in a USDA-eligible rural area in Kentucky

Many Kentucky foreclosures can qualify for USDA financing if they’re in good condition or if repairs are completed before closing.

Kentucky USDA Loan Programs: Which Works Best for Your Situation?

Kentucky homebuyers have two primary USDA rural housing loan options:

USDA 502 Direct Loan Program (Kentucky Low-Income Buyers)

- Income Requirements: 50-80% of Kentucky area median income

- Funding Source: Direct from USDA (government-funded)

- Perfect For: Very low to low-income Kentucky residents

- Credit Flexibility: Higher flexibility with manual underwriting

- Down Payment: $0 down payment required

- Mortgage Insurance: Lower annual fee (0.35%)

- DTI Ratios: May permit higher DTI with strong residual income

- Asset Restrictions: Stricter requirements (cannot have excessive assets)

- Best For: Kentucky families with lower, stable incomes including fixed income and disability benefits

USDA 502 Guaranteed Loan Program (Kentucky Moderate-Income Buyers)

- Income Requirements: Up to 115% of Kentucky area median income

- Funding Source: Private Kentucky lenders with USDA guarantee

- Perfect For: Moderate-income Kentucky homebuyers

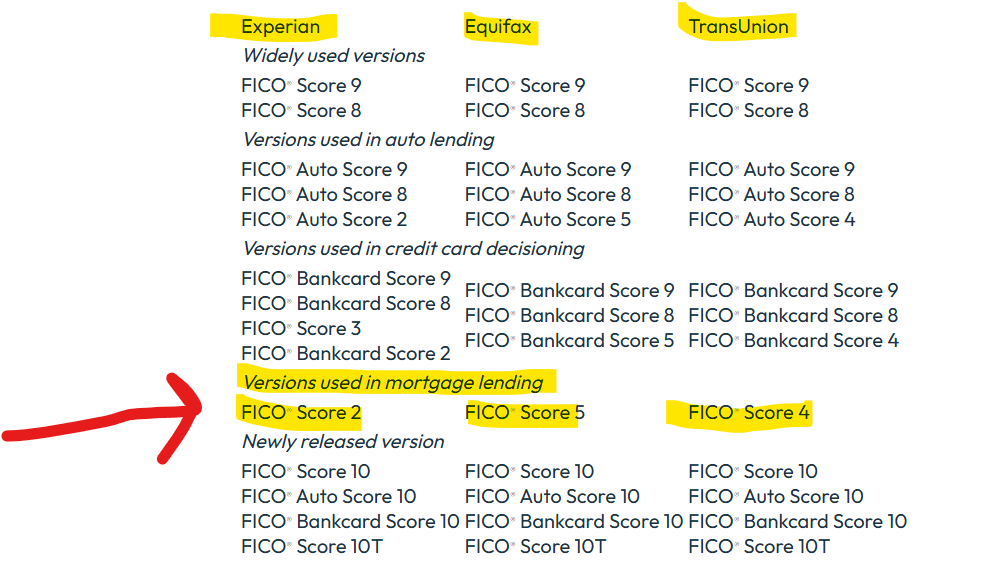

- Credit Requirements: Typically 640+ recommended

- Down Payment: $0 down payment required

- Mortgage Insurance: 1.0% upfront fee, 0.35% annual fee

- DTI Ratios: Generally maximum 41-43%

- Asset Review: More flexible than Direct program

- Best For: Kentucky working families with moderate, stable income

Kentucky USDA Property Requirements: Will That Foreclosure or Fixer-Upper Qualify?

For Kentucky properties to qualify for USDA rural housing financing:

✅ Location Requirement: Must be in a USDA-eligible rural Kentucky area (Check Kentucky Property Eligibility Here)

✅ Occupancy: Must be your primary Kentucky residence

✅ Condition Standards: Must be move-in ready at closing (safe, sanitary, structurally sound)

❌ Repair Restrictions: Cannot require major repairs unless using USDA repair escrow on Guaranteed loans

✅ Foreclosure Eligibility: Foreclosed properties qualify if they meet condition requirements or repairs are completed before appraisal

✅ Property Types: Single-family homes, condos, townhomes, and even manufactured homes (with specific requirements)

Kentucky USDA Loans and Fixed Income: Disability, Social Security, and Retirement Benefits

Kentucky USDA rural housing loans accommodate various income sources, making them accessible to those on fixed incomes:

Kentucky Fixed Income Advantage: USDA loans allow “grossing up” non-taxable income by 25%, significantly helping fixed-income borrowers meet debt ratio requirements.

