Out of Pocket Costs

$0 Down, 100% Financing for Kentucky USDA Rural Housing Loans

Home Qualifications

Single & Multi-Family Rural Homes and Condos that meet FHA Guidelines or Fannie Mae Guidelines

Competitive Interest Rates

Often Lower than Conventional Loans with lower mortgage insurance requirements than FHA and Fannie Mae.

Flexible Credit Guidelines

640 Credit Score Requirement* Can go lower possibly if the loan meets credit and debt to income ratio requirements.

*Scores below 640 may be eligible via manual underwriting.

Kentucky USDA Loan Eligibility Requirements

As with any loan, you must meet certain requirements to confirm USDA loan eligibility. To be an eligible candidate for a USDA loan, consider these general requirements:

Be a legal U.S. resident.

Show two years of income history.

Demonstrate a willingness to repay the loan as proven by no late payments or collections within the prior 12 months.

Have an acceptable debt ratio.

Possess an adjusted annual income of no more than 115% above the median income for the area as related to family size.

Be interested in a property in an area certified by USDA loan agreements.

Frequently Asked Questions

What’s a government-backed mortgage?

These mortgage loans are insured by an agency of the federal government, protecting the lender in the event a borrower can’t repay the debt. This significantly reduces the risk to the lender and may make it easier for borrowers to take out a loan by offering more lenient credit guidelines, interest rates, and down payment options.

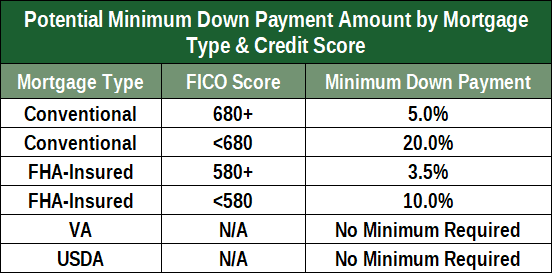

What’s the difference between Kentucky USDA loans and other types of government-backed mortgage loans like Kentucky FHA loans?

While both are government-backed mortgages, Kentucky USDA loans are run by a different government agency than Kentucky FHA loans and has different application, underwriting, appraisal, lending amount, and mortgage insurance requirements. To be eligible for a Kentucky Rural Housing USDA loan, borrowers must be purchasing or refinancing property in rural areas that the USDA has defined as eligible.

Do I have to be a farmer or rancher to get a Rural Kentucky USDA loan?

No, despite what the name implies. As long as you meet the property and eligibility qualifications for a Rural Kentucky USDA loan, you can apply.

How do I know if a home is eligible for a USDA loan?

You can navigate to the link here👉 Rural Development Kentucky USDA’s eligibility website and type in the exact address of the home you want to purchase to find out if it’s in an approved area.

Are there maximum lending amounts for KY Rural Development USDA mortgage loans?

There are no set loan limits for USDA loans in Kentucky, but the maximum amount is set based on your ability to qualify for a USDA loan based on borrower’s income and work history over the last two years. and debt to income ratios. The max back-end debt ratio on USDA loans is set at 45.9% of a borrower’s gross monthly income while the front-end debt ratio centers around 28% to32% depending on credit score, ratios, assets.

Do USDA loans require private mortgage insurance (PMI)?

Yes, Kentucky USDA mortgage loans have an upfront funding fee of 1% currently with a monthly mortgage insurance premium of .35%– mortgage insurance is required by the USDA and pays your lender if you default on your loan.

What’s a USDA guarantee fee and annual fee?

These are fees involved during the USDA home loan process. The upfront guarantee fee is normally equal to 1% of the loan amount. It’s usually added to the initial loan amount and paid at closing. The annual fee is normally equal to 0.35% of the loan amount and some is financed into your loan.

💥👇