Bank Statement Basics for A Kentucky Mortgage Loan Approval for USDA, KHC, FHA, VA, Fannie Mae and Rural Housing Mortgage Loans

Author: Kentucky Mortgage Broker Offering FHA, VA, USDA, Conventional, and KHC Down Payment Assistance Home Loans

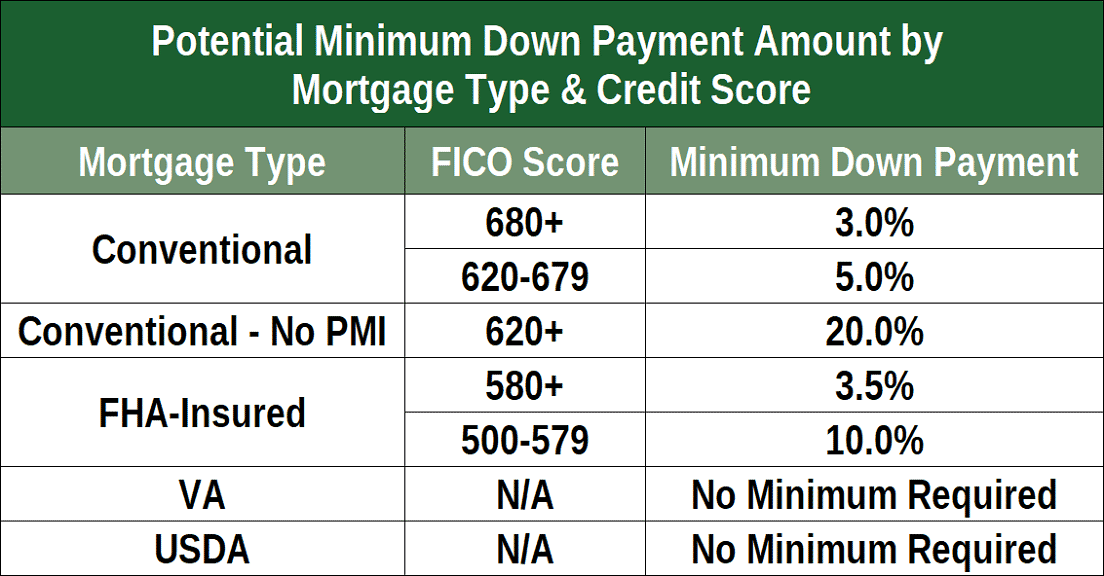

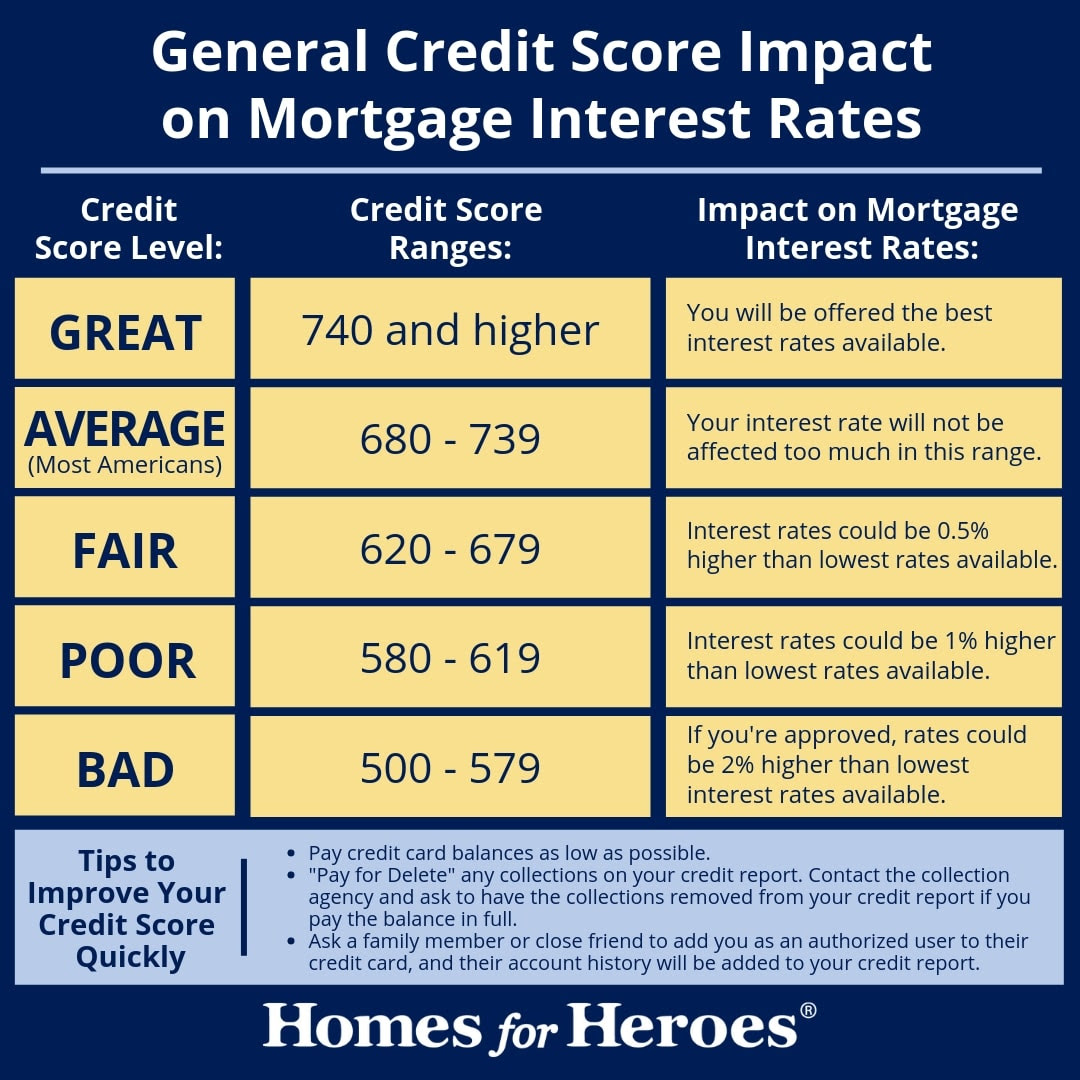

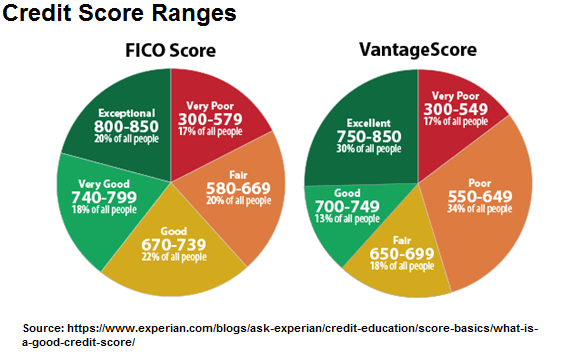

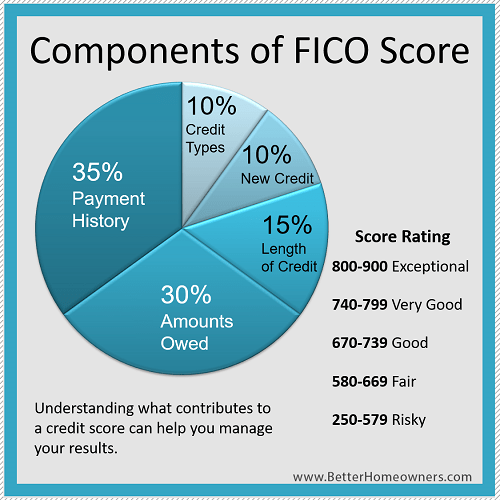

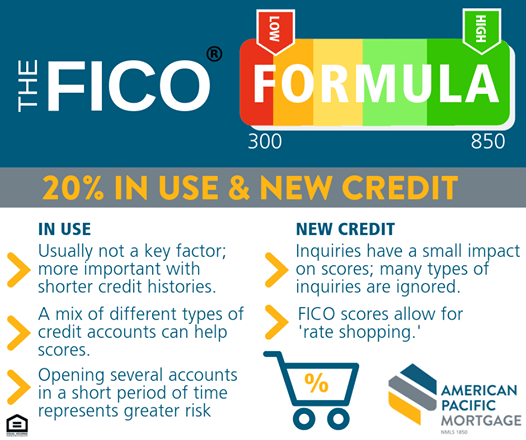

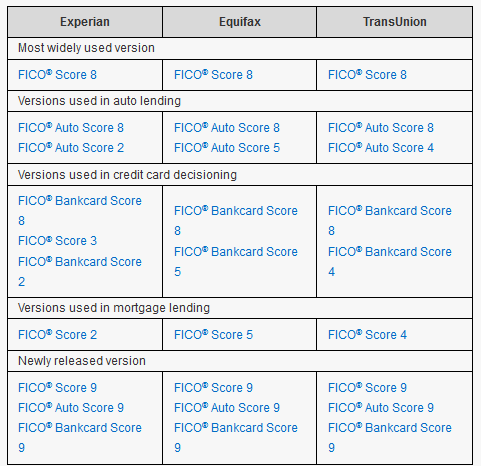

Credit Score Information For Kentucky Home buyers

Credit Scores are important for getting approved for a Mortgage in Kentucky.

Louisville Kentucky Mortgage Loans

getting approved for a Mortgage Loan in Kentucky for 2020

getting approved for a Mortgage Loan in Kentucky for 2020

What is a Kentucky Mortgage Rate Lock?

What is a Kentucky Mortgage Rate Lock?

Manufactured Home Guidelines for Kentucky USDA Rural Housing Loans

USDA loan on a manufactured home on a permanent foundation in Ky.

Kentucky USDA Mortgage Lender for Rural Housing Loans

No Money Down for Manufactured Home Rural Buyers in Kentucky Using the USDA Rural Housing loan Program

View original post 1,265 more words

Kentucky USDA Rural Housing Streamline Refinance Guidelines

(with

•

Allows financing of

unpaid principal and

eligible costs subject

to available equity

Streamlined Refinance

(without

•

Allows financing of