Kentucky USDA Loan Debt-to-Income Ratio Guidelines

Handling Property Repairs with Kentucky USDA Rural Housing Loans

For Kentucky USDA Guaranteed Loans:

- Repair Escrow Option: Available for minor repairs, typically capped around $10,000

- Process: Lender holds funds in escrow; repairs completed after closing

- Limitations: Major structural issues, foundation problems, or unsafe conditions will disqualify the property

For Kentucky USDA Direct Loans:

- Repair Flexibility: May offer more flexibility for limited rehabilitation needs

- Requirement: Property must still be habitable at closing

- Alternative: Consider Kentucky’s FHA 203k or Conventional HomeStyle loans for major renovations

Special Considerations for Kentucky Homebuyers with Disabilities or Lower Income

- ✅ SSI/SSDI income is fully acceptable for qualification

- ✅ Credit scores may receive manual underwriting consideration

- ✅ Asset tests apply only for Direct loan applicants

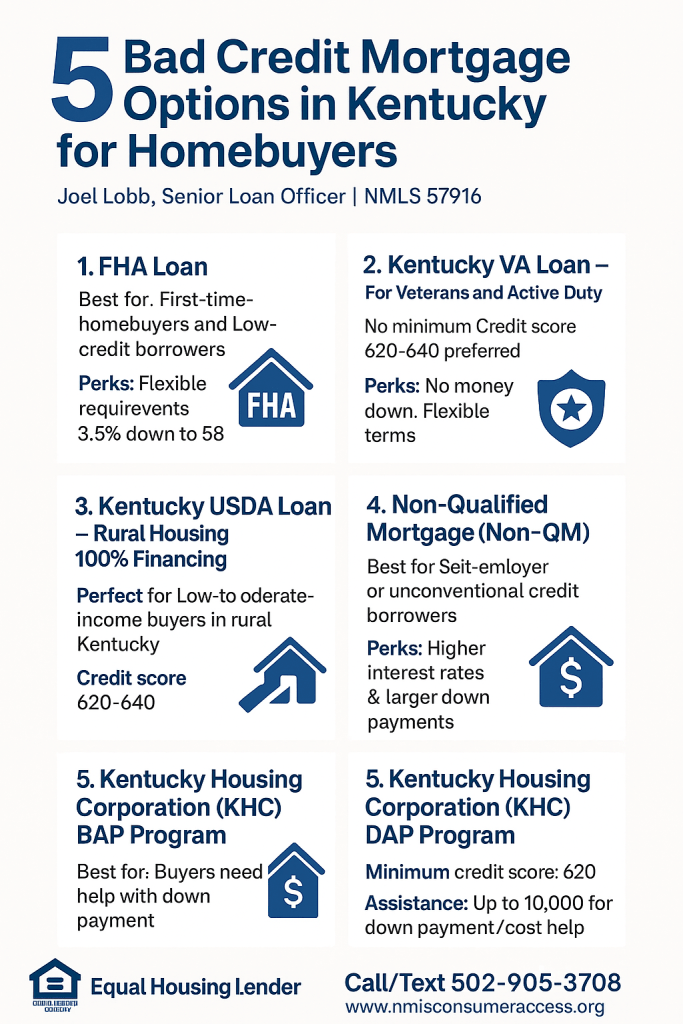

- ✅ Kentucky Housing Corporation (KHC) down payment assistance may be combined with USDA

- ✅ Welcome Home Grant may apply (when seasonally available)

Steps for Kentucky USDA Rural Housing Loan Application

- Verify Property Eligibility: Check if your desired Kentucky location qualifies using the USDA Rural Housing Eligibility Map

- Get Pre-Qualified: Work with a Kentucky lender experienced in USDA rural housing loans

- Property Inspection: Have any potential foreclosure or fixer-upper thoroughly inspected early

- Select Appropriate Program: Determine whether Direct or Guaranteed better suits your circumstances

- Prepare Documentation: Gather income verification, tax returns, benefit award letters, and other required paperwork

Frequently Asked Questions About Kentucky USDA Rural Housing Loans

Can I use a Kentucky USDA loan to purchase a foreclosed property?

Yes, if the foreclosed home meets all USDA livability and safety standards.

Do Kentucky USDA loans accept disability income for qualification?

Absolutely. Both SSI and SSDI are eligible income sources and can often be “grossed up” by 25% if non-taxable.

What if my desired Kentucky property needs repairs?

USDA Guaranteed loans may allow an escrow holdback for minor repairs (typically up to $10,000). Major issues will disqualify the property.

How do Kentucky’s 502 Direct loans differ from Guaranteed loans?

Direct loans are specifically for very low-income borrowers with tighter restrictions; Guaranteed loans accommodate moderate-income buyers and utilize private lenders. View Kentucky income limits here.

Are manufactured homes eligible for Kentucky USDA loans?

Yes, provided they meet HUD standards and are permanently attached to a foundation.

Can I combine Kentucky Housing Corporation down payment assistance with USDA?

Yes, KHC programs can often be paired with USDA loans for additional assistance.

Get Expert Help With Your Kentucky USDA Rural Housing Loan

Need assistance navigating Kentucky’s USDA rural housing loan options? Our experienced mortgage professionals specialize in helping Kentucky homebuyers with fixed income, disability benefits, and unique financing needs.

Joel Lobb, NMLS #57916

Senior Loan Officer, EVO Mortgage

📍 Based in Louisville, serving homebuyers throughout Kentucky

📞 (502) 905-3708

✉️ kentuckyloan@gmail.com

🌐 Apply Online or Get Pre-Qualified Today

This information is not affiliated with HUD, USDA, FHA, or any government agency. Equal Housing Lender. NMLS #57916