KHC is used for mostly applicants in urban areas of Kentucky that don’t have access to USDA or other government agencies to buy a home with no down payment.

A minimum of 3.5% down payment is required with this loan. Down payment assistance loans are available from $4500-$6,000, and are paid back over a period of ten years. They are typically offered to buyers with limited cash reserves and carry an interest rate of 1 to 5.5%.

These loans can make a critical difference to buyers for whom the down payment is an obstacle. Buyers whose 3.5% down payment is less than the $6000 limit may choose to use the remainder of a down payment loan to pay closing costs, further reducing the amount needed to bring to closing.

Conventional Preferred Program

The Kentucky Housing Corporation offers a few different loan programs, including the Conventional Preferred program. These home loans have 30-year fixed interest rates, so your rate won’t change over the life of the loan. The mortgages are serviced by the KHC and maintained in Kentucky, not sold off the way other mortgages are.To qualify for this program, you’ll need:A minimum credit score of 660.A down payment of 3% of your purchase price.To pay monthly mortgage insurance.An income that doesn’t exceed 80% of the local median income.With the Conventional Preferred Program, you also can make use of any of the state’s down payment assistance programs for help with your closing costs.

Conventional Preferred Plus 80 Program

Many of the requirements for the Preferred Plus 80 program are similar to those for the Conventional Preferred Program loans. You’ll need:A minimum credit score of 660.A down payment of 3% of your purchase price.Monthly mortgage insurance.An income that doesn’t exceed your county’s “secondary market” limit.And, the KHC’s down payment assistance programs can be used in conjunction with the Conventional Preferred Plus 80 program.

KHC recognizes that down payments, closing costs, and prepaids are stumbling blocks for many potential home buyers. Here are several loan programs to help. Your KHC-approved lender can help you apply for the program that meets your need.Regular DAP

Purchase price up to $327,334 with Secondary Market.

Assistance in the form of a loan up to $6,000 in $100 increments.

Repayable over a ten-year term at 5.50 percent.

Available to all KHC first-mortgage loan recipients.

Affordable DAP

Purchase price up to $327,334 with Secondary Market.

Assistance up to $6,000.

Repayable over a ten-year term at 1.00 percent.

Borrowers must meet Affordable DAP income limits.

MORE ABOUT DOWN PAYMENT AND CLOSING COSTS

No liquid asset review and no limit on borrower reserves.

Specific credit underwriting standards may apply to down payment programs.

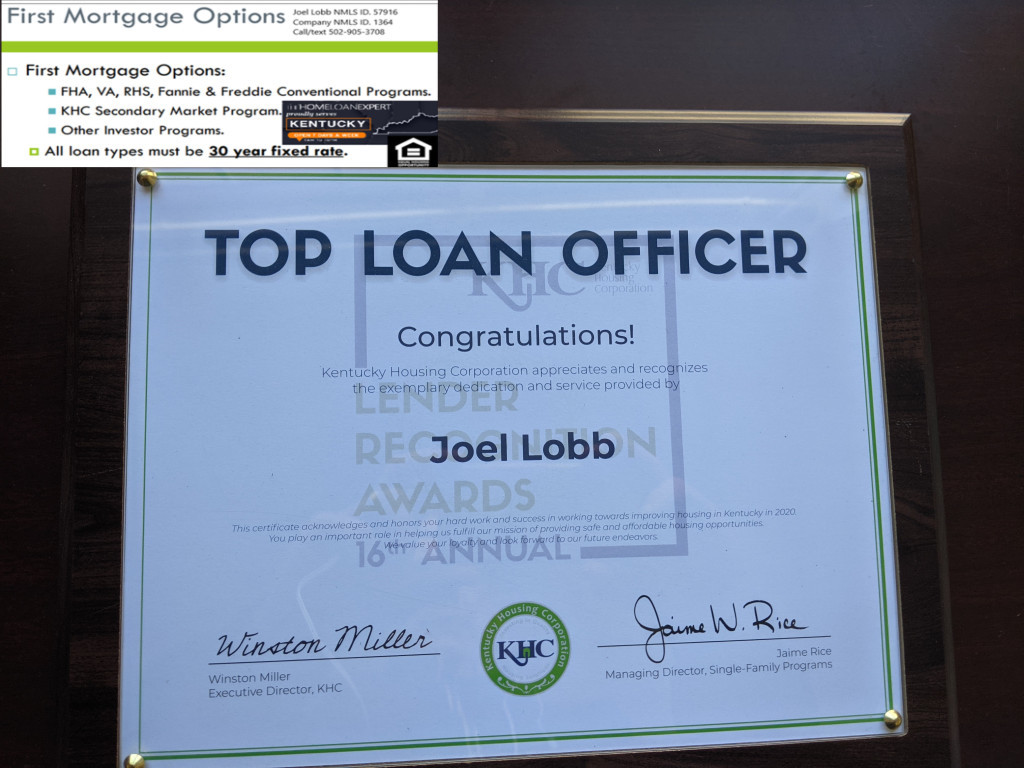

Louisville Kentucky Mortgage Loans

KHC is used for mostly applicants in urban areas of Kentucky that don’t have access to USDA or other government agencies to buy a home with no down payment.

A minimum of 3.5% down payment is required with this loan. Down payment assistance loans are available from $4500-$6,000, and are paid back over a period of ten years. They are typically offered to buyers with limited cash reserves and carry an interest rate of 1 to 5.5%.

These loans can make a critical difference to buyers for whom the down payment is an obstacle. Buyers whose 3.5% down payment is less than the $6000 limit may choose to use the remainder of a down payment loan to pay closing costs, further reducing the amount needed to bring to closing.

- Conventional Preferred Program

- The Kentucky Housing Corporation offers a few different loan programs, including the Conventional Preferred program. These home loans…

View original post 292 more words