unpaid principal

balance and upfront

guarantee fee along

with accrued interest

•

Debt ratios are

calculated

Streamlined

Assist

Refinance (no appraisal

effective 6/2/2016)

•

Allows financing of

unpaid principal

balance and eligible

costs

•

Debt ratios not

calculated

Streamline Refinance

•

A new appraisal is not required (unless the loan being refinanced is a Direct Loan and subsidy

recapture is required).

•

The new loan amount may not exceed the original loan amount of loan being refinanced.

•

The new loan is limited to:

•

The principal balance of the loan being refinanced

•

The upfront guarantee fee (if financed)

•

Accrued interest (current interest)

•

Reasonable and customary fee for reconveyance

•

Subsidy recapture due for Direct Loan borrowers may not be included in the new loan amount

•

A borrower may be removed from the loan as long as at least one original borrower remains on

the new loan.

•

All other rate/term refinance requirements, including debt ratio calculation and limits apply.

(Except as outlined above, all Rate/Term Refinance requirements also apply to Streamline Refinance. See the

HB 1 3555 for all three types of refinance transactions allowed.)

Streamlined

Assist Refinance (cont.)

•

The new loan amount is limited to:

•

The unpaid principal balance of the loan being refinanced

•

The upfront guarantee fee (if financed)

•

