Thank you for visiting. I hope you find this website both informative and empowering as you explore your mortgage options. My goal is to help you feel confident in selecting the right home loan for your unique situation.

I proudly serve all 120 counties in Kentucky, offering a full range of mortgage loan programs, including:

With over 20 years of lending experience, I’ve had the privilege of helping more than 1,300 Kentucky families achieve their homeownership goals. Whether you’re a first-time homebuyer or seeking a second opinion, I’m here to offer honest, no-pressure advice—always free of charge.

I am dedicated to:

-

Attending as many closings as possible

-

Providing responsive, personalized service

-

Ensuring quick, efficient, and accurate loan processing

-

Making myself accessible every step of the way

I’ve been consistently recognized as a top mortgage loan officer in Kentucky for VA, FHA, USDA, and KHC programs. I take pride in being thorough, transparent, and attentive with each and every client.

Please take a moment to read my reviews below. If you have questions or need guidance, feel free to call or text me directly.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

You will not get lost in the shuffle like most borrowers do at the mega banks; you’re just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Give us a try or let us compare your options on your next mortgage transaction. Call me locally at 502-905-3708. Free Mortgage Pre-Qualifications same day on most applications.

Email me at kentuckyloan@gmail.com with your questions

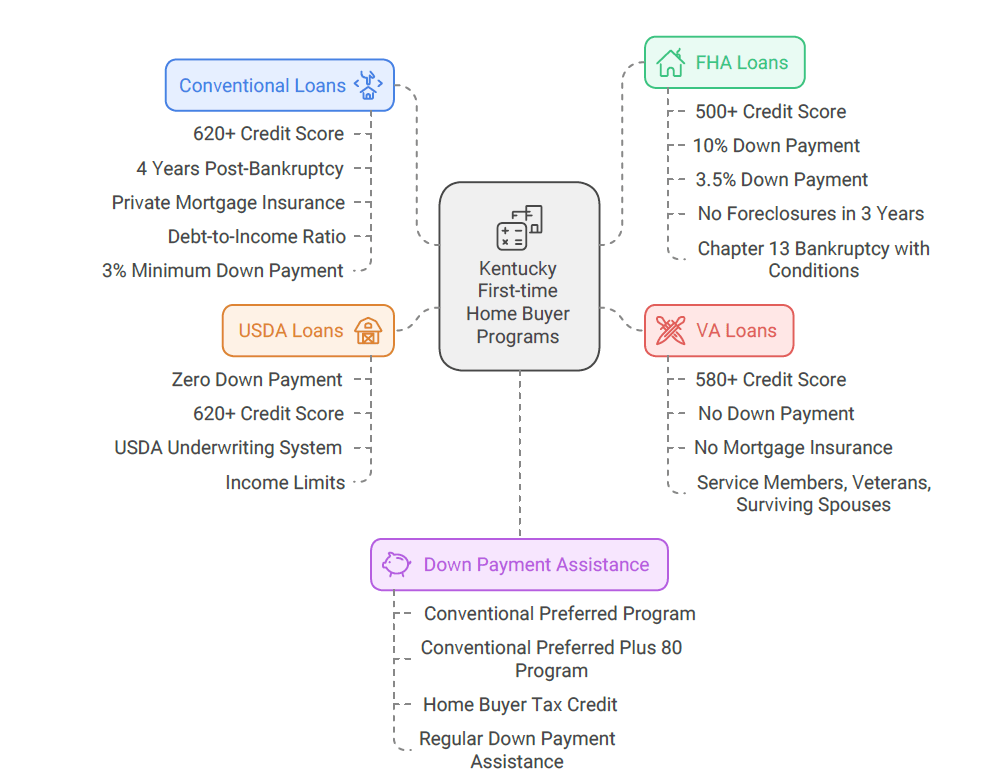

I specialize in Kentucky FHA, VA ,USDA, KHC, Conventional mortgage loans. I am based out of Louisville Kentucky. For the first time buyer , we offer Kentucky Housing or KHC loans with down payment assistance.

