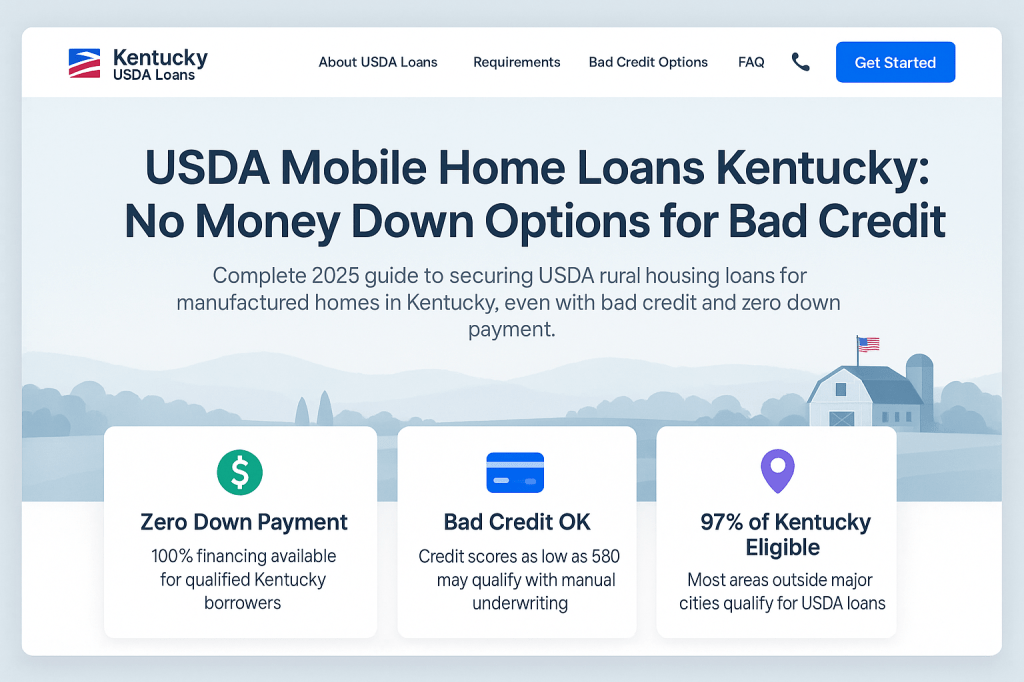

2026 Guide to USDA Rural Housing Loans for Manufactured Homes in Kentucky: No-Money-Down Options, Even with Bad Credit

100% financing available for qualified Kentucky borrower

Table of Contents

- Understanding USDA Mobile Home Loans in Kentucky

- 2026 Game-Changing Updates

- Kentucky USDA Rural Housing Loan Requirements

- Bad Credit Mobile Home Loans in Kentucky

- No Money Down Mobile Home Financing Options

- Kentucky Counties Eligible for USDA Mobile Home Loans

- Foundation and Installation Requirements

- How to Apply for USDA Mobile Home Loans in Kentucky

- Alternative Financing Options

- Frequently Asked Questions

Understanding USDA Mobile Home Loans in Kentucky

The United States Department of Agriculture (USDA) Rural Development program has been quietly revolutionizing homeownership opportunities across Kentucky for decades. Many potential homebuyers don’t realize this. The USDA’s Single Family Housing Guaranteed Loan Program (SFHGLP) extends far beyond traditional stick-built homes. It also includes manufactured and mobile homes. This opens doors for thousands of Kentucky families who previously thought homeownership was out of reach.

Kentucky, with its vast rural landscapes and small-town communities, is well-suited to USDA rural housing programs. Conventional mortgages often demand large down payments and excellent credit. USDA loans, however, are designed for low- to moderate-income families in rural areas. They are an excellent option for mobile home buyers across the Commonwealth.

What Makes USDA Mobile Home Loans Different

- •100% Financing: No money down is required, making it perfect for buyers with limited savings

- •Affordable Terms: Competitive interest rates make monthly payments manageable

- •Rural Housing Opportunities: Ideal for Kentucky homebuyers in small towns and rural areas

- •Flexible Credit Requirements: Holistic approach to creditworthiness evaluation

On March 4, 2025, the USDA officially expanded its Single Family Housing Guaranteed Loan Program. This expansion provides 100% financing for manufactured homes. Industry experts are calling this change the most significant development in rural housing finance in decades.