Accrued interest (current interest)

•

Eligible loan closing costs (not to exceed 2% of total loan amount)

•

Permissible bona fide discount points (not to exceed 2% of total loan amount).

•

Funds to establish an escrow account for real estate taxes and insurance.

•

Subsidy recapture due for Direct Loan borrowers may not be included in new loan amount; however,

the cost of any appraisal obtained for recapture purposes is an eligible closing cost and may be

included.

Note:

The maximum loan amount cannot exceed the balance of the loan being refinanced, plus the guarantee

fee and reasonable and customary closing costs (including funds necessary to establish a new tax and

insurance escrow account). Subordinate financing, such as home equity lines of credit and down payment

assistance “silent” seconds, cannot be included in the new loan amount. Unpaid fees, past due interest and

late fees/penalties due the servicer, cannot be included in the new loan amount.

(Except as outlined above, all Rate/Term Refinance requirements also apply to Streamline

Assist Refinance.)

Joel Lobb

Mortgage Loan OfficerIndividual NMLS ID #57916

American Mortgage Solutions, Inc.10602 Timberwood Circle Louisville, KY 40223Company NMLS ID #1364

click here for directions to our office

Text/call: 502-905-3708fax: 502-327-9119

email: kentuckyloan@gmail.com

https://www.mylouisvillekentuckymortgage.com/