Customer Testimonials

We just moved here the first of January in 2017 from Ohio to the Louisville, KY area and we found Joel’s website online. He was quick to respond to us and got back the same day on our loan approval. He was very knowledgeable about the local market and kept us up-to date throughout the loan process and was a pleasure to meet at closing. Would recommend his services.

Angela Forsythe

“We were searching online for mortgage companies in Louisville, Ky locally to deal with and found Joel’s website, and it was a godsend. He was great to work with, and delivered on everything he said he would do. I ended up referring my co-worker at UPS, and she was very pleased with his service and rates too. Would definitely vouch for him.” September 2016

Monica Leinhardt

“We contacted Joel back in July 2011 to refinance our Mortgage and he was great to work with. We contacted several lenders locally and online, and most where taking almost 60 days to close a refinance, Joel got it done in 23 days start to finish,I would definetly recommmend him. He got us 3.75% with just $900 in closing costs on our FHA Streamline loan.

Kayle Griffin

“Joel is one of the best Mortgage Brokers I have ever worked with in my sixteen years in the real estate and mortgage business.” May 25, 2010

Tim Beck

“Joel has always worked very hard to keep his word and to work out seasonable solutions to difficult problems. He is truly an expert in FHA and other type loans.” September 1, 2010

Nancy Nalley

“I have worked with Joel since 1998. He is a great loan professional.” I refer most of my Louisville, Kentucky area home buyers to him and he always take special care of them. August 23, 2012

Jon Clark

“Joel Lobb is a real professional in the lending industry, with many years of experience, he is the one to go to for any mortgage lending needs.” August 22, 2011

RICHARD VOLZ , Residential Sales , Remax Foursquare Realty

“When looking to purchase our new home in 2006, I had the pleasure of meeting Joel Lobb. Not only was he personable and easy to reach, he was extremely knowledgable in his field and made sure to find us the best rate and a top notch mortgage company. We were able to complete the process in less than 3 weeks with his expertise. I find Joel to have the utmost high integrity and I recommend him to anyone who say’s they are need of mortgage assistance. He is also fantastic and keeping everyone up to date on the latest in the housing industry through his twitter posts. He provided great results for our family and we still communicate to this day!” August 21, 2010

Stacie Drake

“We first use Joel on our new home purchase in 2007 in St Matthews, Kentucky area and he was great to work with. We have since refinanced our home with him in 2010 when rates got really low and he has always delivered on what he says. I could not imagine using anyone else.”

Melody Glasscock March 2014

Absolutely Amazing!! I emailed Joel after I had just got a denial from a bank and just thought i would try to get some advice on what my next steps would be to get a house. I honestly didn’t expect to even get a reply because my credit is not great. That was about a week and a half ago. I just signed a contract on a house last night. ONLY because of Joel Lobb. He even worked with us throughout the weekend, which shocked me. Best decision I have ever made. THANK YOU SO MUCH FOR WORKING WITH US THROUGHOUT THE ENTIRE PROCESS.

Cee Bellisle August 2017

Contacted him about buying a home and he was great to work with. I was moving to Louisville Ky to take a new job and he walked me through the entire process. He explained to me all the different options for FHA, VA, USDA mortgage loans and credit score requirements versus Fannie Mae. Since I was a first time home buyer I needed alot of help and guidance. I would definitely recommend him. Fast to respond and available to answer questions that I or my realtor had after hours.

Anderson Johnson April, 2018

We moved from Michigan to Northern Kentucky area and we were really impressed. We got a USDA loan no money down and closed in less than 3.5 weeks. We shopped around online with other lenders but Joel was always first to respond and his rates were just a little better than other lenders. He kept us informed through the process along with our realtor and there was absolutely no surprises like we heard from other co-workers and friends that they experienced in their loan process. We have already referred another co-worker to Joel . He’s AWESOME!

Website:

Website:  Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204