Key Program Changes

Expanded Eligibility

Manufactured homes now receive the same favorable treatment as traditional homes

Age Restrictions Relaxed

Existing manufactured homes up to 20 years old can now qualify

Streamlined Process

Processing times reduced by 30-40% with new guidelines

Better Credit Pathways

Clearer guidelines for borrowers with credit challenges

Kentucky USDA Rural Housing Loan Requirements

Borrower Requirements

- ✓Income cannot exceed 115% of area median income

- ✓Must occupy home as primary residence

- ✓U.S. citizen, non-citizen national, or qualified alien

- ✓Credit score typically 580+ (manual underwriting available)

Property Requirements

- ✓Built to HUD Code standards (post-1976)

- ✓Permanent foundation required

- ✓Minimum 12 feet wide, 400 sq ft living space

- ✓Located in USDA-eligible rural area

Bad Credit Mobile Home Loans in Kentucky

One of the most significant advantages of USDA mobile home loans is their accessibility to borrowers with less-than-perfect credit. Unlike conventional mortgages, which often have rigid credit score requirements, USDA loans offer flexibility. This flexibility recognizes the unique challenges faced by rural borrowers.

Credit Score Guidelines

640+ Credit Score Streamlined Processing

580 and above Credit Score Manual Underwriting

Note: USDA takes a holistic approach to credit evaluation, considering factors beyond just credit scores.

Often Asked Questions

What credit score do I need for a USDA mobile home loan in Kentucky?

While USDA doesn’t set a minimum credit score, most lenders prefer scores of 580 or higher. Borrowers with lower scores may still qualify through manual underwriting, and the program takes a holistic approach to credit evaluation.

Can I buy a used mobile home with a USDA loan?

Yes, existing manufactured homes can qualify if they’re less than 20 years old. They must meet HUD standards. The homes should be properly installed on permanent foundations. Additionally, they need to meet all other USDA requirements.

Do I need to own the land to get a USDA loan for a mobile home?

USDA loans can finance both the manufactured home and land together. They can also finance just the home if you already own suitable land. However, the home must be permanently installed and classified as real property.

What areas of Kentucky are eligible for USDA loans?

Approximately 97% of Kentucky qualifies as rural for USDA purposes. Most areas outside of Louisville, Lexington, and a few other metropolitan centers are eligible. Use the USDA’s online eligibility tool to check specific addresses.

This comprehensive guide provides general information about USDA mobile home loans in Kentucky. It should not be considered as financial or legal advice. Potential borrowers should consult with qualified lenders, real estate professionals, and legal advisors for guidance specific to their situations.

Contact a Kentucky Mobile Home Loan Expert

For personalized guidance on Kentucky USDA mobile home loans, contact a local mortgage specialist. They can help with options for borrowers with bad credit and no down payment. The specialist will understand the unique requirements of manufactured home financing.

Email: kentuckyloan@gmail.com

Call/Text: 502-905-3708

Joel Lobb – Kentucky Mortgage Loan Officer

NMLS ID: 57916 | Company NMLS ID: 1738461

Equal Housing Lender

Helpful USDA Resources for Kentucky Borrowers

- USDA Income & Property Eligibility Tool

- USDA Training & Resource Library

- SFHGLP Technical Handbook

- Loan Origination FAQs

- SFHGLP Contact Information

- Permanent Foundations Guide

Disclaimer: This website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist Kentucky homebuyers with expert advice and accessible tools.

Can I buy land and a mobile home together with a USDA loan?

USDA loans can finance both the manufactured home and the land in a single transaction. This is possible if both meet USDA eligibility requirements. The combined purchase must not exceed USDA loan limits for your area.

What if my credit score is below 580?

While challenging, approvals are possible with strong compensating factors such as stable employment, low debt-to-income ratios, and cash reserves. Working with an experienced USDA lender who understands manual underwriting is essential. Honestly, best to get score to 620 or 640 range for better changes of loan approval. USDA does not have minimum credit score requirements.

How long does the USDA loan process take?

Typical processing time is 45-60 days from application to closing. Processing is taking longer due to USDA cutbacks. This delay can vary based on property complexity. It also depends on documentation completeness and current USDA processing volumes.

Can I use gift funds for closing costs?

Yes, gift funds from family members are allowed for closing costs and prepaid items. Proper gift documentation and seasoning requirements must be met.

What happens if the home doesn’t appraise for the purchase price?

If the appraisal comes in low, you have several options. You can negotiate with the seller to reduce the price. Another option is to pay the difference in cash. Alternatively, you can cancel the contract if you have an appraisal contingency.

Are there income limits for USDA mobile home loans?

Yes, household income cannot exceed 115% of the Area Median Income for your county. These limits are updated annually and vary significantly across Kentucky.

Can I refinance my existing mobile home with a USDA loan?

USDA offers refinancing options for existing USDA loans, but cannot refinance non-USDA loans. However, if your current mobile home meets USDA requirements, you might qualify for a new purchase loan.

What areas of Kentucky qualify for USDA loans?

Most of Kentucky qualifies as rural under USDA guidelines. Use the USDA eligibility map to verify specific addresses, as eligibility can vary even within the same county.

Resources and Next Steps

Official USDA Resources

- USDA Income & Property Eligibility Tool: eligibility.sc.egov.usda.gov

- USDA Training & Resource Library: rd.usda.gov/resources

- SFHGLP Technical Handbook: rd.usda.gov/resources/directives

- Loan Origination FAQs: rd.usda.gov/media/file

- SFHGLP Contact Information: rd.usda.gov/resources

- Permanent Foundations Guide: huduser.gov/portal/publications

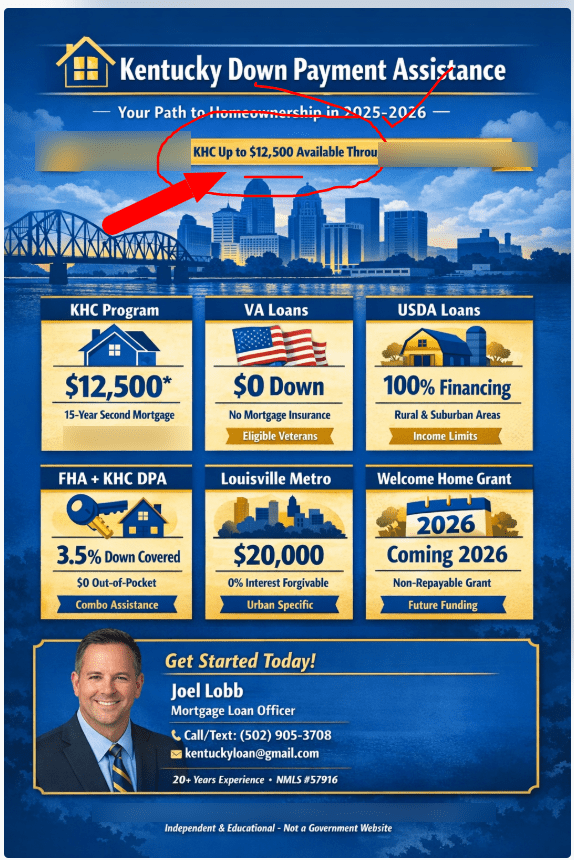

Kentucky Housing Resources

- Kentucky Housing Corporation: kyhousing.org

- Kentucky Cabinet for Economic Development: ced.ky.gov

- Local Housing Authorities: Contact your county government

- HUD-Approved Housing Counseling: hud.gov/findacounselor

Ready to Get Started?

Ready to explore USDA mobile home loan options in Kentucky? Don’t wait, as these programs have annual funding limits. Working with an experienced local lender who understands manufactured home financing is crucial for success.

For personalized guidance on Kentucky USDA mobile home loans:

Contact Joel Lobb – Kentucky Mortgage Specialist

- Email: kentuckyloan@gmail.com

- Phone/Text: 502-905-3708

- Experience: 20+ years helping Kentucky families

- Track Record: Over 1,300 successful Kentucky home purchases and refinances

- Specialization: USDA, FHA, VA, and Kentucky Housing Corporation loans

NMLS Personal ID: 57916 | Company NMLS ID: 1738461

Equal Housing Lender

Call/Text:

Call/Text:  Email:

Email:  Website:

Website:  Address: 911 Barret Ave, Louisville, KY 40204

Address: 911 Barret Ave, Louisville, KY 40204